[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. It’s Katie Martin in London, helping out Rob and Ethan for their holiday-shortened US week.

Yesterday, Ethan overly generously referred to my return to Unhedged duties as “triumphant”. If by contrast you are thinking “oh no, not again”, then you will be thrilled to hear the theme of this newsletter today is: “oh no, not again”.

Drop me a line! katie.martin@ft.com

Fretting about 60/40 (yes, again)

The ink is barely dry on all the articles about the triumphant return of 60/40 portfolios — the classic mix of 60 per cent equities, 40 per cent bonds that is supposed to help balance out market risks.

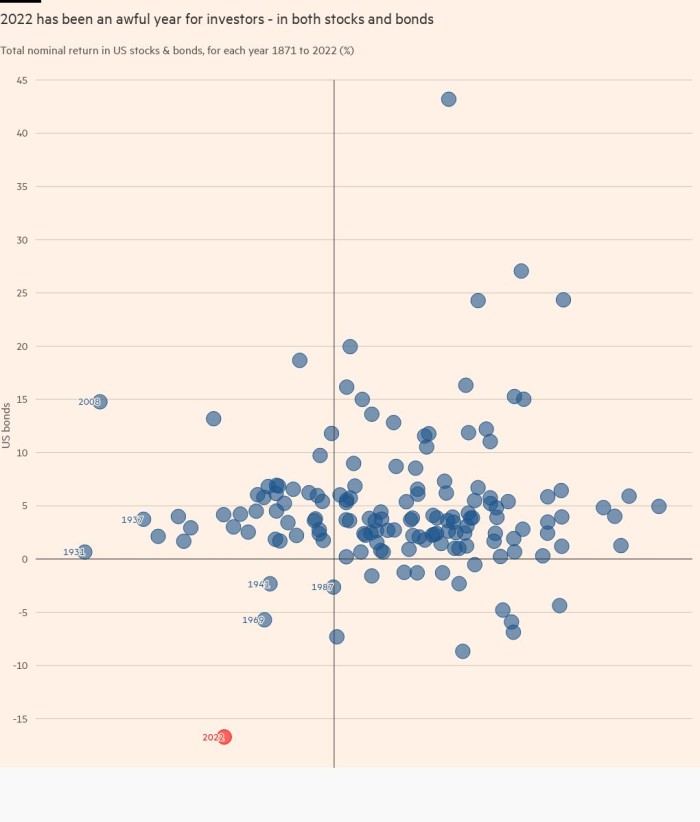

Regular readers of this newsletter will no doubt be aware that this strategy stumbled into a woodchipper last year as scorching inflation chewed up bonds and higher interest rates spat out stocks.

I had this brutal chart drawn up for an FT Big Read on this theme last November, and it has since been presented back to me multiple times as one of asset allocators’ least favourite data projects of all time — the perfect illustration of a horrible year:

But the accepted wisdom has been that 60/40 is back for 2023, with both sides of the equation offering up some bargains.

Just the other day, Capital Group laid out the case for a comeback. Its investment director, Julie Dickson, wrote that conservative investors still need a mix of growth, capital conservation and income:

We believe 60/40 portfolios offer that option and investors should not overlook their long-term credentials because of a single bad year. If we were to look at a hypothetical 60/40 portfolio over a longer timeframe, performances have been consistently solid, with positive returns in 15 out of the past 20 calendar years. Most importantly, in the five years where results were in negative territory, only two (2008 and 2022) were double-digit declines — a testament to the long-term resilience of 60/40 portfolios.

What’s more, when the strategy does have a duff year, it tends to rebound strongly:

So far, so good. However, along comes the latest curveball: the no landing scenario that Ethan outlined so nicely in this newsletter on Monday.

All the debate in markets for months has been about the severity of the supposedly “inevitable” impending recession. Dario “inventor of the moron risk premium” Perkins at TS Lombard maintains this has always been silly. “The ‘2023 recession’ thesis was basically just a sellside marketing campaign,” he wrote last week. Miaow.

In any case, particularly since January’s blowout payrolls report, we have to seriously entertain the notion of neither a soft landing nor a hard landing but no landing at all, at least for now.

Great! Kinda. Torsten Slok at Apollo delivered the buzzkill last week. “The no landing scenario is characterised by inflation being sticky at high levels,” he said.

And that possibly means (emphasis mine) . . .

. . . that the Fed needs to do more demand destruction to get inflation back to 2 per cent. The bottom line is that higher interest rates for longer is negative for consumer spending, capex spending, and corporate earnings.

In short, under the no landing scenario, high inflation is a problem, and the Fed is not done raising rates, which means that the trading environment from 2022 will be coming back, and the 60/40 portfolio will perform poorly.

Say it ain’t so?

One reason not to despair: Even if bonds weaken from here, right now even 10-year Treasuries are yielding 3.8 per cent. What really fried 60/40 last year was that yields’ starting point was pretty much zero per cent. Still, if this strategy flubs again, it really will start to lose its conservative credentials.

A quick thought to leave you with

Is the China trade overdone? A lot of investors appear to think so, judging from Bank of America’s monthly fund manager survey.

The latest survey showed respondents plucked out “long China equities” as the most crowded trade, after seven consecutive months when “long US dollar” topped the list. (Before that, it was “long oil” for four months, and before that it was some variation of long tech and/or b*tcoin for most of three years.)

The CSI 300 index has climbed 18 per cent since the end of October and in dollar terms it is nudging ahead of the S&P 500 so far this year. As my colleague Hudson Lockett and I wrote earlier this month, global investors have snapped up Chinese stocks this year at a record-breaking pace.

Robert St Clair, global strategist at Fullerton Fund Management in Singapore, pointed out that 2023 GDP growth estimates for China stand at about 5-6 per cent, and a back-of-an-envelope calculation would suggest that translates to a 10 per cent gain in stocks. But we are already about half way to that target. “Things have moved very quickly ahead of the hard data,” he said. “Investors are now thinking the rally has been quite strong and fast and maybe it’s time for a bit of a breather.”

FYI: Earnings are due from Baidu on Wednesday, and from Alibaba on Thursday.

One good read

Godwin’s law, AI edition. This is fine.

[ad_2]

Source link