[ad_1]

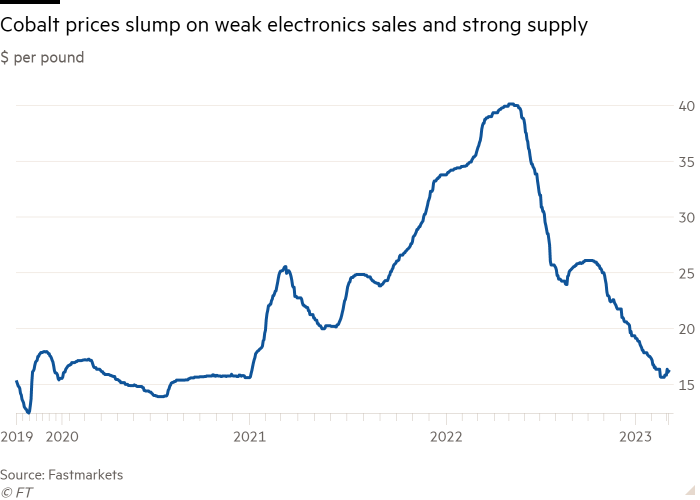

China is set to tighten its grip on global cobalt supply, as the price of the key metal for electric car batteries hits a 32-month low off the back of a surge in production.

Over the next two years, China’s share of cobalt production is expected to reach half of global output, up from 44 per cent at present, according to a report by Darton Commodities, a UK-based cobalt trader.

The increase comes despite western efforts to gain control over supply chains for critical minerals such as cobalt, lithium and nickel, which are essential for making electric car batteries.

Chinese refining activity reached 140,000 tonnes in 2022, more than double its level of five years ago, as volumes processed in the rest of the world stagnated at the 40,000 tonnes mark, handing Asia’s largest economy a 77 per cent global share of refining capacity.

China’s growing role in cobalt supply comes as a 12-month rally for the metal has spun into reverse, with prices dropping 60 per cent to $16 a pound, from their peak above $40 a pound in May.

“A lot of things converged at the same time to push the market down: the relaxation of logistics issues, weak consumer electronic sales and a technology shift towards lower or no cobalt EV batteries,” said Caspar Rawles, chief data officer at Benchmark Mineral Intelligence, a pricing agency.

Global cobalt output increased 23 per cent or by 35,000 tonnes in 2022 over the previous year, according to Darton. That was driven by Swiss commodities group Glencore ramping up production at Mutanda, the world’s largest cobalt mine in the Democratic Republic of Congo, as well as Indonesia emerging as a major producer.

The supply surge was more than double the demand increase, leading to the price collapse. Demand was hit by soft sales of portable electronics globally, draconian Covid-19 lockdowns in China, and a shift in the Chinese electric vehicle market towards lower-range batteries that do not use cobalt.

One trader said there was a “double whammy” as Chinese cobalt refineries and consumers destocked due to weaker consumer demand, but the market was now asking “when does China come back” in terms of demand.

Lower cobalt prices provide some relief to automakers worried about the cost of raw materials for electric batteries, but raise big challenges for getting projects outside of China off the ground.

In the US, Washington’s concerns over China’s dominance of the cobalt supply chain have led to substantial incentives for cobalt production domestically or in countries deemed friendly to America. However, those incentives, codified in the Inflation Reduction Act, will take years to yield any results.

Automakers have been pushing to develop battery chemistries that use less cobalt because of concerns over child labour in the DRC, which generates three-quarters of global supply.

Cobalt is a byproduct from copper or nickel mines, prices of which have remained relatively strong, meaning supply is not readily reduced even when cobalt prices drop.

However, industry sources said small-scale informal mining, which contributes between 15 and 30 per cent of DRC output, has already cut back, with some artisanal producers shifting to copper instead.

Steven Kalmin, Glencore’s chief financial officer, said last month during an analysts call that “we will look to be dynamic around managing cobalt production and sales” to manage lower prices.

Cobalt prices could fall further if Tenke Fungurume, the world’s second-largest cobalt mine owned by China’s CMOC, is allowed to resume exports from the DRC after a tax dispute led to an export ban last July. It has kept producing despite the ban, stockpiling 10,000 to 12,000 tonnes of material, equivalent to 6 per cent of last year’s demand, according to market estimates.

The projected increase in China’s share of global cobalt mining is largely due to the start up at CMOC’s Kisanfu copper-cobalt mine in the DRC this year.

[ad_2]

Source link