[ad_1]

Advising clients who have no children—and don’t intend to—gives some advisors pause. Most of the planning variables that advisors manipulate solve for an equation that includes, and often focuses on, children. Removing the possibility of kids changes the underpinnings of the advisor’s financial planning scripts.

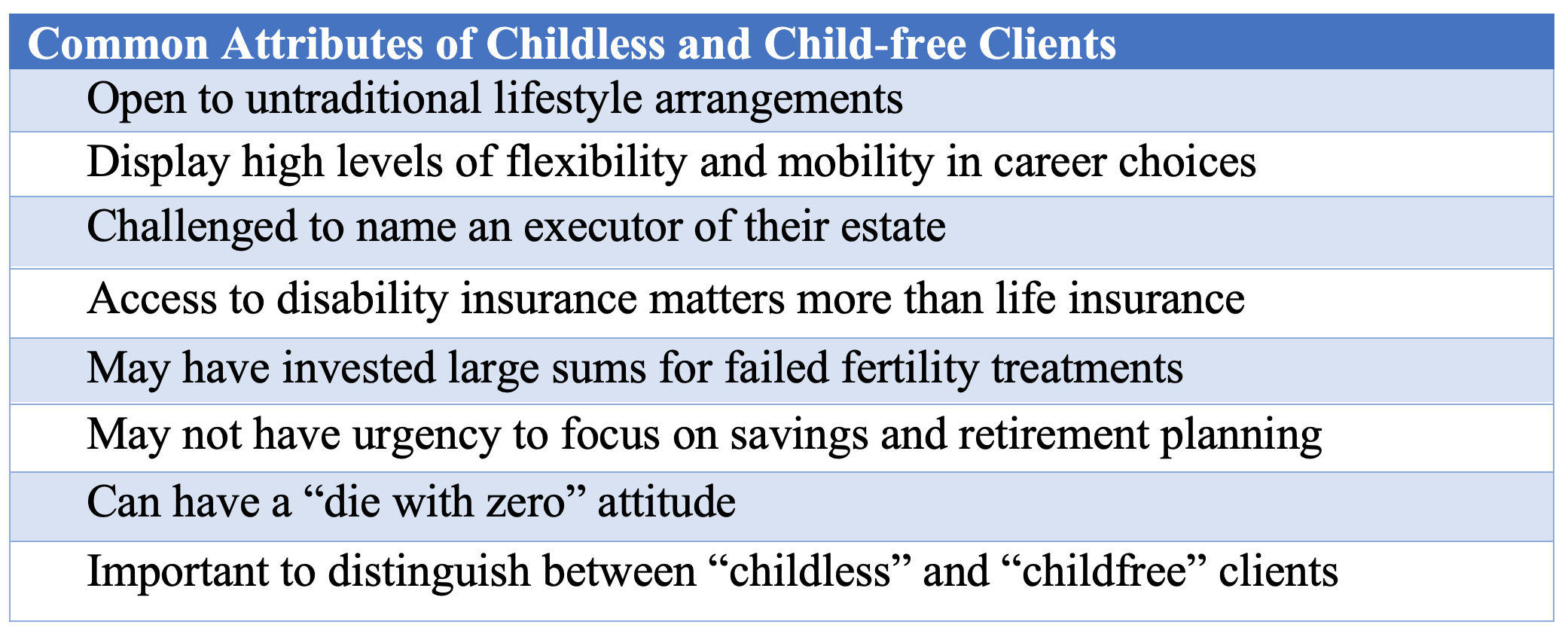

Advisors usually distinguish between “childless” (no children today but perhaps tomorrow) and “childfree” (no children today or tomorrow). But notice how “childless” is defined by deficit and is generally applied to women. Parenthood is such the default that even the labels to identify people without children groan with gendered judgment. Unfortunately, there are at present no better terms, so advisors are stuck with them.

