[ad_1]

(Bloomberg) — Finance professionals all over the world would like to follow Ken Griffin to Miami.

Florida — where Griffin relocated his Citadel hedge fund — tops the investor wish list when asked where they would move if they could work from anywhere globally. The sunny southern locale with low taxes, and specifically Miami, is also coming up as a rival to Singapore and New York for the title of the hottest residential market this year, according to the latest MLIV Pulse survey.

Investors were asked to pick best spot in the world to work from. Source: Bloomberg MLIV Pulse survey Feb. 6-10.

The finance community quickly decamped to friendly climates during the pandemic, with Citadel setting up shop in a luxury Four Seasons hotel in Palm Beach, helping create what’s now known as Wall Street South. Goldman Sachs Group Inc., Apollo Global Management Inc. and Blackstone Inc. have also added presence in the region, and billionaire Stephen Ross’s Related Cos. is looking to expand in Florida as people relocate for jobs. Waterfront properties in the Sunshine State are hitting records.

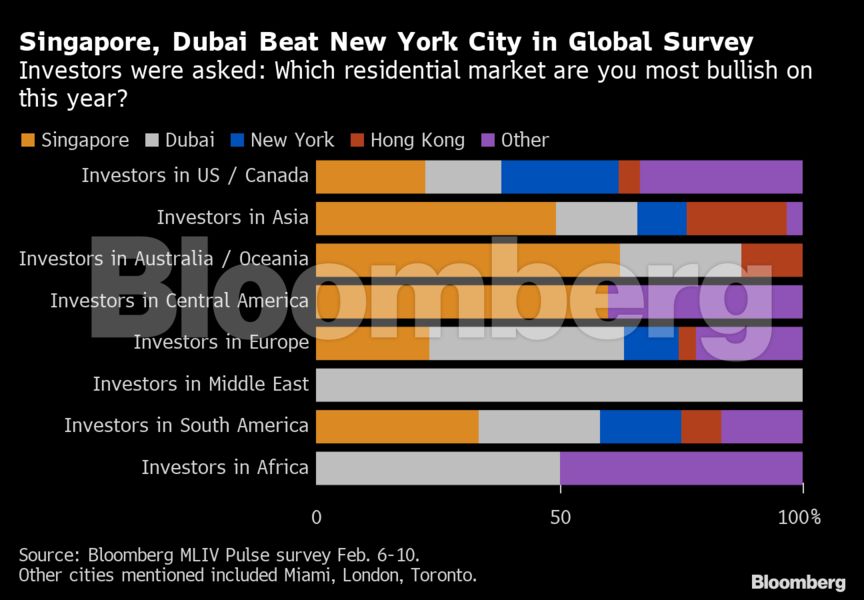

Globally, investors in Asia chose Singapore as their pick for the hottest residential market this year, while those in Africa and the Middle East preferred Dubai. Even among respondents based in the US and Canada, Singapore challenged New York City as top choice.

