[ad_1]

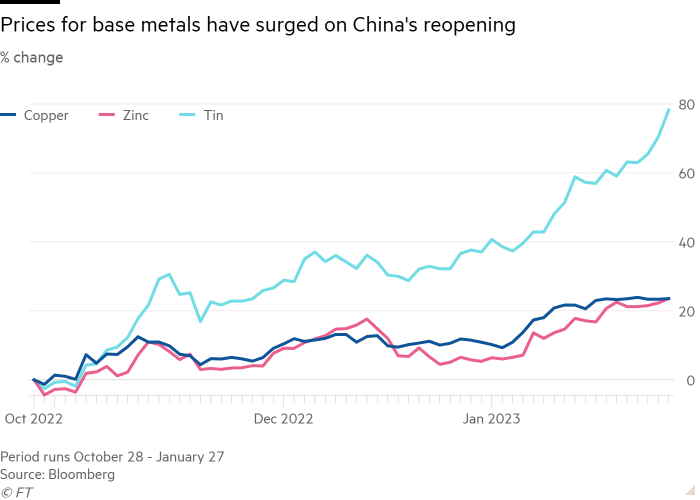

Industrial metals have ripped higher since November on bets that China’s reopening will boost demand for raw materials.

A group of “base metals” led by tin, zinc and copper have surged more than 20 per cent in three months, further supported by the US Federal Reserve signalling a slowdown in the pace of interest rate rises and a softening in the US dollar, which importers use to buy commodities.

Star performer tin has rocketed almost 80 per cent to $32,262 per tonne, the highest level since June, while copper prices have rallied by a tenth this month to $9,329 per tonne on brighter prospects for China’s economy following the easing of its zero-Covid policies.

Investors have largely shrugged off concerns about slowing manufacturing activity in the face of unprecedented coronavirus outbreaks in Asia’s largest economy.

“At the beginning of the year everyone came in very nuanced, saying we were going to have a [global] recession, that copper would dip in the first quarter and then go higher, but we’ve done exactly the opposite,” said Al Munro, a broker at Marex. “Money flow is what has driven metals in 2023 thus far, and that’s about a China reopening story.”

Mining industry executives say the current situation marks a stark reversal from only a few months earlier when sentiment was weak but physical buying from Chinese customers remained strong.

“It has shifted between where we were that perceptions were bad and on-the-ground was good, to now perceptions are better but on-the-ground is uncertain,” said Richard Adkerson, chief executive of Freeport-McMoRan, one of the world’s largest copper producers.

Jeremy Pearce, who leads market intelligence at the International Tin Association, said that much the same could be said of the metal used primarily to solder electronics.

“The issue is all demand indicators are very negative as global manufacturing purchasing managers’ indices have been nosediving,” he said. “The demand picture is the opposite and disconnected from the price.”

Further fuelling the rally for some base metals has been a spate of supply disruptions from protests roiling copper and tin producers in Peru and production snags in Chile, to Indonesia stalling export license renewals for tin smelters ahead of a mooted tin ingot export ban.

The price of tin, which is becoming increasingly strategic because of its use in solar panels and microchips, has also been pushed higher by speculative buying by China, leading to a build in inventories.

Despite weak demand, last year China swung from net exports of 9,000 tonnes in 2021 to net imports of 20,000 tonnes, according to Amalgamated Metal Trading, a metals brokerage.

“To what extent is it traders or governments building the inventories up?” asks Daniel Smith, head of research at AMT. “If it’s the government then they may sit on it longer”, which would keep prices higher longer term.

[ad_2]

Source link