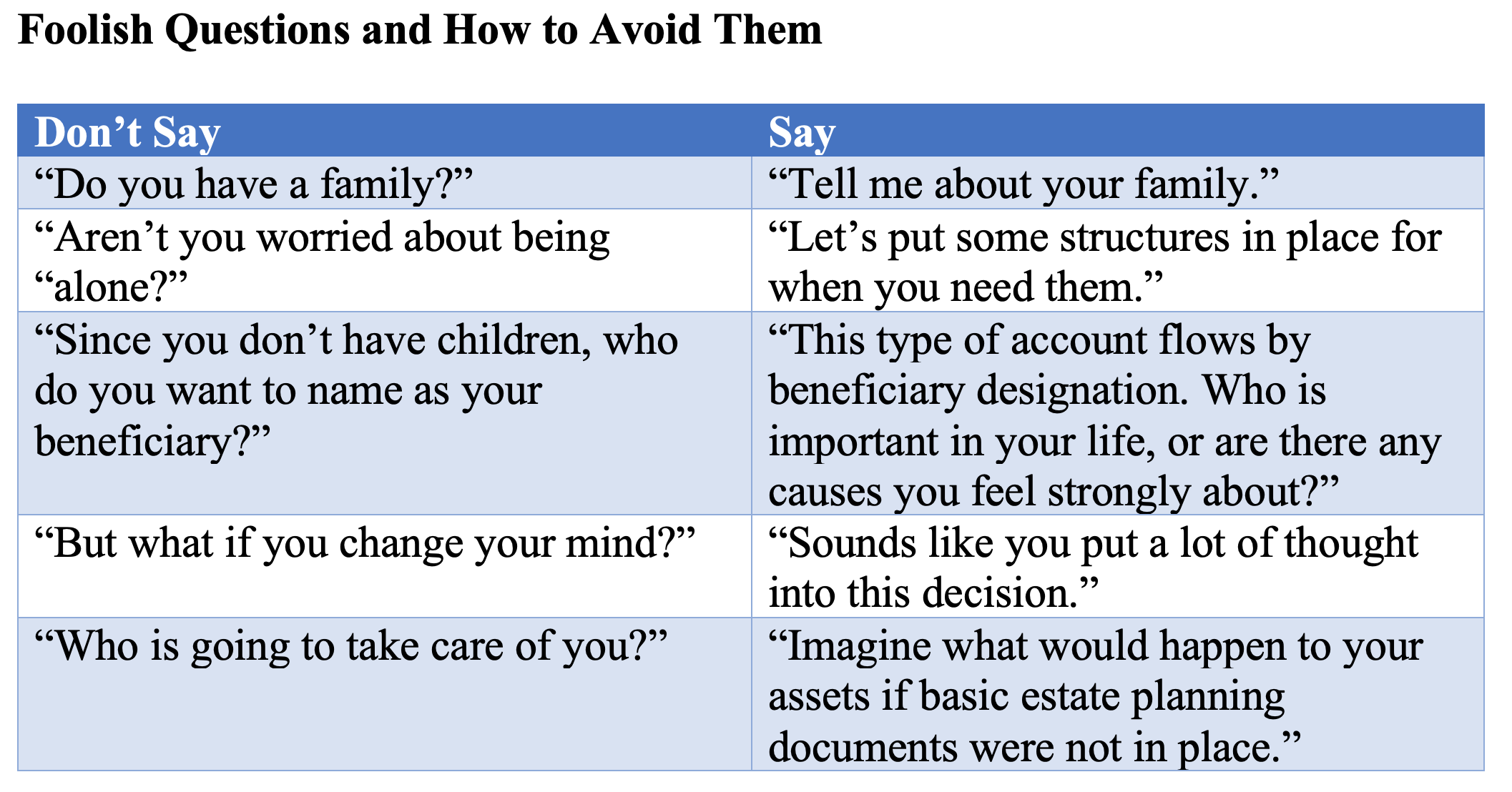

The first rule for advisors in dealing with childless and childfree clients is to avoid asking unnecessary questions. People of childbearing age who have determined to live their lives without bearing children often feel stigmatized. There are definite questions and phrases you should avoid.

