[ad_1]

The cost of buying insurance to protect against Credit Suisse defaulting on its debt soared to a record high this week, in a sign of growing jitters about the lender’s financial position after the failure of two US banks sent shockwaves through global markets.

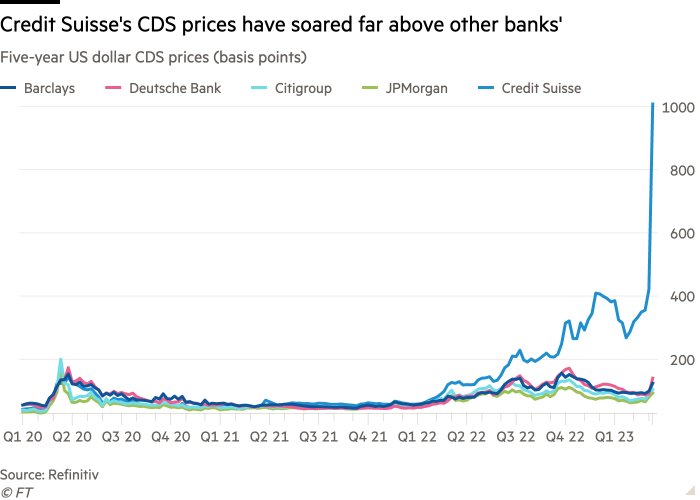

As Credit Suisse’s stock and bond prices have whipsawed in recent days, the price of credit default swaps (CDS) tied to the bank — derivatives that act like insurance and pay out if a company reneges on its borrowings — have rocketed. The Swiss bank’s five-year US dollar CDS has now topped 1,000 basis points — up from less than 400 basis points as recently as early March — with similar moves for euro-based contracts.

That escalation in the price of insuring against default follows a series of setbacks that have weighed on Credit Suisse’s equity and debt, culminating in the group turning to the Swiss National Bank on Wednesday to borrow SFr50bn ($54bn) and announcing a SFr3bn debt buyback.

“With [Credit Suisse], it’s just been one headline after another for the better part of the last five years,” said John McClain, portfolio manager at Brandywine Global Investment Management. “It’s just one thing after another here.”

The recent moves in Credit Suisse’s CDS also follow the failure of US lenders Silicon Valley Bank and Signature. Rating agency Moody slashed its outlook for the whole US banking system from “stable” to “negative” on Tuesday because of the “rapid deterioration in the operating environment”.

Other big banks have also seen their CDS prices climb, but the moves are dwarfed by the moves in Credit Suisse contracts. Five-year dollar CDS for US lender JPMorgan added 15 basis points in the week to Thursday, reaching 94 basis points, according to Bloomberg data. The same measure of CDS for Citi rose around 20 basis points to 113 basis points.

Five-year euro CDS for Deutsche Bank, one of Credit Suisse’s European peers that has faced its own stresses in recent years, climbed more emphatically in price, rising more than 70 basis points to over 160 basis points.

“The recent failure of two US banks has made investors much more cautious on the sector, bringing ‘problem’ banks under even more scrutiny,” Joost Beaumont, head of bank research at ABN Amro, wrote this week, referring to the “CS situation as a special case” and not a sign of “broader weakness in the banking sector”.

Beaumont added that the “special case” argument was reflected by spreads of other banks’ bonds widening by less than Credit Suisse, referring to the gulf in yields between bank bonds and less risky government debt.

Single company name CDS are often very thinly traded, helping to exaggerate market moves. Broadly, “when a company is under stress, their CDS comes under significant strain, but it gets amplified by the fact that it’s a very, very shallow market”. said a bank credit analyst at a big US asset manager.

[ad_2]

Source link