[ad_1]

The global wind sector will face a supply chain crunch this decade, as looming bottlenecks for key components and ships are set to squeeze the sector, an industry body has warned.

The Global Wind Energy Council said “spare capacity” in wind energy manufacturing was “likely to disappear by 2026”.

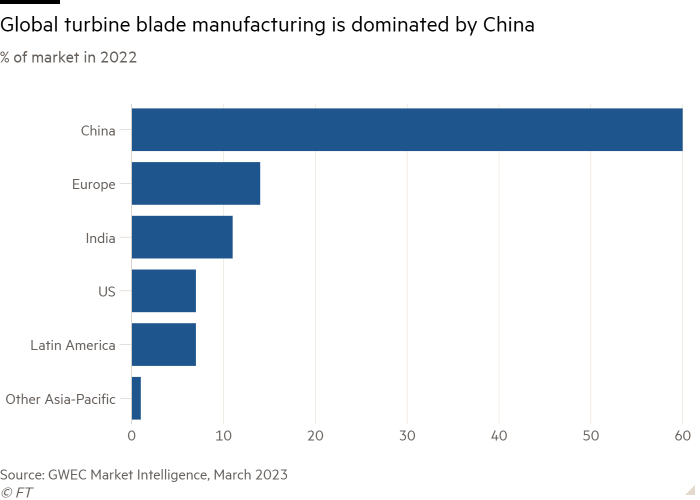

The squeeze will hit the US and Europe particularly hard as they both target an ambitious rollout of domestic renewable energy projects even as much of the wind industry’s supply chain is concentrated in China, the group said.

Companies were already feeling the crunch, with Singaporean shipping group Marco Polo warning of a “big vacuum” of the large vessels required to install offshore turbines.

Growing demand for new wind projects meant that “this problem is now becoming more acute”, said Sean Lee, chief executive of Marco Polo Marine Group.

European wind turbine manufacturers including Vestas and Siemens Gamesa endured a bruising 2022, as a combination of rising input costs, supply chain constraints and the slow permitting process for new projects hit profits and caused delays.

GWEC said 2022 had been the third best year for new wind capacity installations despite the tough conditions, and forecast that 2023 would be the year the world reached 1TW of total installed wind capacity.

However, it warned that policymakers “need to act now to avoid a supply chain bottleneck stalling the deployment of wind energy from 2026”. There was an “urgent need” to increase investment in the global onshore and offshore wind sector supply chains, it added.

Many companies were “not in a position to invest to the degree that they should be because they haven’t made money for the last few years”, said GWEC’s chief executive Ben Backwell.

Attempts by European and US lawmakers to encourage a shift of manufacturing away from China, in key sectors including renewable energy, risked amplifying the shortages, GWEC warned.

Shortages for key components such as wind turbine nacelles, which contain the gearbox, generator, and brake and blades, were likely to emerge, the report added.

Europe’s offshore turbine nacelle assembly capacity would “no longer be able to support growth outside of Europe” from 2026, and by 2030 it would need to double from current levels “to meet European demand alone”, GWEC said.

China accounts for about 60 per cent of total onshore and offshore nacelle production. There are no offshore nacelle assembly facilities in North America, though companies including GE Renewable Energy and Vestas have recently announced US investment plans.

[ad_2]

Source link