Different Conversations

Retirement planning for clients invokes common questions when you know they have no children and don’t plan to have any. “The most common concerns among this cohort are ‘Who will care for me when I need help at the end of life?’ and ‘Who will carry out my wishes once I have passed?’” says Kristina Mello, financial planner and advisor at StrategicPoint Investment Advisors in Providence, R.I. “It can be a delicate topic to navigate but is extremely important, because proper planning can alleviate concerns and make them feel at peace,” she says.

For David Winslow, managing director of Charlotte, N.C.–based Choreo, a good starting point for the necessary conversation about children is to open with, “Tell me about the family you grew up with.” “Paint the conversation as a cradle-to-grave narrative instead of a point in time,” he says. “Make the conversation about children a quality of life decision, no different from the quality of life decisions of clients with children.”

The challenge for advisors is less determining the slightly modified services and workflows childless clients require and more adjusting their own assumptions, biases and onboarding language to accommodate the unique lifescripts and heightened sensitivities that clients without children present. Such clients need to consider alternatives when it comes to appointing someone as power of attorney or executor of their estate. Appointing institutional executors and successor trustees is theoretically possible, but often is difficult to implement.

By the Numbers

Households without children are becoming more common every year. A growing share of adults in the U.S. who are not already parents say they are unlikely ever to have children, according to a 2021 Pew Research Center survey. Some 44% of nonparents ages 18 to 49 report it is “not too or not at all likely” that they will have children someday, an increase of seven percentage points from the 37% who said the same thing in 2018.

Reject the assumption that childless people are relatively wealthy by virtue of being childfree. It’s true that the average cost of having a child from birth through 18 years of age is about $310,000, according to a Brookings Institution analysis of data from the U.S. Department of Agriculture. And, it’s tempting to conclude these clients have squirreled away and are ready to invest the funds they would otherwise have spent on children. It’s more likely that many have gleefully spent the money on travel, hobbies and entertainment. Moreover, suggests Jody D’Agostini, a financial professional with Equitable Advisors in Morristown, N.J., “They may have invested a small fortune in failed fertility treatments over the years and may not have as robust a financial picture as expected,” she says.

Tammy Trenta, founder and CEO of Los Angeles–based Family Financial, asks clients if they want to bestow any significant estate at the end of their lives and, if so, to what end.

Beneficiary Issues

Clients without children often struggle with whom to name as their beneficiaries. Some may project a die-with-zero attitude. Others may choose to remember extended family, such as nieces or nephews. Many opt to leave their estates to charity. Some advisors suggest a charitable remainder annuity, where clients can live off the income from their assets, and on death, the principal passes directly to the charity of their choice.

From a financial planning perspective, childfree households may have a lesser emphasis on estate planning and a greater emphasis on social impact, says

Tammy Trenta, founder and CEO of Los Angeles–based Family Financial. One important question to answer, she suggests, is whether the clients want to bestow any significant estate at the end of their lives and, if so, to what end. Are there philanthropic causes that they wish to support? Do they have pets that they wish to be taken care of? “The answers to these questions also impact how a portfolio might be invested and the extent of estate planning to be done,” Trenta says.

Tracy Bell, director of equity investment strategies at First Horizon Bank in Birmingham, Ala., and who personally identifies with this demographic, understands that childless clients will almost always have certain people or causes they want to plan for. Bell herself has two nieces that are important to her. She shared, for example, that one of her clients in this demographic is determined to leave a certain sum to her church upon her death. Bell helped her obtain life insurance in that amount, so the gift is assured regardless of the financial situation the client faces at the end of her life.

It’s critical for advisors to plan for the complications that can occur for the surviving spouse. The solutions are rarely obvious. For the surviving spouses of high-net-worth childfree clients, it’s possible to appoint a professional fiduciary to help manage finances, including bill pay and account management. It is much harder for an average retiree to get this type of assistance, says Doug Amis, president, CEO, Cardinal Retirement Planning in Chapel Hill, N.C.

“It’s a very practical challenge that only can be partially met by professional teams,” agrees Melissa Weisz, wealth advisor, RegentAtlantic in Morristown, N.J. “Corporate trustees, care managers, accountants, attorneys and daily money managers can help fill the gap, but there’s no silver bullet for choosing an executor or power of attorney if you don’t have someone to name. I’ve raised this question to several estate attorneys and am surprised it’s such a complicated issue to solve for,” she adds.

