[ad_1]

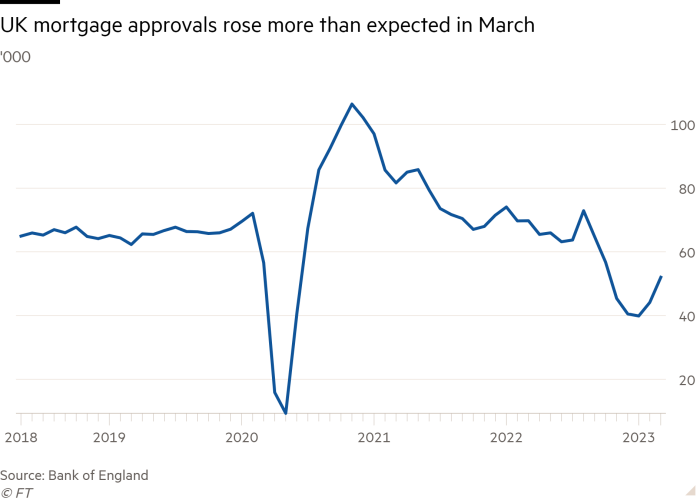

UK mortgage approvals rose more than expected in March hitting a five-month high in a sign that the property market is stabilising after the volatility of recent months.

Net mortgage approvals for house purchases rose to 52,000 in March, from 44,100 in February, according to data from the Bank of England released on Thursday.

The figure outstripped the 46,250 forecast by economists polled by Reuters and was its highest since October 2022.

The BoE data also showed that the failure of US bank SVB and takeover of Credit Suisse in March triggered only a small withdrawal of funds from UK banks.

UK bank deposits fell by £18.1bn in March, from a £4.3bn drop the previous month, on a seasonally adjusted basis. Ashley Webb, UK economist at Capital Economics, said this was “not big enough to constitute a bank run”.

Analysts said the rise in overall withdrawals could also reflect that households were dipping into their savings more as real wages were squeezed. The raw data showed household deposits into banks rose in the month, but not as much as normal for the month of March.

The jump in mortgage approvals suggests the property market is recovering after former prime minister’s Liz Truss’s “mini” Budget in September sparked panic that led lenders to withdraw home loans.

Kim McGinley, director at Vibe Specialist Finance, said that mortgage approvals fell sharply after the “mini” Budget but “confidence steadily returned as mortgage rates came down and the economic outlook felt less bleak”.

Britons borrowed an additional £1.6bn in consumer credit in March, up from £1.5bn the previous month and well above analysts’ expectations of £1.2bn, BoE data showed.

Separate data published earlier in the week by the mortgage provider Nationwide showed that house prices rose 0.5 per cent between March and April, ending seven consecutive months of decline.

Despite the rise, mortgage approvals were still 36 per cent below the level in March 2021 when the housing market was boosted by record-low interest rates.

Since then, the BoE has raised rates from a historical low of 0.1 per cent to the current 4.25 per cent. Markets are pricing in a quarter-point interest rate rise at the monetary policy meeting next week.

Webb expected interest rates to remain high for the rest of the year, meaning mortgage lending will “probably remain weak”.

A separate BoE survey of chief operating officers, also released on Thursday, showed that businesses expected their year-ahead output price inflation to be 5.5 per cent in the three months to April, unchanged from the three months to March.

This suggests persistent price pressures that were confirmed by separate data by the S&P Global/Cips UK services PMI business activity survey also published on Thursday.

[ad_2]

Source link