[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. The Chinese government has vowed to make consumption the “main driving force” of the economy as hopes grow that Beijing’s abandonment of zero Covid policies will unleash a flood of spending by Chinese consumers, fuelling a global rebound.

“The greatest potential of the Chinese economy lies in the consumption by the 1.4 billion people,” Li Keqiang, China’s premier said during a meeting of China’s cabinet, the state council, according to a statement released late on Saturday.

While China has long sought to boost consumer spending, the comments from its outgoing premier come at a crucial moment as Beijing seeks to rebuild the economy after years of punishing lockdowns.

The Chinese economy grew by just 3 per cent in 2022, underscoring the impact of the government’s zero-Covid strategy before it was abandoned last month. Last year’s collapse of the property market, which has contributed around one quarter of GDP over the past decade, has also added to economic stress.

Economists hope that China’s pent-up consumer activity will buoy global demand. Multinationals including Unilever have said in recent weeks they were expecting a rebound in demand in the country and banks including Morgan Stanley have increased their Chinese growth forecasts.

Still doubts remain over the willingness of Chinese consumers to start spending again.

Experts have long warned that China’s desire to move away from property-driven growth towards greater consumer spending will be challenging. Household spending accounted for 38 per cent of Chinese gross domestic product in 2021. By comparison, it accounted for nearly 70 per cent of US GDP in 2022. The last few years of Covid has also bred economic caution as incomes and house prices came under pressure in the real estate crash.

Thank you for reading FirstFT Asia. Here is the rest of today’s news. — Amanda

Five more stories in the news

1. Adani Group says short seller’s report was ‘calculated attack on India’ India’s Adani Group has published an angry rebuttal of allegations of wrongdoing by short seller Hindenberg Research that wiped about 20 per cent, or more than $50bn, from its value last week. The 54-page rebuttal called the allegations of stock manipulation and accounting fraud a “calculated attack on India.”

2. Israel to strengthen West Bank settlements and loosen civilian gun laws Israel says it will make it easier for civilians to carry guns and strengthen settlements in the occupied West Bank, after Jerusalem was hit by two shootings in less than 24 hours. The surge in violence has exacerbated fears that long-simmering Israeli-Palestinian tensions could erupt into a broader conflict.

3. Drones target Iranian military site in Isfahan Iran acknowledged a drone strike had targeted one of its military sites in Isfahan late Saturday night, but stopped short of accusing any foreign or opposition groups of engineering the attack. The strike caused no casualties and comes at a time when international and domestic pressure is mounting on the Islamic republic on several fronts.

4. Commodity trade costs surge as industry seeks up to $500bn in extra finance High interest rates, volatile prices, and the war in Ukraine have made it more expensive to move goods around the world. The commodity trading sector needs an extra $300bn to $500bn in financing to transport cargoes, according to a new study by McKinsey.

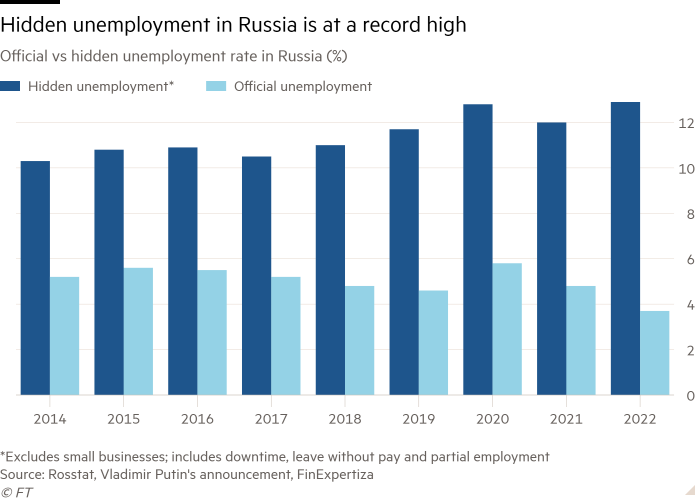

5. Russia’s internal struggle over classified financial data For months, Russia has withheld economic data as a defence against western sanctions. Now, its central bank governor is leading the push to declassify more data in order for markets to grow. The debate highlights the extent to which economic data has become part of Russia’s information war accompanying Vladimir Putin’s offensive in Ukraine and the west’s efforts to slow it down.

The day ahead

Nato visits South Korea and Japan Nato secretary-general Jens Stoltenberg will travel to Tokyo today after delivering remarks at the CHEY Institute in Seoul. In Tokyo, Stoltenberg will meet Prime Minister Fumio Kishida and other senior officials. The visit follows South Korea and Japan’s involvement for the first time in European Nato summits and demonstrates Nato’s support in the face of security challenges posed by China and North Korea.

China’s stock markets reopen Stock markets in China will resume trade after being closed for the lunar new year holiday.

India’s Martyr’s Day India will observe Martyr’s Day, which this year will mark the 75th anniversary of the murder of Mahatma Gandhi.

-

Go deeper: While Gandhi remains officially the “father of the nation”, he is becoming increasingly unpopular in his homeland as Hindu nationalism surges.

What else we’re reading

China’s film industry shoots for post-Covid recovery China’s box office receipts tumbled more than a third in 2022 from the previous year. As the country sheds Covid restrictions, film producers and analysts worry declining financing, censorship, and changing tastes could scupper the industry’s hopes of a strong recovery.

Japanese firms step up intelligence gathering A growing number of Japanese businesses are strengthening their intelligence gathering as the country finds itself increasingly exposed to the mounting tensions between the US and China. Nearly a third of Japanese-listed companies with sales of more than ¥500bn cited “geopolitics” in their annual reports, compared to 11 per cent a year earlier, according to PwC Advisory.

Inside the ‘Qatargate’ graft scandal rocking the EU Eva Kaili lived life more like a movie star than a member of European parliament. The Greek politician is currently in prison after allegations from Brussels of accepting cash and gifts from Qatar and Morocco in exchange for votes. The scandal has rocked the EU and forced it to confront uncomfortable truths about how it manages lobbying by foreign powers.

Hungary’s soaring inflation puts squeeze on Viktor Orbán Public discontent is mounting in Hungary as prices for food and power continue to soar. Food and power prices are up 50 per cent in December year-over-year, according to government data. The economic troubles will limit Orbán’s scope to pacify the public with costly populist measures, just as his party prepares for municipal and European elections in 2024.

The problem with Kishida’s ‘new capitalism’ philosophy Japanese companies have largely stuck to their line that employees should carry equal weight with shareholders among the priorities of CEOs. Now, mass tech lay-offs in the US are forcing Japanese executives to rethink their corporate culture, writes Leo Lewis.

Take a break from the news

From hip-hop in Manhattan to Vermeer in Amsterdam, here are four cultural spots to hit this spring.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link