Tracy Bell, director of equity investment strategies at First Horizon Bank in Birmingham, Ala., advises her childless and childfree clients to fund both taxed and tax-deferred retirement accounts.

End-of-Life Expectations

Bell advises her childless and childfree clients to fund both taxed and tax-deferred retirement accounts. Taxed accounts better serve childfree clients who typically have more flexibility and mobility when it comes to relocating, changing careers or even taking extended breaks from work. They may need to access their money without penalty.

Scott E. Kidd, senior vice president and investment counselor at Bailard in San Francisco, introduced one elderly childless couple to donor-advised funds. “DAFs are attractive from the standpoint of providing tax benefits (by receiving an income tax deduction and donating appreciated securities) but, perhaps, more importantly allowed them to have a consolidated platform where they have direct control and visibility to their giving,” Kidd says. Further discussions around estate planning led the couple to increase their giving via their annual IRA required minimum distributions to benefit a specific program at a local hospital.

Long-Term Care Insurance

Implementing long-term care plans poses unique challenges to childless and childfree clients. Lacking the availability to move in with the next generation, these clients often are faced with enacting a plan of care with comparatively less family support and access to informal care—typically provided by family members, often at no explicit cost. Instead, these adults may need to hire professionals.

“Most health care and financial systems are created with the default expectation of having a next of kin to make decisions,” says Jay Zigmont, a Water Valley, Miss.–based financial planner and author of Portraits of Childfree Wealth.

“When that next of kin does not exist, or when there is an alternative family structure, these systems are stressed,” he notes.

The reduced need of childless people for life insurance as compared with couples with dependent children is more than offset by their greater need for disability coverage. “Childfree clients often prioritize long-term care insurance as a way to ensure they are not a burden on others in old age,” Zigmont notes. Often, the best solution is for childless clients to establish long-term care insurance decades earlier in life than people in the wider population. He advises his childless clients to lock in such policies by age 45.

Unfortunately, long-term care policies are quite costly and inflating at a high rate. Funding such policies—average costs can run over $500 per month for robust coverage—will tax the budgets of many clients. Moreover, many clients present with health issues that make them unable to be underwritten. In that case, one solution is to establish an investment bucket dedicated to funding long-term care insurance premiums.

Income Strategies

Setting up a lifetime annuity is one income strategy often recommended for childless clients by Melody Evans, wealth management advisor, TIAA in Andover, Mass. A lifetime annuity payment to create fixed guaranteed income simplifies a client’s overall income plan. “Clients without children may not be as concerned with leaving a legacy to their beneficiaries, but they do have to worry about outliving their money,” Evans adds. Turning lump sum investments into annuity income streams can allow them to have more consistent income that is designed to pay out over the length of a comfortable retirement.

Many clients, both with children and without, turn to continuing care retirement communities—also known as “life plan communities”—to better control the unknowns around long-term care in retirement. “These can be a very helpful living situation, especially for individuals without children because participants progress through levels of care and know that whatever care is needed will be provided on campus,” TIAA’s Evans says. The facilities typically require an entrance fee of between $100,000 and $1 million, plus a monthly fee that may increase over time. The community considers the entrance fee as prepayment for the client’s ongoing care and living arrangements, as well as to fund operating costs.

The way Pam Lucina, chief fiduciary officer for Chicago-based Northern Trust Wealth Management, handles difficult end-of-life planning discussions is to ask clients to imagine what would happen if basic estate planning documents were not in place and contemplate who will be charged with making important decisions. “I encourage clients to put names to the activities, such as imagining their estranged brother making healthcare decisions on their behalf. Because they lack children to rely on to take care of them when their health is failing, they need to consider who will look after them as they age,” Lucina says.

Living a childfree life is liberating in one respect and constricting in another. It’s true that the childfree lifescript liberates clients from having children depending on them. But it also liberates clients from having children they can depend on.

[ad_2]

Source link