[ad_1]

(Bloomberg) — Said Haidar’s conviction that inflation was about to explode across the globe can be summarized by a single number: $63 billion. That’s how much his Haidar Capital Management reported in assets to start 2022.

The catch? The hedge fund actually oversaw just $1.2 billion.

That copious leverage led to a tumultuous year — one month the fund was up 54%, another it was down 20% — but ultimately paid off, producing a 193% return for investors. Haidar bet big that interest rates would climb at a rapid clip, correctly positioning to profit from the surge in inflation that led to the most aggressive central bank tightening campaign in a generation.

Some, like Haidar, can say they saw all of this coming. He wrote to clients in January 2022 that markets would have to price in more rate hikes, leading to “choppiness in risk assets.”

Few reaped a bigger windfall.

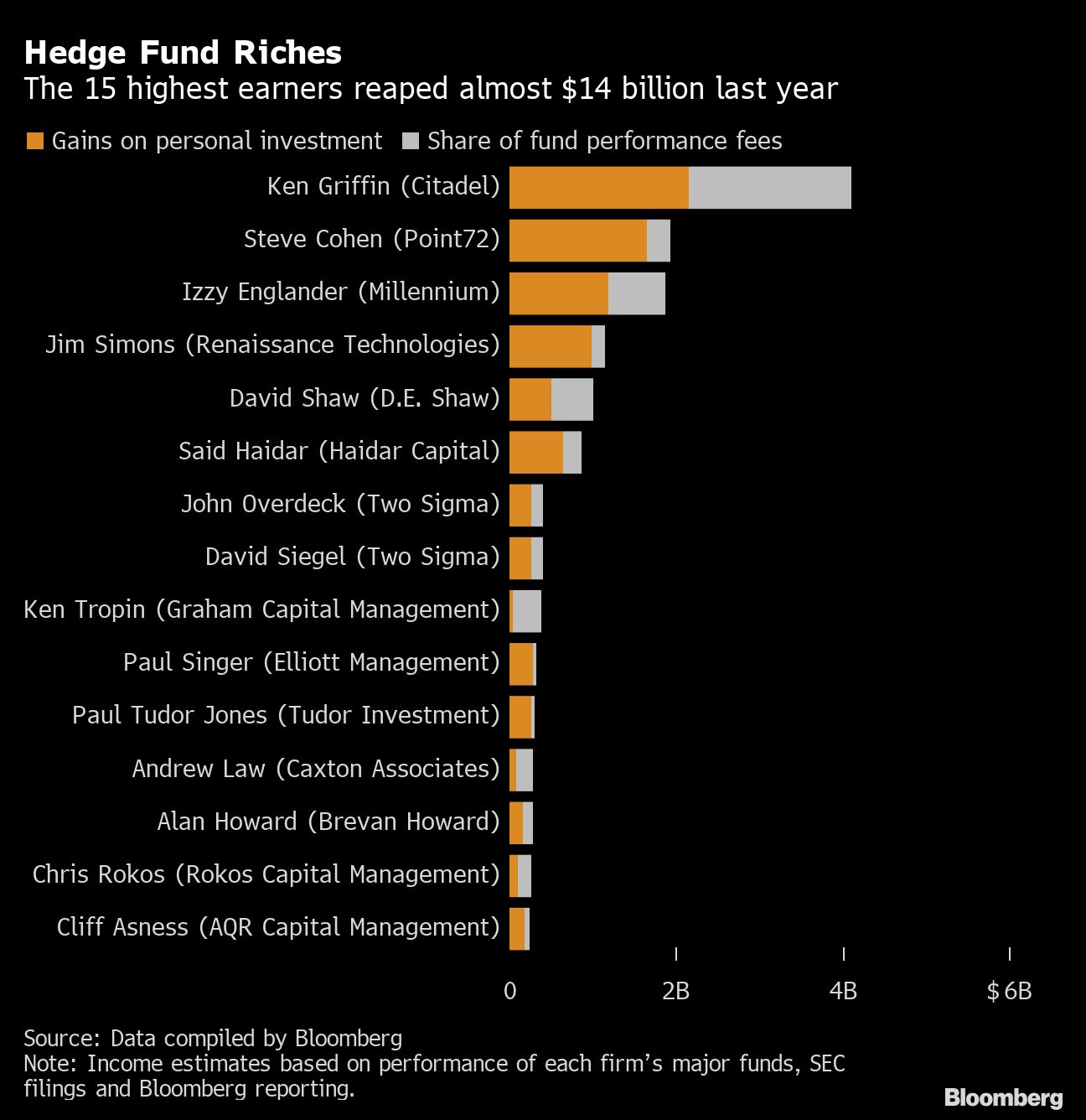

Haidar personally raked in $859 million in 2022, placing him sixth on Bloomberg’s annual ranking of top-earning hedge fund managers. He’s the newest and least-known name on a list otherwise dominated by industry heavyweights. Citadel’s Ken Griffin, Point72’s Steve Cohen and Millennium’s Izzy Englander, worth about $55 billion combined, nabbed the first three spots.

A spokesman for Haidar declined to comment.

Read more: Haidar’s Hedge Fund Dominates Macro Resurgence With 274% Gain

Haidar, a trader who started his hedge fund more than 25 years ago, reflects a resurgence in the hedge fund world’s old guard after being outpaced at times in recent years by more tech-focused investors like Chase Coleman and his fellow Tiger Cubs. The biggest winners include macro specialists like Haidar, as well as quants and multi-strategy funds. Citadel, for one, rose 38% on the year. The losers, including Coleman’s Tiger Global Management, Lone Pine Capital and Coatue Management, posted some of their worst annual returns ever.

The founders of those firms felt that glory and pain personally. Griffin, 54, made $4.1 billion last year alone. Coleman, 47, lost $1.7 billion, according to Bloomberg’s analysis.

See last year’s ranking here: Unknown Hedge Fund Manager Made $2 Billion, Beating Titans

