[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Sherwin-Williams (a paint company) joined the bad guidance gang yesterday: it said 2023 sales will be flat to down. The stock fell nearly 9 per cent. Not every cyclical stock is providing negative surprises, of course. Seagate (computer memory) surprised to the upside, and its shares rose close to 11 per cent. But the two are different. Sherwin-Williams is an expensive stock that dashed investors’ hopes for growth. Seagate is a cheap stock in a washed-out industry, which said things were not quite as bad as investors had thought. There is a lesson in there somewhere. Email us: robert.armstrong@ft.com and ethan.wu@ft.com.

Totalitarians, asset managers, and ESG

A few weeks ago Toby Nangle wrote a very good column in the FT, and I’ve been thinking about it, with some discomfort, ever since.

Nangle made his bones in the asset management industry, and he helped Unhedged (and a lot of other people) understand the 2022 British pension meltdown. His recent column took on the ethical quandaries raised when fund managers invest money on behalf of totalitarian states’ sovereign wealth funds, central banks or pension funds. Nagle singles out China’s CIC sovereign wealth fund and Saudi Arabia’s Public Investment Fund, and raises the awful spectres of Uyghur re-education camps and the murder of Jamal Khashoggi. He writes:

While working on a state mandate, asset managers effectively become outsourced treasury officials seeking to boost their client’s financial power. In other words, they help authoritarian states around the world to finance aims that can be both repressive and repugnant.

I would not want to do that sort of work. I feel strongly that democracy is better than autocracy, and I think it would be better if autocrats had to manage their own money, without help from clever people who enjoy the great privilege of living in a liberal democracy.

What bugs me about this thought is that it seems to fit poorly with my deep scepticism about environmental, social and governance investing in general. One of my main arguments against ESG is that its primary mechanism of action must be influencing companies’ cost of capital and therefore how they behave. But I don’t think ESG can have enough influence on capital costs to make a material difference in the real world. Many companies generate enough capital internally that their cost of equity or debt don’t matter much, and there is plenty of capital out there (most of it private) willing to sweep in and provide expensive capital to “dirty” companies. Remember, a higher cost of capital for companies always means higher returns for investors (I make this and other arguments here, here, here, here and here, among other places).

If where investors put their money has such a limited influence on making the world a better place (however you might define “better”), then why should it matter if I decide to manage some wretched tyrant’s bond portfolio? Nangle is sensitive to this point, writing that:

Fund managers downing tools won’t stop torture, extrajudicial deaths or other awful things that some clients are responsible for. At most, denying them investment services might make odious regimes marginally poorer.

Now, investing in a dirty company and working for a dirty regime are different things with different impacts. But there is an underlying connection: just as refusing to own oil companies will not reduce the global supply of, or demand for, fossil fuels, refusing to manage despots’ cash won’t stop freedom fighters from getting murdered. So why should the prospect of the latter make me feel queasy?

Nangle offers three reasons why “refusing to work to enrich governments with bad human rights records remains the right thing to do”:

-

“Investment firms need to attract, retain and engage their staff. There are studies aplenty linking purpose to profitability through the medium of staff engagement.”

-

“Companies that limit their prospective talent pool to those with the most malleable ethical codes are more likely to find themselves in hot water.”

-

“Living by the principles you project is good business. The marginal new client in asset management cares about ESG, as do the bulk of existing ones. And with net outflows the norm across the active investment industry, competition for business is fierce.”

To summarise, if you work for monsters, fewer people will want to work for you; the ones who will work for you are more likely to be creeps; and you’ll turn off prospective clients. Notice that these arguments should apply not only to who fund managers work for, but what they invest in. If you put capital to work with companies that corrode the social good (however one might interpret that), you will draw from a smaller talent pool, increase compliance risk and turn off clients.

This, in turn, is an argument for investing in funds that take ESG principles seriously — because it is a way to make sure you are investing with and alongside high-quality, reliable people.

Is this a good argument? I’m not sure. I think people are happier, do better work, and stay out of trouble when they are (to use a mildly nauseating phrase) living their values. Integrity is important. Putting aside the vexed question of exactly which values I might want my fund manager to follow, I want them to have an ethical compass, and I’d want it to look vaguely like my own.

