[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Thank you for your feedback on FirstFT’s redesign. We’ve taken on some of your suggestions, which you’ll see in today’s newsletter. Let us know what you think at firstft@ft.com.

Happy first day of spring. The season starts with a historic $3.25bn takeover of Credit Suisse by rival UBS, the culmination of a frantic five-day effort by Swiss regulators to end a deepening crisis after a SFr50bn ($54bn) lifeline from the central bank failed to arrest a decline in Credit Suisse’s share price.

UBS will pay about SFr0.76 a share in its own stock, up from an earlier bid of SFr0.25 that was rejected by the Credit Suisse board. The offer remains far below Credit Suisse’s closing price of SFr1.86 on Friday.

As part of the deal announced yesterday evening, Switzerland’s financial regulator Finma ordered SFr16bn of Credit Suisse’s additional tier one (AT1) bonds, a relatively risky class of bank debt, be written down to zero. The surprise move is expected to cause ructions in the European debt markets when they open today.

To improve global access to dollar liquidity, the Federal Reserve and five other central banks will today switch from weekly to daily auctions of dollars and run the daily swaps until at least the end of next month.

If like me you’re wondering about what to make of the rapidly growing crises on both sides of the Atlantic, I recommend reading:

Here’s what else I’m keeping tabs on today:

-

Stock indices: Quarterly changes to equity indices in the UK, Germany and France, including the FTSE 250, DAX and CAC, come into force.

-

Xi in Moscow: Chinese president Xi Jinping tests his “no limits partnership” with Russia’s Vladimir Putin when the two leaders meet in Moscow.

-

Protests: More than 70,000 university staff strike in the UK over pay, while South Africa is preparing for a “national shutdown” of the economy by opposition supporters.

Today’s top news

1. New York Community Bank has agreed to buy most of the operations of failed Signature Bank, including “substantially all” of its deposits and just over a third of its assets. Read the full story here.

2. Plans to revamp UK bank capital rules risk a 25 per cent cut in lending to small businesses, threatening jobs and economic growth, a new study has warned. Read more on how the Bank of England’s plans could result in the £44bn drop.

-

UK taxes: England’s council tax, stamp duty and business rates should be replaced with a devolved land value tax to “cut out” the Treasury, a think-tank chaired by former chancellor George Osborne said.

3. EXCLUSIVE: The US proposal for a new carbon credit system has begun sizing up potential interest from countries and corporate backers to help finance the shift of poorer nations away from fossil fuels. Here’s how it could dovetail with “just energy transition” efforts.

4. Microsoft is preparing to launch a new games store on iPhones and Android smartphones as soon as next year if its $75bn acquisition of Activision Blizzard is cleared by regulators, according to the head of its Xbox business.

5. EXCLUSIVE: Big Pharma has asked for a slice of the US’s $280bn chip industry support package as part of an effort to build up the country’s biotechnology industry and stave off Chinese competition. Read more about the tax breaks and subsidies that drugmakers are requesting.

The Big Read

There are few problems larger than the climate crisis. But one potential solution is so small it cannot be seen with the naked eye: microbes. In 2019, Tegan Nock, a 32-year-old former rancher, co-founded farming start-up Loam Bio and has developed a microbial fungi that when applied to soil might not only improve its health but greatly enhance its ability to store carbon. These small but mighty microorganisms could be the way forward.

We’re also reading . . .

Chart of the day

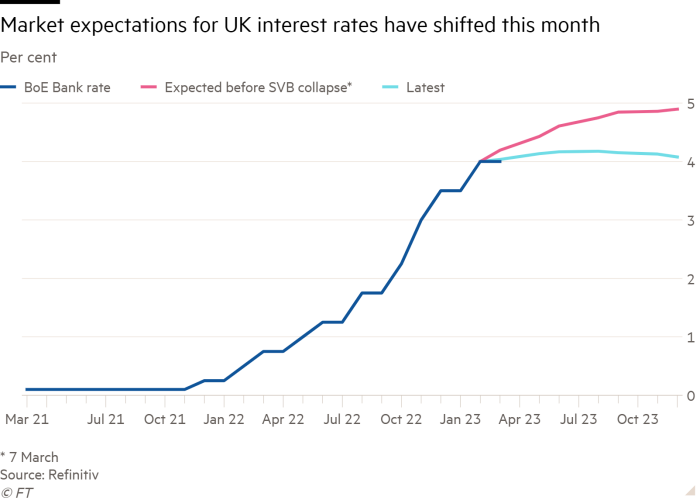

Little more than a week ago, investors largely thought the Bank of England would press ahead with another round of interest rate increases this week, but now the odds look closer to 50-50. Meanwhile, most economists polled by the FT think the Fed will keep raising rates despite the banking turmoil.

Take a break from the news

In this Weekend Essay, FT Shanghai correspondent Thomas Hale reflects on when the pandemic forced Hong Kong, a city defined by movement, to shut off from the world and stand still. Coupled with images from award-winning photographer Lam Yik Fei, Hale examines how the city has changed.

Additional contributions by Annie Jonas and Emily Goldberg

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link