[ad_1]

The abstract nature of finance can make understanding businesses in the sector difficult. Insurers are a particular headache. Their job is to turn a profit from covering unpredictable risks. In life insurance, this is complicated by timeframes measured over decades.

Insurers collect premiums from customers and invest them in assets they hope will match the expected path of payouts. When done well, this produces steady profits and dividends for shareholders.

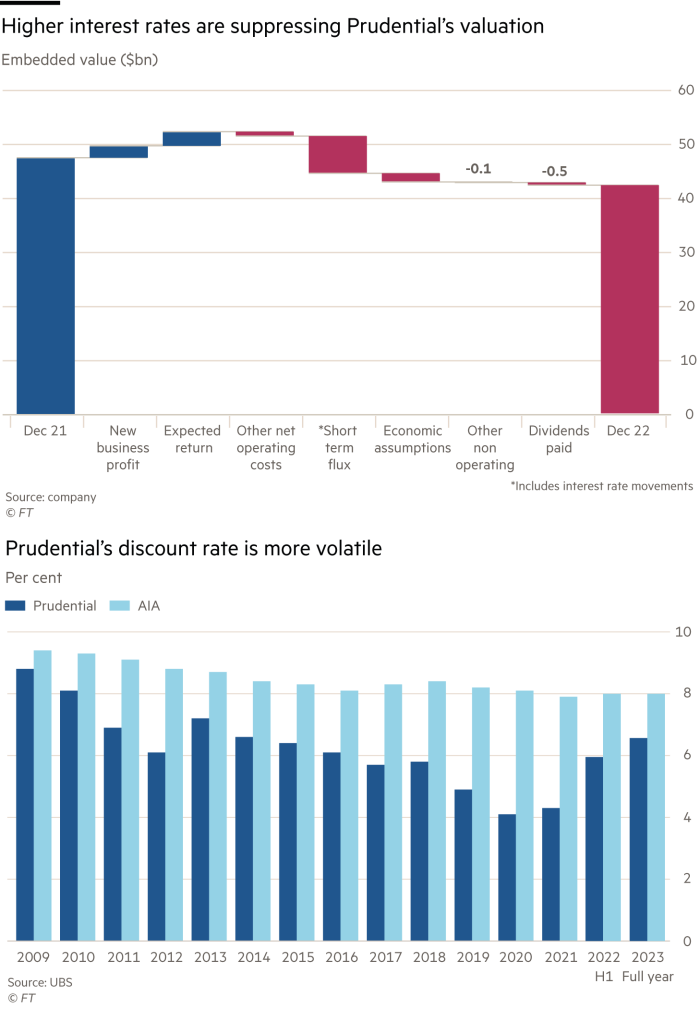

Shepherding large amounts of assets over long time periods means interest rates are important. Asia-focused insurance and savings group Prudential highlighted this in results this week. Higher rates wiped almost $7bn from the company’s “embedded value” last year.

Embedded value is a key metric in insurance. It is also controversial. It is defined as the estimated present value of future profits plus adjusted net asset value. Calculating it involves some subjectivity. Critics say it can too easily be fudged.

Embedded value tends to fall when interest rates rise, reflecting the use of a parallel rising discount rate to estimate present value. This means future profits are worth less today.

Prudential’s total embedded value fell from $47.4bn at the end of 2021 to $42.2bn at the end of last year. That decline was better than analysts expected. The shares still fell on the day.

Investors also take a close interest in how much new business insurers are doing. This can be tricky to measure because profits from new policies are also subject to discount rates as part of the embedded value calculation.

At Prudential, new business profits fell 14 per cent to $2.2bn. This reflected real world issues as well as interest rates. Covid lockdowns in China, Prudential’s main market, reduced volumes. The impact was worse in Hong Kong, where customers prefer higher-margin life and health products.

With lockdowns easing, sales in the year to February this year were 15 per cent higher. Further gains from pent-up demand are expected over the rest of 2023.

Valuation metrics come into focus when making comparisons with local insurance peer AIA, which calculates its embedded value in a slightly different way.

Prudential shares have traditionally traded at a smaller premium to embedded value than AIA. A similar gap exists between the two when valuing the shares against forward earnings.

Prudential might be tempted to change the way it calculates embedded value to align with AIA. However, savvy investors are wise to take embedded values in any form with a few pinches of salt from the South China Sea. Some other insurers have recognised the limitations of the metric and emphasise measures of hard cash instead.

One handy metric is cash remitted from divisions to the insurer’s holding company. At Prudential, this figure dropped by about $150mn to $1.3bn in 2022, usefully aligning with other measures. Dividends jumped from $421mn to $474mn.

That amounted to a statement of intent from new chief executive Anil Wadhwani. He now needs to get metrics that are harder to control pointing upwards too.

Growth remains the biggest issue for Wadhwani. Prudential’s raison d’être for breaking away from its UK and US businesses was to focus on fast growing Asian markets. The group has spare capital and is expected to buy greater exposure to mainland China.

Charles Schwab: broker not broken

The abrupt collapse of Silicon Valley Bank has not only hammered the share prices of banks. America’s largest brokerage, Charles Schwab, is feeling the squeeze too.

Shares in Schwab shed nearly a quarter of their value, or $36bn, last week. The retail broker makes an unlikely target for investors looking for the next SVB. Over the years, though, it has mushroomed into one of America’s largest banks by deposits. These deposits, which stood at almost $367bn at the end of last year, are now in the spotlight.

Like SVB, Schwab put clients’ cash to work in higher-yielding debt securities such as Treasuries and mortgage-backed securities in the years when interest rates were low. These are now underwater amid the run-up in interest rates. Unrealised losses on its $333bn securities portfolio stood at nearly $28bn as of December 31.

Schwab also suffers from deposit outflows — albeit in the form of “cash sorting”. This is when clients chase higher returns elsewhere. That is reflected in a 17 per cent drop in deposits in 2022.

The bear scenario is as follows. A spike in cash sorting could force Schwab to liquidate securities and crystallise paper losses. That could drag down its tier 1 leverage ratio below the regulatory minimum of 4 per cent and force a capital raise.

The scenario is unlikely. Eighty per cent of Schwab’s deposits are insured. Cash sorting settles down as rate hikes ease.

Schwab ended 2022 with a $17bn capital buffer. The business generates about $28bn of cash each quarter through principal maturity, interest and net new asset growth. Schwab has access to over $300bn of liquidity through the Federal Home Loan Bank and other facilities. That is ample capacity to handle even dire short-term illiquidity.

That said, anxiety is contagious. But this creates opportunities for bargain hunters who take the long view.

Lex: a sum of the pars exercise

Please tell the FT’s flagship investment column what its priorities should be for its next 90 years by participating in our readership survey.

[ad_2]

Source link