[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

The fallout from the collapse of Silicon Valley Bank continues to shake global financial markets as questions grow louder about the health of US regional banks. Today, we bring you the inside story on how policymakers raced over the weekend to halt the panic gripping SVB depositors.

Outside our continuing coverage of the SVB crisis, the US, UK and Australia have unveiled a plan to supply Canberra with nuclear-powered submarines and Facebook owner Meta is to announce more job cuts.

Here’s what else to keep tabs on today:

-

Economic data: Instability in the financial system has changed investors’ calculus about the future direction of interest rates but today’s consumer prices data will put the US economy back in the spotlight.

-

Monetary policy: Federal Reserve governor Michelle Bowman will deliver a timely speech on modernising the US banking system at a community bankers’ association gathering in Honolulu, Hawaii.

Let me know if you have any thoughts on today’s news at firstft@ft.com. Thanks for reading FirstFT.

Tickets are now on sale for this year’s FTWeekend Festival in Washington DC. Join Jamie Lee Curtis, Ta-Nehisi Coates, Barbara Sturm, Alice Waters, Colm Tóibín, and your favourite FT writers on May 20. Register now and as a newsletter subscriber, save $20 by using the promo code NewslettersxFestival.

Today’s top news

1. Large US banks are being inundated with requests from customers trying to transfer funds from smaller lenders, following the collapse of Silicon Valley Bank. JPMorgan Chase, Citigroup and other large financial institutions are speeding up the normal “onboarding” process in what executives say is the biggest movement in deposits in more than a decade.

-

The race to restore confidence: Regulators worked through the weekend to prevent contagion spreading through the US banking system, ending on Sunday with a guarantee for all depositors. Read how agreement was reached.

-

US capitalism is ‘breaking down before our eyes’: The founder of the Citadel hedge fund told the Financial Times that the US government should not have intervened to guarantee all SVB depositors.

-

Opinion: SVB shows the perils of regulators fighting the last war, worrying about credit and liquidity risks rather than interest rates, writes Gillian Tett.

2. Mark Zuckerberg will begin a second round of job cuts at Facebook and Instagram owner Meta tomorrow. The social media company is preparing to slash thousands of posts on top of reductions announced at the end of last year as part of a “year of efficiency”.

3. The US, UK and Australia have unveiled a decades-long project to supply Canberra with nuclear-powered submarines. The announcement followed 18 months of talks since the allies signed the trilateral Aukus security pact in September 2021 and is designed to counter China in the Indo-Pacific.

4. Volkswagen is to invest €180bn on battery technology over the next five years as it speeds up plans for the rollout of electric vehicles. As part of a multibillion-dollar investment package VW will build its first North American battery plant in Canada.

5. EXCLUSIVE: TikTok has been accused of mishandling sexual harassment allegations against a former senior manager. Steve Ware made inappropriate sexual comments and advances to young female staff members and clients, according to four women who worked with him. Ware has told the FT all allegations against him are false. Read the full story.

The Big Read

Jeremy Hunt will present his first spring Budget tomorrow, and despite the chancellor’s noisy refutations, the UK economy is in the doldrums. The IMF has forecast it will be the worst-performing large advanced economy this year. But Britain’s decline relative to other rich nations is rooted in problems both old and new.

We’re also reading . . .

Chart of the day

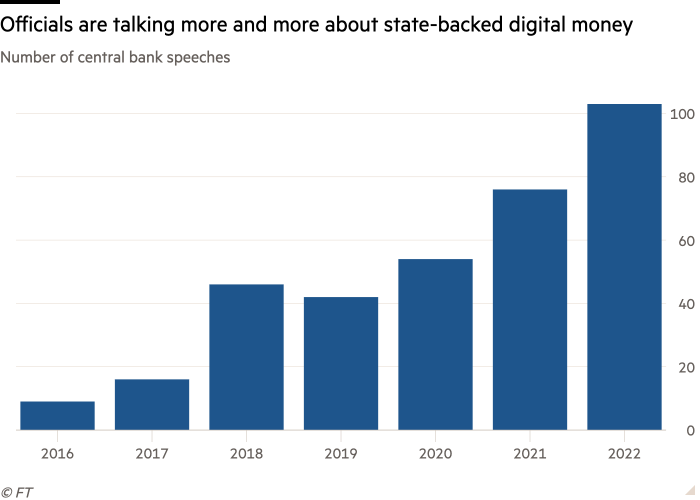

About 85 central banks are engaged in projects to create digital currencies, according to figures from the Bank for International Settlements. Yet governments’ enthusiasm is not matched by the citizens they represent, many of whom view central bank digital currencies as an encroachment into their private lives.

Take a break from the news

The colours were muted on the Oscars champagne carpet — but there were still plenty of standout looks at Hollywood’s biggest night.

Before you go, what was the last Beatles hit before the band broke up? Try your hand at 2-down in our crossword puzzle on the FT app.

Additional contributions by Tee Zhuo and Emily Goldberg

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link