This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening. With Darren on holiday, I’m here to navigate through us these Disrupted Times.

The cost of living crisis has hit the British middle classes with a jump in housing costs. According to analysis by the Institute for Fiscal Studies, 1.4mn UK homeowners are set to see their monthly payments rise. This is in addition to stubbornly high inflation, stuck in double digits.

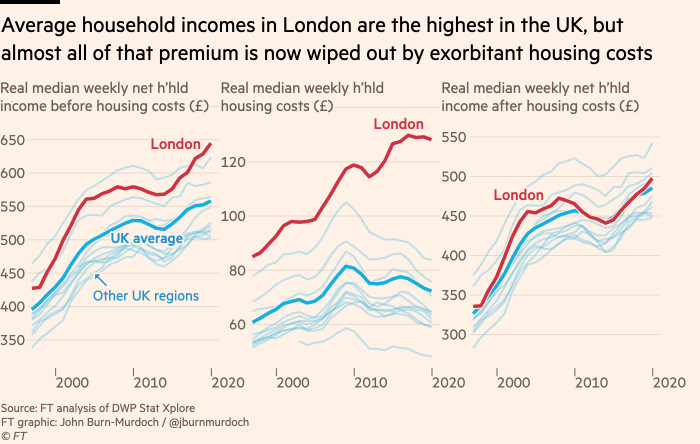

London’s sky-high property costs are forcing young families out of the capital, according to analysis by the FT’s John Burn-Murdoch. London households make about 15 per cent more than the rest of the country — but subtract housing costs, and a household in the capital is no better off than the national average.

The situation is hardest for younger families. For those aged 25 to 39, the prime demographic for first-time home ownership, housing costs amount to 36 per cent of net household incomes, nearly twice the cost burden for the same age group 30 years earlier.

The result is that while London’s population continues to climb, people of typical housebuying and family formation age become a smaller percentage of the total. London has aged more rapidly than any other part of the UK since 2015, its median age rising three times faster than the UK average.

Meanwhile, Tesla has increased the price of its premium Model S and X in the US after shares fell in the wake of fears surrounding its price-cutting policy. The electric-car maker missed profit expectations for the first three months of the year due to price reductions.

Need to know: UK and Europe economy

UK retail sales fell 0.9 per cent in March, below forecasts, according to the Office for National Statistics today. Bad weather was blamed for dissuading many shoppers from venturing out on to the high street. Department stores, clothing shops and garden centres did particularly poorly, according to Darren Morgan, ONS director of economic statistics.

However, consumer confidence seems to be slowly recovering in the UK, climbing to its highest level since Russia’s invasion of Ukraine in February 2022, according to research group GfK. Its index of consumer confidence rose by 6 points to -30 in April.

This seems to reflect a cautious optimism more widely. Although investors expect UK interest rates to rise further following stronger-than-expected jobs and inflation data, the Bank of England continues to suggest it is close to the end of its monetary policy tightening cycle.

Across the Channel, economists are expecting the European Central Bank to further raise interest rates in May following strong eurozone business activity driven by high demand, easing price pressures and rapid employment.

In a dispute challenging Switzerland’s reputation as the world’s most politically stable and reliable financial centre, investors representing $4.5bn of wiped-out Credit Suisse bonds have filed a lawsuit against Swiss banking regulator Finma. This comes after Credit Suisse was accused of “dishonest conduct” in London’s High Court by Jersey-based investor Loreley Financing.

Syrup-laced honey from China is flooding the EU’s 2.3bn euro honey market and driving down prices. Twenty EU countries, led by Slovenia, want to tighten regulation against what one EU official dubbed “honey laundering”.

Need to know: Global economy

US and European stocks fell yesterday after worse than expected first-quarter earnings reports. Wall Street’s benchmark S&P 500 fell 0.6 per cent while the tech-heavy Nasdaq Composite slid 0.8 per cent. Tesla shares sank almost 10 per cent after the electric-carmaker reported that price cuts had driven its profit margin even lower than pessimistic forecasts.

In San Francisco, problems with homelessness and addiction as well as increasing office vacancies since the pandemic are leaving the city feeling hollowed out.

Alphabet is ending a long-running internal rivalry between its London and Silicon Valley-based groups DeepMind and Google Brain AI by combining the two groups in an attempt to get ahead in generative AI against Microsoft and OpenAI.

The generative AI market is booming and becoming increasingly competitive. Less than five months since the launch of ChatGPT, the biggest tech companies are racing to mark their territory in sections of the industry.

Meanwhile, researchers are divided over how to keep control of the threats posed by recent advances in generative AI. Ultra-intelligent machines such as Open AI’s GPT-4 and Google’s Bard have the potential to raise economic productivity and enhance human creativity but researchers are cautious of what it could mean when humanity loses control of the machines we have created.

Need to know: business

The future of the CBI looks uncertain with a wave of membership cancellations and a second rape allegation at the UK employers’ body. Insurers Aviva and Phoenix, pension scheme the People’s Partnership and PwC are following trade body the British Insurance Brokers’ Association in cancelling their CBI memberships. Aviva said: “The CBI is no longer able to fulfil its core function — to be a representative voice of business in the UK.”

This comes after the CBI said yesterday that it had given the police “additional information relating to a report of a serious criminal offence”.

The UK banking sector is marking the fifth anniversary of open banking, a government-backed initiative under which the Competition and Markets Authority coerced banks to hand over current account transaction data to third-party providers. The CMA ruled in January that Barclays, HSBC, Lloyds, Nationwide, NatWest and Santander have all implemented the Open Banking Roadmap.

Deloitte is the latest of the Big Four accounting firms to respond to a slowdown on the consulting side of its business with plans to cut 1,200 jobs in the US amounting to 1.5 per cent of its US workforce.

The Financial Conduct Authority looks set to protect leaseholders from excessive insurance costs charged by brokers and paid in large sums to landlords, promising a clampdown on brokers who overcharge.

BuzzFeed News has become the latest victim of the digital media downturn, cutting its workforce by 15 per cent and resulting in 180 employees losing their jobs.

Science round up

After its first orbital launch test on Monday was called off, SpaceX’s Starship rocket took to the skies yesterday. But not for long. The near 400ft-tall rocket built by Elon Musk’s company exploded before stage separation in, what SpaceX called “a rapid unscheduled disassembly.”

Stress-tracking technology intended to help people manage their wellbeing in the workplace could be manipulated by bosses looking to check on those who thrive under pressure — and those who don’t.

Some good news

A groundbreaking new study published in the journal Nature might have unearthed what causes human hair to go grey. As people age, melanocyte stem cells or McSCs lose their ability to move between growth compartments in hair follicles, affecting hair colour. Could grey hair one day be a thing of the past?

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

Comments are closed, but trackbacks and pingbacks are open.