Griffin derived just over half of his earnings from his investment in Miami-based Citadel’s funds, with the rest coming from his share of performance fees. It’s the most anyone has taken home since Bloomberg started the ranking in 2019, and more than double the $1.9 billion earned by Cohen, the owner of Point72 Asset Management and the New York Mets, who ranked second.

For how Bloomberg calculated the lists: click here.

Despite Griffin’s haul, the $13.8 billion collected by the 15 top-earning managers was the lowest annual total since 2019. Two years ago, it was $23 billion, when Coleman took home $3 billion to nab the top spot.

The losses, meanwhile, were enormous.

Tiger Global’s public funds shrank in 2022 as its bets on China, tech stocks and private startups backfired after years of blockbuster gains. Scott Shleifer, the firm’s head of private investments, lost $530 million. Bloomberg’s analysis only examined firms’ hedge and long-only funds, not dedicated private equity and venture capital portfolios.

Other stalwarts of Bloomberg’s previous lists of top hedge fund earners also faced reversals of fortune. D1 Capital’s Dan Sundheim, TCI’s Chris Hohn, Lone Pine Capital’s Stephen Mandel and Viking Global’s Andreas Halvorsen incurred the biggest personal losses last year. What many of those firms have in common: big bets on tech stocks, sometimes including VC investments. Many of the managers started their careers at Julian Robertson’s Tiger Management, earning them the Tiger Cub moniker.

Bloomberg’s list excludes those who no longer manage money for external investors. That means Michael Platt isn’t ranked, despite adding $3 billion to his fortune as BlueCrest Capital booked a 153% return.

Read more: Michael Platt’s Highly Leveraged Fortune Balloons to $11 Billion

As for Haidar, he got off to a rocky start this year. His fund sank 13% in January after being caught off-guard by an unexpected drop in bond yields. He told clients in an interview this month that he remains convinced inflation will remain elevated, forcing central banks to keep ratcheting up interest rates.

“If inflation does come down as quickly as central banks predict,’’ he said, “it’ll be because they get really lucky.”

–With assistance from Amanda Albright, Nishant Kumar and Katherine Burton.

To contact the authors of this story:

Tom Maloney in New York at [email protected]

Hema Parmar in New York at [email protected]

© 2023 Bloomberg L.P.

[ad_2]

Source link