[ad_1]

Clear Street, which says it is building “modern infrastructure” for capital markets, has raised $270 million in the second tranche of a Series B funding round at a $2 billion valuation.

Growth equity firm Prysm Capital led the financing, which brings the round total to $435 million. New York-based Clear Street raised the first tranche of the round in May of 2022 at a $1.7 billion valuation. Prysm led that first tranche as well, which was the company’s first round of funding raised from outside investors. Until last year, Clear Street had been operating with only capital provided from its co-founders.

The company was founded in 2018 with a mission “to replace the outdated infrastructure being used across capital markets,” starting with a prime brokerage platform for institutional investors, said Chris Pento, co-founder and CEO.

“The public U.S. securities industry, which moves trillions of dollars a day, still relies on mainframe technology from the 1980s. These legacy systems are entrenched in manual processes and siloed data, resulting in costly errors and expensive technical debt,” he said. “For many firms, replacing these antiquated systems would be like removing the engine from a plane in mid-air. It’s time-consuming and difficult to execute with fragmented technology.”

Clear Street built its cloud-native prime brokerage and clearing system from scratch – including integrations with central clearing houses and the development of APIs – with the goal of “maximizing returns while minimizing risk and cost” for its clients by providing them with “everything they need to clear, custody, and finance U.S. equities and options,” according to Sachin Kumar, co-founder and CTO.

Those clients include roughly 200 institutional sized investors and hundreds of smaller active trading entities, according to COO Andy Volz, who declined to provide names, saying that those clients “prefer anonymity.” Long term, the company’s aim is to serve a variety of investor types across multiple asset classes on a global scale.

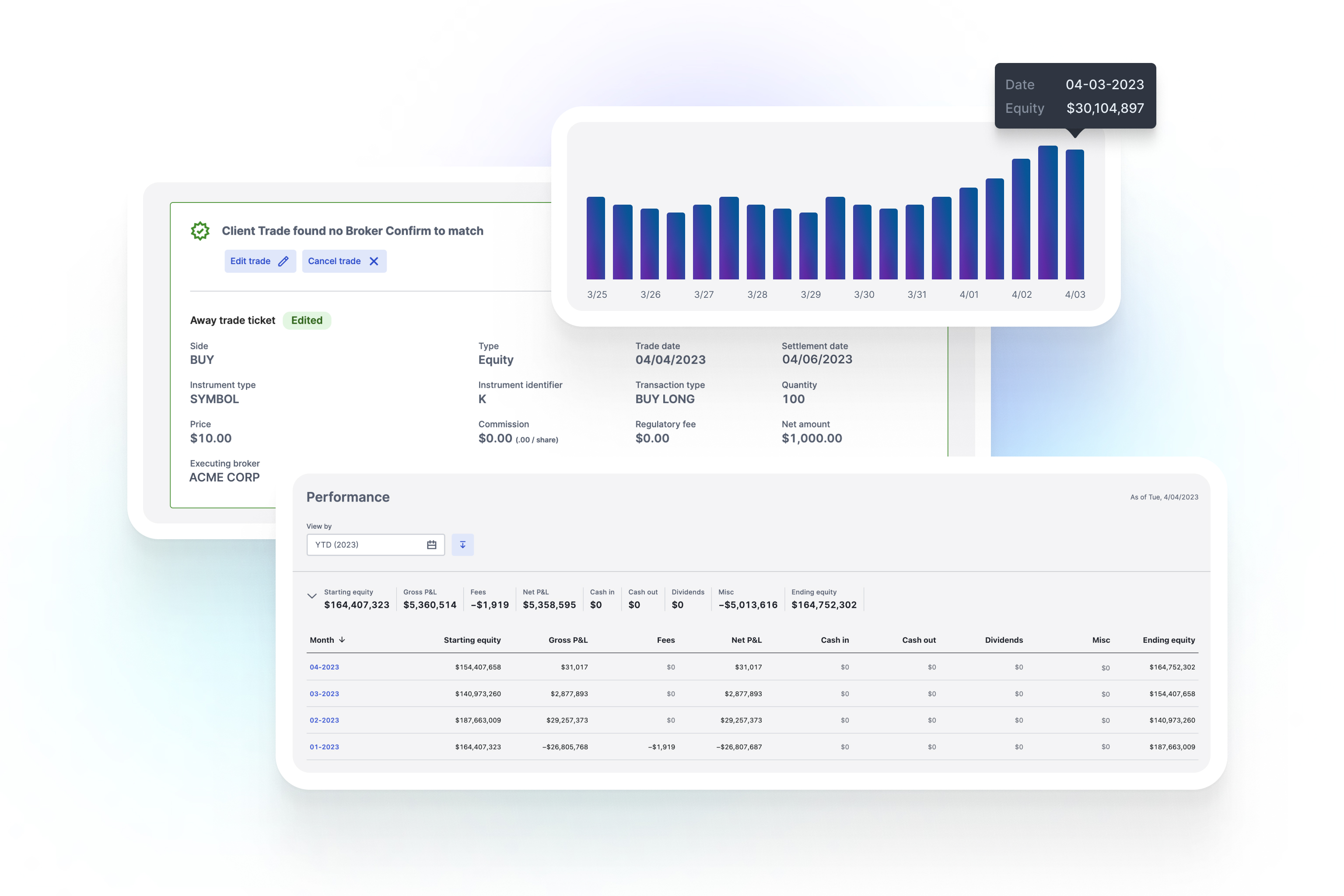

Image Credits: Clear Street

Clear Street’s executives declined to provide hard revenue figures but noted that over the past year, the company has seen the number of institutional clients on its platform increase by 500%. Meanwhile, its daily transactional volume increased by more than 300%, and its financing balances increased by nearly 150%, they said. The company claims that its prime clearing platform processes 2.5% of the gross notional U.S. equities volume, which the executives say amounts to about $10 billion in daily notional trading value of U.S. equities.

The company makes money by charging fees for transactions and the financing of public market securities.

“We feel this structure is better aligned than other options in the current markets,” Volz said.

Presently, the company has about 400 employees today, up from around 325 in April of 2022.

In the last year, Clear Street launched capital introduction and repo businesses. It also made what it describes as “key hires in Europe and in the derivatives space.” The company plans to use its new capital to expand into new markets and asset classes as well as to expand its product offering to support the clearing needs of market makers, which it views “as a major growth area.”

Matt Roberts, co-founder & partner at Prysm Capital, believes Clear Street is unique in terms of its “differentiated user experience, real-time risk analytics and tools, and scalability” of its platform.

Other backers in the company included NextGen Venture Partners, IMC Investments, Walleye Capital, Belvedere, NEAR Foundation, McLaren Strategic Ventures, and Validus Growth Investors. In February, Clear Street announced that it had received an undisclosed strategic investment from IMC Investments, the venture capital arm of IMC, a proprietary trading firm and global market maker.

In total, Clear Street says it has $700 million “in capital,” including its external raise. Prior to taking in equity investment, Clear Street says it raised debt from insurance companies and regional banks. Prysm maintains a minority stake in the company.

Want more fintech news in your inbox? Sign up here.

[ad_2]

Source link