[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. Chinese tourist spending during this week’s labour day holiday has exceeded pre-pandemic levels for the first time, in a sign of economic momentum, authorities have said.

Travel this past week was closely watched as an indicator of the Chinese economy’s recovery and as a barometer for consumer spending since the government lifted pandemic restrictions late last year. China recorded 274mn domestic trips over the five days to Wednesday, according to the Ministry of Culture and Tourism, 71 per cent higher year on year and 19 per cent higher than in 2019.

Total tourism revenues were Rmb148bn ($21.5bn), up sharply year on year and 1 per cent higher than the comparable 2019 level. The figures indicated a clear improvement in travel and spending compared with recent holidays such as lunar new year in January, which was affected by a wave of infections in the biggest cities as the government rolled back its zero-Covid regime.

Although international flights are recovering more slowly than domestic flights in China, Washington announced yesterday that Chinese airlines will be allowed to expand their flights to the US — a small concession to Beijing amid tensions between the two nations.

Here’s what else is happening in the coming days:

-

Australia: Reserve Bank of Australia will publish its quarterly economic outlook today.

-

Black Sea grain deal discussions: Defence officials from Turkey, Ukraine and Russia will meet in Istanbul today for talks on the Black Sea Grain Initiative.

-

Coronation: Charles III and Camilla will be crowned king and queen of the United Kingdom and the Commonwealth on Saturday.

-

Berkshire Hathaway: Warren Buffett’s company will holds its renowned annual shareholders meeting in Omaha, Nebraska, on Saturday.

Five more top stories

1. US regional banks suffered severe share price declines amid fresh calls for an intervention from Washington. As PacWest became the latest bank to seek a financial lifeline, activist investor Nelson Peltz told the FT that the deposit insurance limit should be increased. Here’s the latest on the US banking turmoil.

2. European Central Bank raised interest rates by a quarter of a percentage point yesterday, as president Christine Lagarde warned the fight against inflation is not yet won. Lagarde signalled that it would not be the last such move this year. See her full remarks.

3. Chinese authorities have moved to tighten controls on sensitive corporate information, with Beijing telling state-owned companies and those listed on the mainland to step up security checks when appointing auditors. It’s the latest sign of regulators’ concerns regarding the security of corporate data.

4. Adani Group has completed the sale of its port business in Myanmar, marking an exit from a flagship foreign investment that has been long criticised by human rights campaigners. Solar Energy Ltd will buy the Yangon-based business for $30mn, but there are calls for Adani to donate proceeds from the sale.

5. The parent company of one of China’s biggest ecommerce sites has moved its headquarters to Ireland, a move analysts suggest is meant to shield the company from US-China tensions. The shift could also have tax benefits for PDD Holdings, which owns ecommerce site Pinduoduo and online marketplace Temu.

How well did you keep up with the news this week. Take our quiz.

The Big Read

Next week Rina Gonoi will release her account of two harrowing years as a member of Japan’s Ground Self-Defense Forces. Her story has forced unprecedented self-examination at a pivotal time for the Japan’s military as budgets expand to help the country respond to the increased threat from China. Is Japan’s military fit for purpose, asks today’s Big Read.

We’re also reading . . .

-

Russia’s Indian tankers: Gatik Ship Management has emerged seemingly out nowhere as an international oil shipping giant since the war in Ukraine.

-

Civic duty: This week’s local elections will be the first time that many Hongkongers on British National (Overseas) visas will vote in the UK. But voting is hardly straightforward for these families, writes Georgina Quach.

-

‘Birdwatch’: The strength of Twitter’s Community Notes fact-checking feature is that it works through consensus, writes Jemima Kelly.

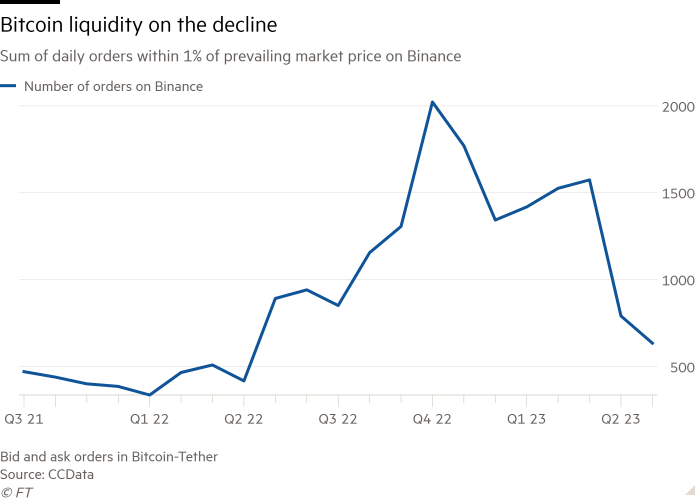

Chart of the day

Cryptocurrency trading activity has dwindled even as bitcoin enjoys its longest winning streak in more than two years. It’s the latest sign that many investors are increasingly reluctant to buy into the rebound after a string of collapses and scandals in 2022.

Take a break from the news

Tim Bevan and Eric Fellner reinvented popular British cinema with hits from Four Weddings to Love Actually. The industry has changed remarkably since then. But their MO is much as it was 30 years ago. “Every movie still essentially comes down to this: cover your nuts and jump,” Bevan said.

Additional contributions by Gordon Smith and Tee Zhuo

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link