The problem is that a lot of the ESG investing industry is grounded in bullshit, and bullshit is bad. Three examples:

-

The ESG industry argues, implicitly and explicitly, that investors will “do well by doing good” — that is, that ESG-compliant investments will outperform in the long term. There are no empirical reasons why this should be, and several logical reasons why it can’t be (see the links above).

-

The ESG industry makes false claims, implicit and explicit, about saving the world with your investment portfolio that are just not true. And believing these bogus claims might make people more complacent about doing things that actually create change — with careful choices about what they buy and who they vote for, for example. ESG is a dangerous placebo.

-

The ESG industry is an massive fee trough for fund managers, consultants and all the rest, and all of those fees come out of well-intentioned investors’ pockets.

This leaves investors with something of a paradox. It seems like a good idea to invest with people who have and live by clear values, for the reasons that Nangle articulates. But people who turn their values into a big selling point are probably on the make, and should be studiously avoided.

The money supply shrinks

Here’s something that’s changed recently:

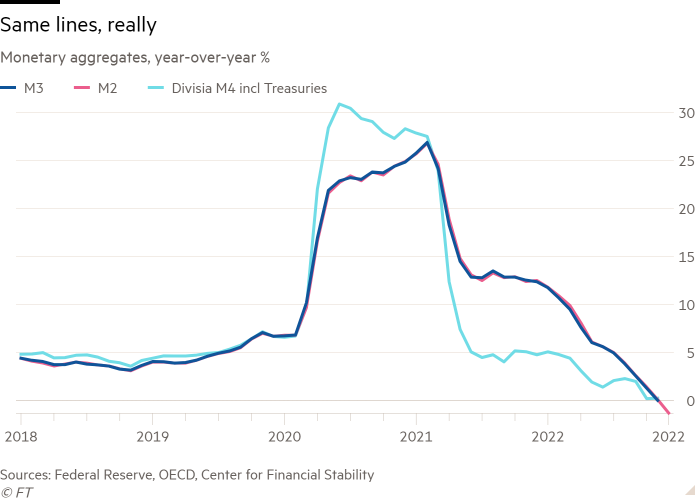

The chart shows M2, a popular measure of the money supply that includes cash, checking and savings accounts, certificates of deposit and retail money market funds; basically, anything you or I would treat as cash. On an annual basis, the stock of M2 is now shrinking.

Does this matter? We aren’t committed monetarists by any means, but maybe a contracting money supply is telling us something about the economy. M2 fell $147bn in December, or -0.7 per cent month-over-month, which Don Rissmiller at Strategas points out is a record monthly decline since the data began in 1959. He thinks it could be further evidence tighter monetary policy is, after a lag, starting to bite:

Why is it happening? Are people, or firms, starting to take money out of liquid deposits? That fits with a decline in M2. Maybe they’re going into other substitutes, maybe they’re starting to make purchases of durable goods with cash [as opposed to financing with debt]. What’s interesting is there’s evidence of an inflection point. We’ve been arguing policy acts with a lag, but it hasn’t done much yet. Well, here’s somebody, either a consumer or business, changing their actions.

You can quibble with M2 as a measure. Some think it’s too narrow and prefer to look at M3, which throws in more arcane instruments such as institutional money market funds and repo. Or there’s Divisia M4, which includes nearly everything but the kitchen sink. M2, 3 or 4 — none really looks that different:

Joseph Wang over at the Fed Guy blog chalked this up to a shifting balance between two countervailing forces. The first is the Fed’s quantitative tightening programme, which is, $95bn at a time, sucking cash out of the financial system.

The second is bank lending. As rates rose last year, commercial banks quickly revised up their lending rates, but their slow-moving base of retail deposits created a low-interest funding source. Net interest margins widened, and lending activity jumped. The magic of fractional-reserve banking kicked in: a rise in bank lending injected new cash into the system. Yet this began to tail off late last year, even as QT marched on in the background. Wang offered this chart from the Fed in a recent blog post:

Less cash flowing in from new lending, more cash flowing out from QT, so the money supply contracts.

Wang thinks changes in M2 growth matter far less than what happens in bank credit creation. And this fits with Rissmiller’s point that M2 shrinking is a signal — in this case that the credit taps are, on the margin, drying up. We don’t have any confident predictions about what that will mean; as Wang notes, credit cycles can span years. But it bears watching. (Ethan Wu)

One good read

Where’s the VR boom?

[ad_2]

Source link