It is not hard to see why short-term risks may be front of mind for US equity investors. If uncertainties over the US Federal Reserve’s next moves were not enough to cloud the outlook, there are bank collapses and a political stand-off looming over the US debt ceiling to worry about.

But perhaps longer-term risks over the relative prospects of US stocks compared with other markets should figure more on the radar of investors.

“Valuations in the US are much worse than everywhere else,” Karen Karniol-Tambour, co-chief investment officer of Bridgewater Associates, told the Milken Institute’s annual gathering in Los Angeles this week.

The manager at the world’s largest hedge fund sketched a picture of US markets having been the place to be — but not any longer. “Usually when you have companies win for so long, that gets priced in,” she added. “You had this long period where US tech, especially, sort of ate everything. Now it’s completely priced in.” Karniol-Tambour argues it is hard to have more US dominance in investment portfolios than what already exists.

US equities currently make up just under half of global stock market capitalisation, up from about a third in 2010, according to Absolute Strategy Research. That’s lower than during boom periods such as the dotcom bubble — but that is hardly much comfort. And in the past few months, other stock markets have outstripped the US. The S&P 500 has risen 8 per cent in six months, but the FTSE Eurofirst 300 is up almost 25 per cent in dollars and even Japanese blue-chips are 16 per cent to the good.

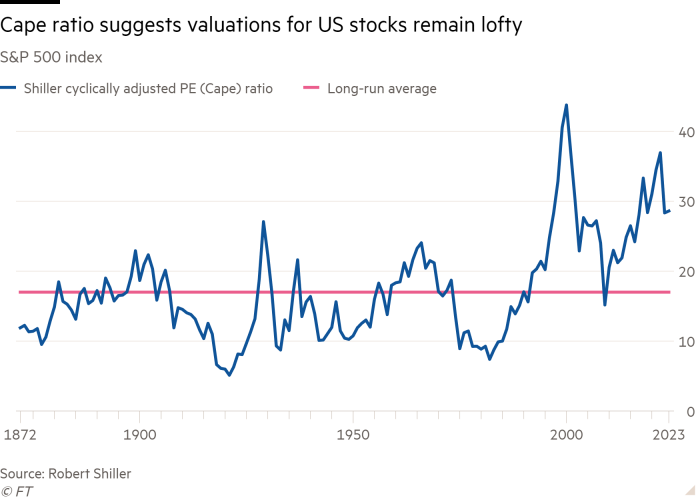

Yet US valuations remain punchy. One long-term benchmark is the cyclically adjusted, price-to-earnings ratio. This measure compares prices with the average of earnings for the previous decade and is often cited by longer-term focused investors as a key metric. For the US benchmark S&P 500 index, the current Cape ratio is just under 29 versus a long-run average nearer 17. Small wonder that US fund managers, usually very domestically focused, have been looking to build their presence overseas, the Financial Times reported last month.

The higher the valuations already, the harder to squeeze out more returns. The long-run relationship between the Cape and performance implies annualised total returns of a meagre 3 to 5 per cent over the next decade, reckons Ian Harnett, co-founder and chief investment strategist at Absolute Strategy Research.

Factoring in likely dividend income, numbers that weak more or less imply the index won’t be going anywhere. Harnett points out there have been several periods where it’s taken a decade — or more — for real returns to turn positive. “It’s not what people want to hear, but it shouldn’t be a surprise from these elevated valuations,” he says.

For example, Harnett points out it took 11 years for investors that bought US stocks in December 1974 to see their returns, adjusted by inflation, to turn positive and 13 years for those who backed equities in the last gasp of the dotcom rally in August 2000.

Equity investors with shoot-for-the-moon hopes don’t typically bother with currencies, but the dollar has the potential to be a big factor here. Its haven status is a huge support in luring funds from overseas into US stocks and bonds. Between March 2008 and September 2022, the dollar gained 60 per cent against a basket of its peers, climbing even during a financial crisis caused by the US. Yet this year, it has slid 4 per cent since turmoil first hit US regional banks in March.

“There’s been a feedback loop between the dollar, US assets and the economy,” said Julian Brigden, co-founder and head of research at MI2 Partners. ”It was a virtuous circle, now this could be a tipping point.”

But the flip side — and there’s always one of those — of not wanting to put more money to work in the US is finding another big market with long-term potential. The eurozone is having a moment, for sure, with an unexpectedly buoyant economy and relief that Russia’s war with Ukraine isn’t hitting it harder.

However, diverting funds from the US over the long term means being confident that returns in the eurozone are going to steadily outstrip those in the US. That’s a big ask from a region with a history of weak growth and fewer standout performers such as luxury goods maker LVMH, which just became Europe’s first company to reach a $500bn market cap.

There’s also Asia and within that China. The recovery continues in those equity markets, but with a marked lack of enthusiasm from US investors in particular as geopolitical tensions worsen. “We’re having a lot of conversations with clients but except for a few large asset managers, most people think it’s uninvestable right now,” said one trading head at a large bank.

There weren’t many great suggestions for alternative destinations on offer at the Milken event, and not everyone enjoying West Coast sunshine agreed with Karniol-Tambour either. But the longer headlines continue to flag weak banks and political wrangles over debts coming due, the more questions investors will — and should — be asking about the long-term outlook for their US holdings.

Comments are closed, but trackbacks and pingbacks are open.