[ad_1]

UK inflation accelerated unexpectedly in February, adding to expectations that the Bank of England will raise interest rates again at its meeting on Thursday.

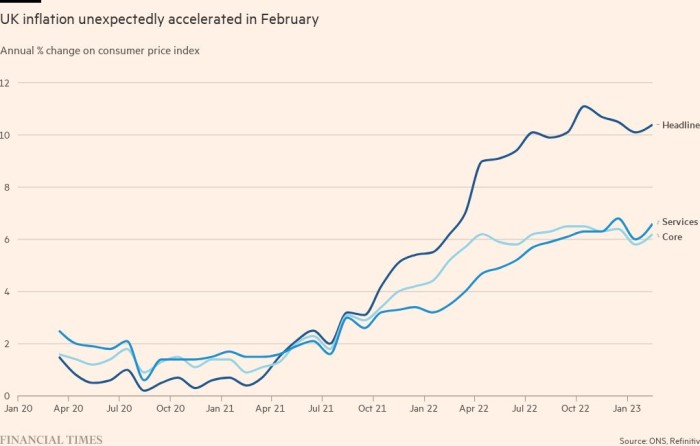

The annual rate of consumer price inflation rose to 10.4 per cent in February, the Office for National Statistics said on Wednesday. That was up from 10.1 per cent in January and higher than the 9.9 per cent forecast by the BoE and economists polled by Reuters.

Compared with the previous month, prices were up 1.1 per cent, nearly double the 0.6 per cent increase forecast by analysts.

Following the unexpected rise in inflation, investors were betting that the BoE will lift interest rates by 0.25 percentage points this week, with a small chance of a larger half point increase. Before the data, markets were evenly split between forecasting a quarter point rise and no change in borrowing costs on Thursday.

The pound climbed 0.5 per cent against the dollar after the inflation report, trading at $1.227. Sterling has risen 1.9 per cent this month. Against the euro, the UK currency rose 0.5 per cent to trade at €1.139. It has risen 0.8 per cent this year against the single currency.

ONS chief economist Grant Fitzner said that inflation “ticked up in February mainly driven by rising alcohol prices in pubs and restaurants” following discounting in January.

Prices of food and non-alcoholic drink accelerated to 18.2 per cent, the highest pace in more than 45 years. The ONS reported increases for some salad and vegetable items as high energy costs and bad weather across parts of Europe led to shortages and rationing.

Core inflation, which strips out volatile food, energy, alcohol and tobacco prices, also rose sharply to 6.2 per cent in February, up from 5.8 per cent the previous month. That exceeded economists’ expectations of a slowdown to 5.7 per cent.

Kitty Ussher, chief economist at the Institute of Directors, said the febrile environment in the banking sector had led to suggestions that central banks should pause before raising rates further. “Today’s data suggests the opposite; the Bank of England’s job is not yet done,” she added.

Food price inflation is hitting the poorest households as it accounts for a larger proportion of their spending.

Responding to the latest figures, shadow chancellor Rachel Reeves argued that after 13 years of a Conservative government many families were now “feeling worse off” economically.

“The cost of living crisis is still biting hard, and taxes are rising, yet the government chose to use the Budget to hand a £1bn bung to the top 1 per cent,” she said.

Joanna Elson, chief executive of the Money Advice Trust, the charity that runs National Debtline and Business Debtline, said that the latest inflation figures “show that the relentless pressure on household budgets is set to continue with no sign of easing soon”.

Services inflation, which is closely watched by policymakers as a better measure of domestic price pressures, rose to 6.6 per cent in February, up from 6 per cent in the previous month and near its three decades high of 6.8 per cent reached in December.

Prices in restaurants and hotels rose by an annual rate of 12.1 per cent in February, up from 10.8 per cent in January, and the highest rate since data began in 1991.

UK inflation is still five times higher than the BoE’s target of price stability at 2 per cent. It is also higher than in all other G7 countries. In the US, annual inflation eased to 6 per cent in February from a peak of 9.1 per cent, and it slowed to 8.5 per cent from a peak of 10.6 per cent in the eurozone.

Chancellor Jeremy Hunt said: “Falling inflation isn’t inevitable, so we need to stick to our plan to halve it this year.”

Additional reporting by Jasmine Cameron-Chileshe

[ad_2]

Source link