Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning.

Today we start with the news that Bridgewater Associates, the world’s largest hedge fund, is preparing for the most significant shake-up of the firm since its founder Ray Dalio ceded control.

And scroll down for our latest scoop on Adani Group, which has continued to dismiss short seller claims of fraud and share price manipulation to little effect.

Here’s what to watch in the day ahead:

-

Foreign affairs: The G20 Foreign Ministers Meeting concludes in Delhi today. Separately, Indian prime minister Narendra Modi will host his Italian counterpart Giorgia Meloni.

-

EU flash inflation figures: Consumer prices figures indicate that European inflation is likely to persist ahead of the publication of February euro area flash inflation data today.

-

Earnings: Results are expected from companies including Anheuser-Busch InBev, China Tower, London Stock Exchange, Merck, Salvatore Ferragamo and Universal Music Group.

Thanks for all the feedback on FirstFT’s new look. Keep it coming: firstft@ft.com.

Join us in Singapore on March 16 for our inaugural Wealth Management Summit to discuss how best to scale up whilst navigating geopolitical tensions, regulatory shifts, and investment risks. Register today.

Today’s top news

1. Bridgewater will cut about 100 jobs while its Pure Alpha fund will stop accepting new money once it hits a certain size, one person familiar with the plan said. The cap on the fund will be set at a threshold that is 20-30 per cent lower than its peak size of $100bn. Learn what played a role in the decision.

2. Exclusive: India’s Adani Group has told bondholders it has access to a $3bn credit line from backers including at least one sovereign wealth fund, as it tries to assuage concerns about its financial health in the wake of a damaging short seller report accusing it of fraud.

3. Swiss prosecutors have charged four bankers with helping to hide tens of millions of Swiss francs on behalf of Vladimir Putin, in one of the first ever court cases in the west to directly involve assets allegedly belonging to the Russian president. Read more on the four individuals.

-

Related read: Western allies are pushing the United Arab Emirates to halt exports of critical goods to Russia as they seek to starve Putin’s military of components to sustain its war against Ukraine.

4. Belgium’s cyber security agency has linked China-sponsored hackers to an attack on a prominent Belgian politician, Samuel Cogolati, as European governments become increasingly willing to challenge Beijing over alleged cyber offences. Keep reading.

5. Chinese factory activity expanded at its fastest pace in more than a decade in February. The data is an early indication of the country’s recovery following the end of strict Covid restrictions in December — but enthusiasm for China’s economic reopening is not universally shared.

The Big Read

Can the world’s workers press home their demands for better pay? This is the single biggest question facing central bankers around the globe as they fight to curb the rates at which prices are rising.

We’re also reading and listening to . . .

-

Lab leak theory: Whether Covid came from a lab or a seafood market is almost beside the point, writes Edward Luce. Humanity’s interest is to stop the next pandemic from happening.

-

Mansion for sale: The Holme, set in four acres of London’s Regent’s Park, may become the UK capital’s most expensive house ever sold.

-

???? ‘Cash stuffing’: On this episode of the Money Clinic podcast, host Claer Barrett speaks to “cash stuffer” Euphemia Senna about the pros and cons of budgeting this way (and the digital equivalent).

Chart of the day

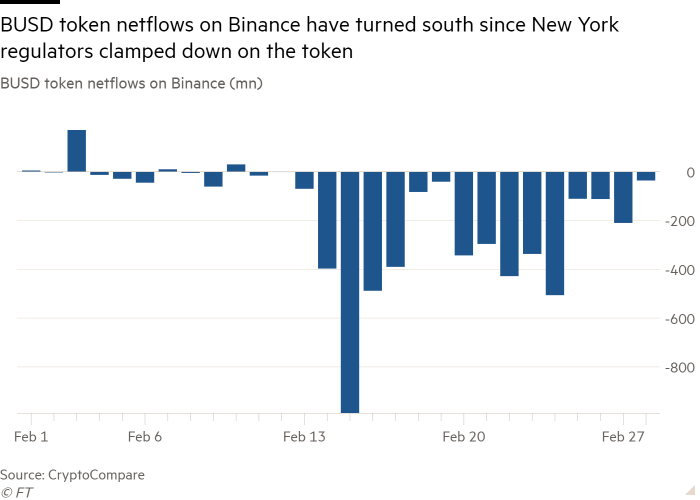

The world’s largest crypto exchange is under pressure. Investors have pulled more than $6bn out of a Binance-branded digital token known as BUSD in the past month, in a sign that a recent US regulatory crackdown on digital assets is making waves.

Take a break from the news

You’ve responded to an advert seeking crew for a dangerous naval expedition. A flyer for the polar voyage promised months of darkness, low wages and a slim chance of safe return. From the very start of the game The Pale Beyond, it’s clear that you’ll be lucky even to survive.

Additional contributions by Gordon Smith and Tee Zhuo

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

Comments are closed, but trackbacks and pingbacks are open.