This article is an on-site version of our Trade Secrets newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday

Welcome to Trade Secrets. The EU leaders’ green summit that I and others had written about in advance took place last week. It ended much as you’d imagine: the French (and the European Commission) made their pitch for more centralised funding, there was pushback from fiscal conservatives such as the Netherlands, governments agreed to use unspent money first, before finding new sources. These debates will run and run. One interesting thing was that the messaging from the commission emphasised Chinese subsidies as well as American, which isn’t always the case. In related news, today’s newsletter looks at the EU’s disenchantment with an investment treaty it says slows down member states from pursuing the green transition. Charted waters is on the remarkable resilience of US-China trade.

Get in touch. Email me at alan.beattie@ft.com

A deal running out of energy

If you could turn irony into electrical power, that surrounding the Energy Charter Treaty would be enough to run Europe’s fleet of electric cars for a decade. The pact, with 53 members, dates from 1994. It was originally designed to protect western European investments in the fossil fuel free-for-all of Russia and other former Soviet states after the cold war.

These days, following Russia’s invasion of Ukraine, the EU is actively trying to deter investment in Russia via sanctions and moral dissuasion, and it’s the rich western European countries that are getting clobbered under the ECT. Companies have brought a string of investment claims saying they have been affected by changes in taxes and regulations on renewables. Spain has been particularly targeted — perversely because of green incentives the government introduced and then retreated from.

After a few years chuntering and proposing amendments to tilt the treaty against complainants, the EU has got bored with the idea of incremental reform and said it was inevitable that all member states would junk it. A bunch already have, including Germany, the Netherlands and Italy, the last of which was well ahead of the game, quitting in 2014. The European Court of Justice had also punched a hole in the ECT by saying it doesn’t apply to intra-EU arbitration.

Naturally the provisional wing of the investment protection community is out of the traps complaining. Jay Newman, the heroic defender of property rights/malign genius (delete one), formerly of Elliott Management, which famously pursued the likes of Argentina over defaulted sovereign bonds, wrote in the FT’s Alphaville recently that Spain was now second only to Argentina in the number of arbitration awards defaulted on. Newman sagely warned/concern-trolled (delete one) that the European Commission’s big green spending splurge might founder if companies lost confidence in the protection of their investments.

This seems a bit unlikely, frankly. If there’s enough public money sloshing about, there will always be companies trying to scoop it up, and a sunset clause means ECT provisions continue to apply for 20 years after a country leaves. But it’s true there’s an issue of principle here, and one that might take some explaining by the EU.

Environmentalists have long complained that trade law gives far too little leeway for green regulations or subsidies. There’s a long history of World Trade Organization litigation on the subject, including the seminal shrimp-turtle case which began in 1996 and first brought the WTO under widespread scrutiny by green campaigners.

The Biden administration and its outriders have now embraced this view with enthusiasm, using the environmental imperative to defend the Inflation Reduction Act and its electric vehicle tax credits, and basically to ignore what WTO rulings say. (One day there will be a Trade Secrets that doesn’t mention the electrical vehicle tax credits, but not today).

To a casual observer, it looks a bit odd that the EU is recommending abrogating a treaty because of the restrictions it places on environmentally-friendly subsidies — while complaining the US is doing the same. Now, the EU can argue (with justification) that there are bad trade laws and good trade laws, that the ECT was a treaty of its time with overbroad protections that applied in a different context, that investor-state arbitration is not the same as government-to-government WTO litigation and that there’s plenty of room to do environmental policy within WTO rules.

All reasonable enough, but the ECT story supports a popular framing that the environment needs saving, that progressive countries are hurling money at the problem, and that pettifogging objections about outdated trade rules should not be allowed to get in the way. I’ll write more about the detail of green subsidies in a future newsletter, or column. This is just to note that the shift to renewables and other carbon-light technologies is here putting a global trading power on opposing sides of the same issue in different contexts. The law is complex, and so is the narrative.

As well as this newsletter, I write a weekly Trade Secrets column for FT.com. Click here to read the latest, and visit ft.com/trade-secrets to see all my columns and previous newsletters too.

Charted waters

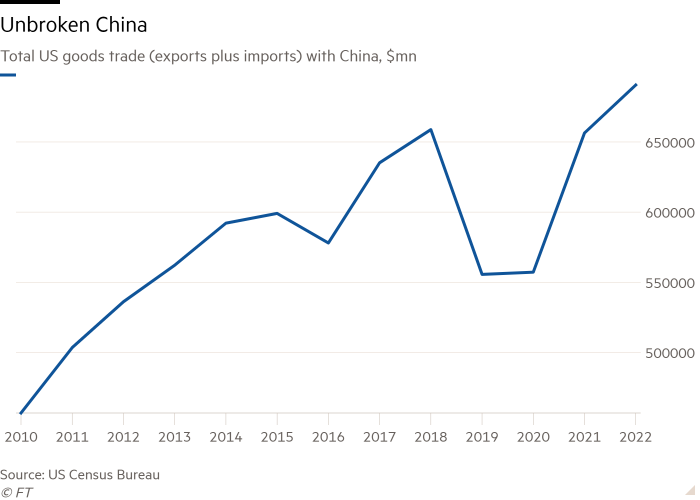

A regular reminder that political rhetoric is one thing but actual trade another. Over the past decade, US-Chinese trade has been under continual political pressure, first from former president Donald Trump’s blunderbuss protectionism and now from Joe Biden’s precision-guided industrial policy. And yet goods trade at least sails on unperturbed. Data released last week showed it’s ridden the Covid-19 shock and bounced back just fine.

Of course, some of Biden’s actions are very recent and won’t have had time to come through. And the US tech war and export controls might affect China’s economy in ways not picked up by these overall data. But it is quite impressive how much flak the trading relationship has taken without much sign of damage.

Trade links

In a post timed for Valentine’s Day, Ed Gresser at the Progressive Policy Institute shows how women’s underwear has higher US tariffs than men’s. With regard to the effect on the consumer, I’d note that whether those constraints pinch will depend on — WAIT FOR IT — the elasticity. I’ll be here all week.

Former US Treasury international finance guru Mark Sobel says the IMF should take the lead in persuading China fully to participate as a creditor in sovereign debt writedowns.

Check how fast prices are rising in your region via the FT’s international inflation tracker.

In the indispensable Britain After Brexit newsletter, my FT colleague Peter Foster explains how UK companies are struggling with the new British “Reach” chemicals regulations, which is costing them business in the EU. If only someone had warned about this before.

Comments are closed, but trackbacks and pingbacks are open.