[ad_1]

This article is an on-site version of our The Week Ahead newsletter. Sign up here to get the newsletter sent straight to your inbox every Sunday

Hello and welcome to the working week.

Friday marks the first anniversary of Russia’s full-scale invasion of Ukraine, an event that shocked the world by bringing large-scale conflict to European soil.

US president Joe Biden’s visit to Poland at the start of the week will serve as a show of strength to Ukrainian and Nato allies in the face of Russia’s long-expected spring offensive.

The EU’s Foreign Affairs Council meeting on Monday will focus on the war and it will be the keynote item at Friday’s UN Security Council meeting in New York. Ukrainian president Volodymyr Zelenskyy may travel to Manhattan to address the assembled delegates.

The Financial Times has a special magazine issue marking the anniversary of the war featuring essays by our Ukrainian correspondent Christopher Miller and academic Mary Elise Sarotte, alongside a powerful picture package by Ukrainian photographers.

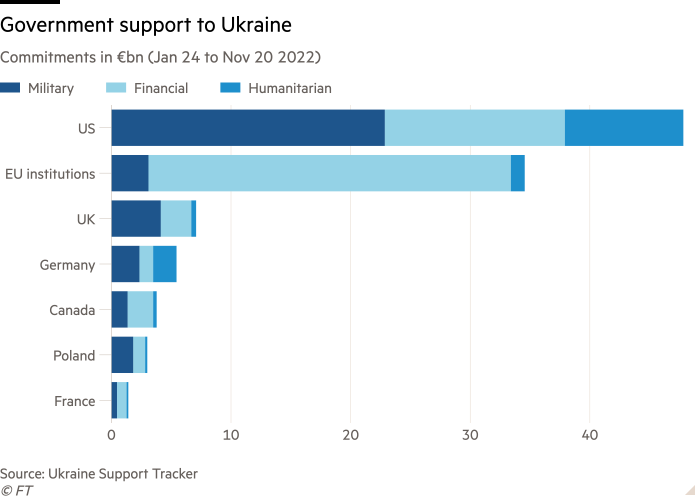

Henry Foy examines how western governments have provided more than $110bn in support to Kyiv since last February — $38bn in the form of weapons — and how the reality of maintaining these numbers is only just beginning to dawn on the west.

The UK’s winter of industrial unrest rumbles on. Staff at more than 150 higher education institutions will walk out in a long-running dispute over pay and conditions while regional ambulance staff in England and Northern Ireland will hold various strikes this week.

FT Live holds a free online event, the Future of Business Education: Spotlight on MBA, on Wednesday, where the FT’s global education editor and business education rankings manager, will share details about how the best business schools are rated. Click here to register.

As ever your comments and suggestions about items are appreciated. For this edition, email me at alastair.bailey@ft.com or if you received this email in your inbox just hit reply. Jonathan will be back next week.

Economic data

Gross domestic product is the main US data point on Tuesday and minutes from the last Federal Reserve’s meeting land on Wednesday.

UK public-sector borrowing figures for January are out on Tuesday. Increases in debt interest and spending on energy support schemes made last month’s release the highest monthly total since records began in January 1993.

Turkey’s central bank announces interest rates on Thursday.

Companies

UK banks will stay in the spotlight. Last week NatWest announced an almost tripling of profits driven by higher interest rates. These should also boost profits for HSBC and Lloyds Banking Group when they report on Tuesday and Wednesday respectively, but these revenue channels are looking increasingly exhausted.

Several miners report this week, including Newmont, the world’s largest gold miner, which launched an all-share $17bn bid for Australian rival Newcrest earlier this month. Global demand for gold is surging as central banks and investors shelter from persistent inflation and geopolitical upheaval.

Key economic and company reports

Here is a more complete list of what to expect in terms of company reports and economic data this week.