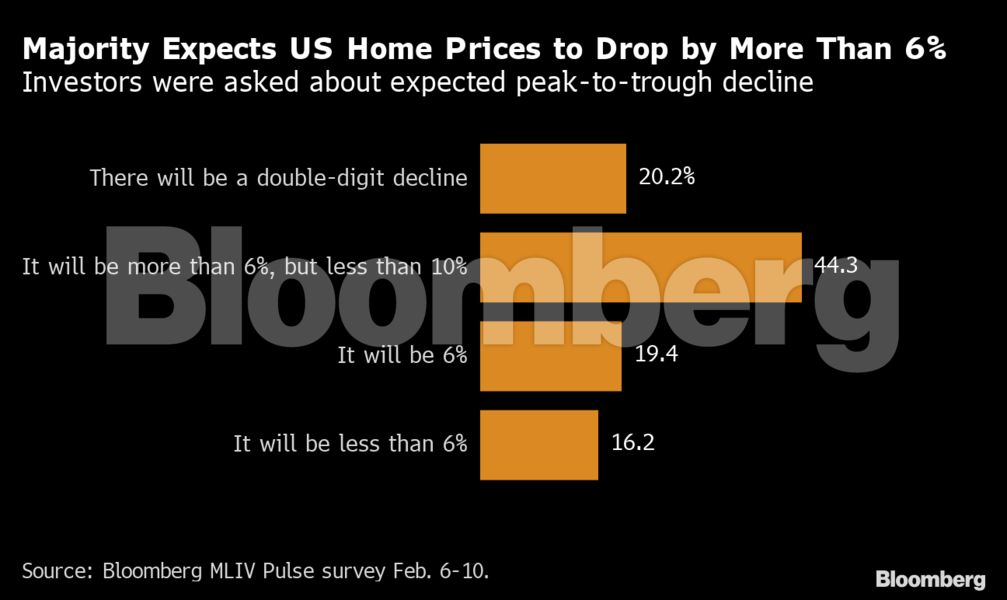

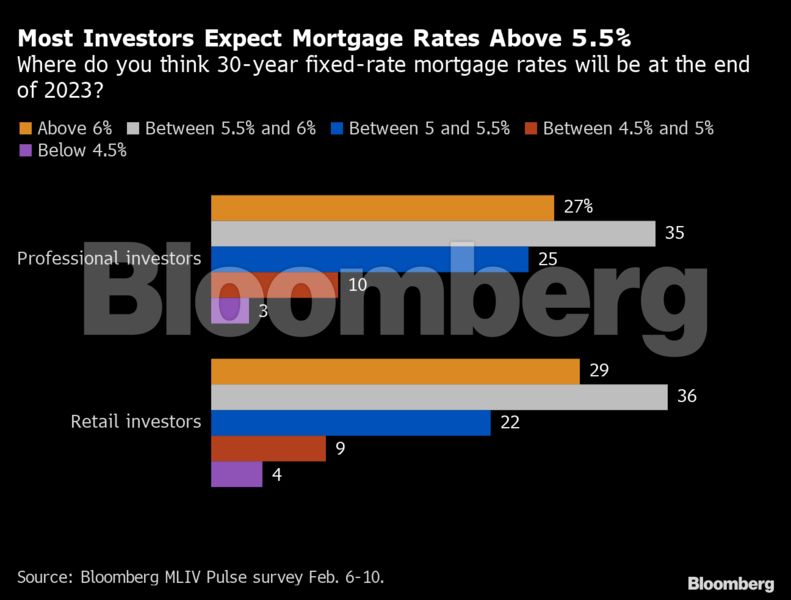

The outlook for the broader US housing market, however, is rather glum. Mortgage rates will stay above 5.5% this year, investors say in the Feb. 6-10 survey. Some expect home prices to decline by more than 10% peak-to-trough. For Americans used to home prices predominantly going up, this could eventually hurt confidence and spending, denting the broader economy.

US mortgage rates more than doubled last year, compounding difficulties for some would-be buyers and putting the housing market in a deep freeze. Residential construction has had a negative impact on GDP for the past seven quarters and the majority of 510 respondents expect the drag to last at least through the end of this year.

Housing prices in the US hadn’t posted a significant decline in roughly two decades that preceded the great financial crisis. It took about 10 years for the Case-Shiller National Home Price Index to recover. Prices had been climbing ever since, until peaking in June, right when mortgage rates hit the 5.5% level.

High borrowing costs, the result of the Federal Reserve’s crusade against inflation, have made current owners hesitant to list their homes and forgo the mortgages they took out when rates were low. High labor and material costs also mean that renovating a house before putting it on the market, always an expensive undertaking, has become even pricier.

Still, as the US approaches the spring selling season, the peak activity time akin to Christmas for retailers, some green shoots are emerging.

Pending-home sales unexpectedly increased in December and homebuilder stocks are up about 50% since bottoming in June, propped up by better-than-expected results from companies like D.R. Horton Inc. and PulteGroup Inc. While regional prices vary across the country, bidding wars are now underway in the New York suburbs, demonstrating how low inventory can keep housing expensive regardless of higher borrowing costs.

“We have not solved the supply issue, and there’s an affordability issue,” Doug Duncan, chief economist at mortgage giant Fannie Mae, said in an interview. “That’s the theme for 2023 — awaiting affordability.” Fannie Mae forecasts a cumulative 6.7% home price decline over the next two years with affordability “unsustainably stretched.”

In towns north of Manhattan with high-rated schools, asking prices for homes are up more than 10% year over year. Still, when surveyed about the hottest residential market globally, MLIV Pulse respondents more often point to Singapore. The city-state’s stability and infrastructure are bolstering its attraction as an Asian financial hub, especially as China tightens its grip on Hong Kong. The government there has also rolled out policies to attract high-income earners and the wealthy, pushing up private home prices by 8.6% last year.

To subscribe to MLIV Pulse stories on the terminal, click here. To fill out this week’s survey, focused on retirement savings, click here.

–With assistance from Lulu Yilun Chen.

To contact the author of this story:

Felice Maranz in New York at [email protected]

© 2023 Bloomberg L.P.

[ad_2]

Source link