[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Federal Reserve chair Jay Powell warned yesterday that it would probably take a “significant period of time” to tame inflation given stronger labour market data.

Powell’s comments to the Economic Club of Washington were his first since Friday’s data showing a surprising jump in jobs growth last month, which suggested the Fed might have to go further in its monetary tightening to cool down the economy.

Answering questions from David Rubenstein, co-founder of private equity group Carlyle, Powell said the “disinflationary process” still had a “long way to go” and was in its early stages. “It’s probably going to be bumpy,” he added.

“I think there has been an expectation that [inflation] will go away quickly and painlessly and I don’t think that’s at all guaranteed. That’s not the base case,” Powell said.

“The base case, for me, is that it will take some time. And we will have to do more rate increases and then we’ll have to look around and see whether we’ve done enough.”

But the comments were not as hawkish as some investors had anticipated, given the labour market data on Friday that confirmed the US economy added more than half a million jobs in January and the unemployment rate fell to the lowest level in 53 years.

After a bout of choppy trading that briefly dragged stocks into negative territory, US equities rallied to close higher. The benchmark S&P 500 rose 1.3 per cent and the tech-heavy Nasdaq Composite gained 1.9 per cent. European stocks have followed Wall Street’s lead today. US futures, however, have lost ground with contracts tracking the S&P 500 and Nasdaq down 0.3 per cent.

-

Go deeper: Financial markets got off to a rip-roaring start to 2023. The risk-on appetite hinged on expectations for a “soft landing” in the US: speedy disinflation, without a recession. Investors were brought back down to earth by Friday’s jobs report, writes the FT’s editorial board.

Five more stories in the news

1. Biden warns China over threats to US sovereignty President Joe Biden used his annual State of the Union address to Congress to deliver a defiant message to Beijing and defend his economic record in the White House. Biden also said his economic plans, with billions of dollars in subsidies for domestic manufacturing including semiconductors, were helping the US win the economic competition.

2. Microsoft takes aim at Google’s search dominance Microsoft’s use of the AI used in ChatGPT to disrupt the internet search market is set to demolish the high profit margins that have underpinned Google’s core business, chief executive Satya Nadella predicted yesterday. “From now on, the [gross margin] of search is going to drop forever,” Nadella said in an interview with the Financial Times as the software giant unveiled an overhaul of its Bing search engine.

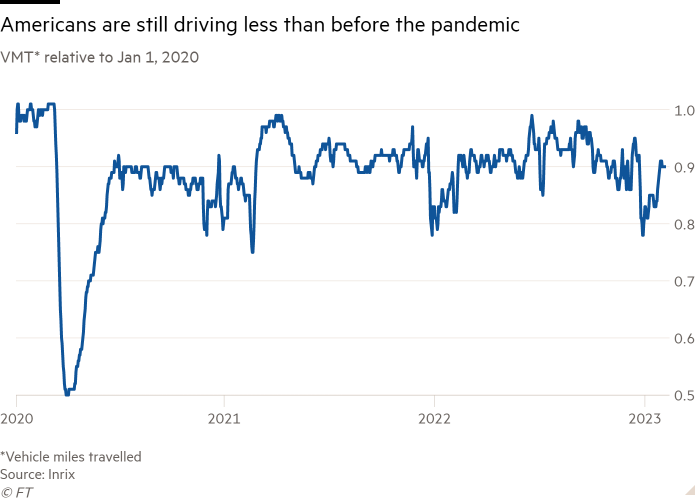

3. Fall in US petrol use heralds shift for global markets The gas-guzzling heyday of the world’s largest oil market is receding as more efficient cars, the arrival of mass-market electric vehicles and the rise of working from home prompt US motorists to burn less petrol. The US consumed 8.78mn barrels a day of petrol last year, down 6 per cent on the record volumes sold before the coronavirus pandemic. Consumption will continue to decline in 2023 and 2024, the US Energy Information Administration forecast yesterday.

4. Death toll from Turkey and Syria earthquakes passes 11,000 A frantic rescue effort stretched into a third day as the death toll from earthquakes in Turkey and Syria rose to more than 11,000. Yesterday Turkish president Recep Tayyip Erdoğan declared a state of emergency to deal with the humanitarian crisis. The emergency powers will enable him to rule by decree in much of Turkey’s south-east, bypassing parliament and regional authorities run by opposition parties.

5. UAE grants Russian lender rare banking licence The United Arab Emirates has approved a licence for MTS Bank. The move will help meet growing demand for financial services from Russian expatriates but also risks exacerbating western concerns about the Gulf state’s emergence as a potential financial haven for Moscow.

The day ahead

Monetary policy There are more appearances today by Federal Reserve governors, including Christopher Waller, Lisa Cook, New York Fed president John Williams and Minneapolis Fed president Neel Kashkari. Vice-chair for supervision Michael Barr is also speaking at an economic mobility student career expo in Mississippi.

Earnings Disney reports its first quarterly earnings since activist investor Nelson Peltz built a $900mn stake in the entertainment group and tried to force his way on to the board. Also reporting before the bell are rideshare group Uber, Under Armour, Brookfield Asset Management, Taco Bell parent Yum! Brands, pharmacy chain CVS Health and media company Fox Corp. Broker Robinhood, airline Frontier Group, and buy-now-pay-later company Affirm will report after the market closes.

Politics Republicans on the House oversight committee, chaired by the Republican congressman from Kentucky James Comer, will grill three former Twitter executives over the alleged censorship of news about Hunter Biden.

Ukraine Volodymyr Zelenskyy will pay a surprise visit to the UK today, where he will meet prime minister Rishi Sunak and address parliament on the day Britain unveiled more military support for Ukraine — including training for Nato-standard jets.

What else we’re reading

Credit Suisse’s make-or-break moment Tomorrow the scandal-plagued lender is set to publish what will arguably be the most important set of financial results in its 167-year history. Credit Suisse has warned it is on course for its second consecutive annual loss, with chair Axel Lehmann describing 2022 as a “horrifying year”. Will a radical restructuring be enough to turn it into a banking powerhouse?

How FTX built its network of stars Endorsements from celebrities and athletes such as American football player Tom Brady, basketball star Steph Curry and comedian Larry David played a big role in the rapid rise of FTX. But behind the star-studded facade, court documents reveal a web of personal and financial relationships.

What the west’s shifting red lines mean for Ukraine There is growing consensus among western military officials that Ukraine has a narrow window to launch a counteroffensive against Russia in the spring, prompting the US and other allies to commit weapons systems once considered off limits. Analysts say the constant crossing of self-imposed boundaries reflects Kyiv’s changing battlefield requirements.

The revenge of the incumbents Amazon’s retreat on physical stores shows that disruption is harder than it looks, writes Brooke Masters. We are seeing the best environment in decades for established companies with strong franchises to push back against disrupters with innovative products and services of their own.

Allure of abroad fades for Chinese MBA students Enrolling for an MBA abroad has been an important part of many Chinese professionals’ career plans for the best part of two decades. But the pandemic and rising tensions between China and the west are leading some prospective students to study domestically or within Asia. Thanks to all those readers who voted in yesterday’s poll. Nearly two-thirds of participants believed MBAs were not an advantage for running a business.

Take a break from the news

Actress Naomi Watts is just one of a growing number of public figures speaking out about the menopause with a range of symptoms such as hot flushes (Michelle Obama), palpitations (Oprah Winfrey), sleep problems, dry skin and sexual discomfort (Davina McCall). As celebrities help break these taboos around what is really the “bookend of puberty”, brands are looking to cash in.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link