Monday

-

EU, December construction output figures

-

EU, Consumer confidence data

-

UK, Sam Woods, deputy governor for Prudential Regulation and chief executive of the Prudential Regulation Authority, speaks at the Association of British Insurers Annual Dinner

-

UK, Office for National Statistics publishes its evidence review on hidden homelessness

Tuesday

-

EU, S&P Global manufacturing PMI flash data

-

EU, Zew Economic Sentiment Index

-

UK, S&P Global/Cips Services and Manufacturing PMI Flash data

-

UK, CBI Industrial Trends orders

-

Results: Standard Chartered FY; HSBC FY; Antofagasta FY; InterContinental Hotels FY; Home Depot. Q4; Medtronic Q3; Palo Alto Networks Q2; Capgemini FY; Engie FY; Coinbase FY

Wednesday

-

France, Business confidence data

-

Germany, January harmonised index of consumer price inflation data

-

Italy, January consumer price index (CPI) inflation data

-

US, Federal Reserve Bank of New York president John Williams participates in a fireside chat on Taming Inflation before the hybrid Credibility of Government Policies conference

-

Results: Lloyds FY; Nvidia FY; Stellantis FY; Baidu Q4; Danone FY; Ebay Q4; Garmin FY; Etsy FY; Domino’s Pizza Q4; Rio Tinto FY

Thursday

-

UK, Keynote speech at the Resolution Foundation in London by Catherine L Mann: ‘The result of rising rates: Expectations, lags and the result of rising rates’.

-

UK, Bank of England deputy governor Jon Cunliffe speaks on cross-border payments at a meeting of G20 officials

-

US, unemployment claims

-

US, Q4 Personal Consumption Expenditures (PCE) index

-

Results: Alibaba Group Q3; Deutsche Telekom Q4; Intuit Q2; American Tower Q4; Dr Pepper Snapple Group Q4; Budweiser Q4; CBRE FY; Warner Bros Discovery Q4; BAE Systems FY; Telefónica FY; Coterra Q4; Live Nation FY; Serco FY; Drax FY; Rolls-Royce FY; Spectris FY; Greencoat UK FY; Morgan Sindall FY; Qantas Q2; Anglo American FY; Newmont FY

Friday

-

France, Q4 GDP data

-

Germany, Q4 GDP data

-

Japan, January consumer price index (CPI) inflation data

-

UK, April-June 2022 housebuilding data released

-

UK, Cost of living and higher education students, England (Scolis) data: January 30 to February 13

-

US, data on new home sales

-

Results: Jupiter Asset Management FY; International Consolidated Airlines Group FY; OCBC FY; CIBC Q1; Endesa FY; Holcim Group FY; Amadeus FY; PKN Orlen FY

World events

Finally, here is a rundown of other events and milestones this week.

Monday

-

Greece, US secretary of state Antony Blinken makes his first trip abroad since cancelling a planned visit to China

-

Israel, the Knesset holds the first reading of a contentious legal reform bill

-

Spain, the International Renewable Energy Conference begins in Madrid

-

UN World Day of Social Justice

-

US, George Washington’s birthday marks Presidents’ Day where a federal holiday is observed

Tuesday

-

Belgium, meeting of the EU General Affairs Council in Brussels

-

Italy, Venice Carnival ends

-

Sweden, EU energy ministers meet until Wednesday in Stockholm

-

UK, London Fashion Week ends

-

Unesco International Mother Language Day promoting linguistic and cultural diversity

-

US, Mardi Gras parade and celebrations in New Orleans, Louisiana

-

US, Supreme Court releases orders and hears oral arguments

Wednesday

-

India, Finance ministers of G20 countries and their central bank chiefs begin a summit in Bengaluru until Saturday

-

Indonesia, Chin’s foreign minister Qin Gang visits Jakarta

-

Japan, the Emperor’s Birthday (Naruhito) is marked with a public holiday

-

South Africa, finance minister Enoch Godongwana presents the 2023 budget

-

US, UN Security Council to meet on Somalia

-

US, First Lady Jill Biden begins a trip to Africa with stops in Namibia and Kenya

Thursday

-

Spain, energy minister Teresa Ribera to speak at economy forum in Madrid

-

US, UN Security Council to meet on co-operation between the UN and EU

Friday

Saturday

-

Nigeria, elections to the Nigerian presidency, Senate and House of Representatives

-

US, the 2023 Asia-Pacific Economic Cooperation (Apec) Finance and Central Bank Deputies’ meeting

Sunday

-

South Africa, ICC Women’s T20 Cricket World Cup final in Cape Town

-

UK, Manchester United play Newcastle United in the Carabao Cup Final at Wembley Stadium

[ad_2]

Source link