[ad_1]

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Technology companies now account for a larger share of Wall Street’s primary gauge of “value” stocks than after any previous rebalancing in the benchmark’s near-30-year existence.

The metric is a sign of the humbling of the once high-flying sector, with last year’s sharp sell-off sending a swath of stocks spinning from growth indices into the out-of-favour bargain bucket, but also provoking scrutiny of the indices themselves.

“It’s just a confusing rebalance,” said Jeremy Schwartz, global chief investment officer at WisdomTree. “If you thought you were a value investor buying cheap stocks it’s become more than that.”

Following an annual end-of-year revamp, Microsoft, Amazon and Meta are among the five largest weights in the S&P 500 Value index, alongside the likes of Cisco Systems, Salesforce, Netflix, IBM, Intel and PayPal.

“Meta and Netflix were among the five poster children for the excitement around growth stocks so it’s interesting to see them in value,” said Wes Crill, head of investment strategists at Dimensional Fund Advisors.

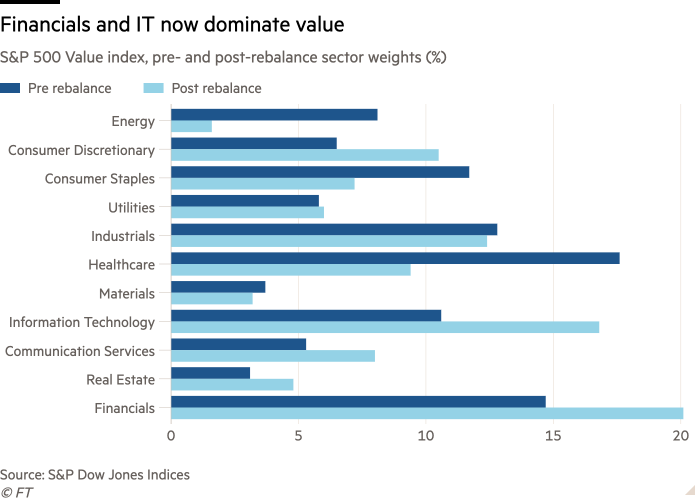

Although not all these companies are classed as information technology stocks, the weight of the IT sector itself in the Value index jumped to 16.8 per cent after the reconstitution, up from 10.6 per cent previously and the highest post-rebalance figure for tech since the index’s creation in 1994, according to data from S&P Dow Jones Indices.

The tech sector has only had higher daily weightings in the Value index for 44 of the 7,302 trading days since the benchmark’s inception, all in 2019.

The indignity for the tech sector — long associated with “growth”, the polar opposite of value — is the result of a slide that saw sector-wide share prices slump 28.8 per cent last year, compared to a 19.8 per cent fall in the broad S&P 500, alongside outperformance by traditional value sectors such as energy, utilities, consumer staples and healthcare.

Tech is now the second-biggest sector in the Value index, behind financials.

S&P Dow Jones’ style indices were tracked by about $300bn of passive money and benchmarked by a further $83bn of active funds as of the end of 2021, S&P said. The Value index itself underpins funds such as the $25.8bn iShares S&P 500 Value ETF (IVE) and $3.3bn Vanguard S&P 500 Value ETF (VOOV).

The end-of-year rebalancing threw up a number of other oddities.

Erstwhile value stalwart consumer staples (down from 11.7 per cent of the index to 7.2 per cent) is now outweighed by the traditionally sexier consumer discretionary sector (up from 6.6 to 10.5 per cent) in the Value index.

Meanwhile the energy sector’s weight has plunged from 8.2 per cent to 1.6 per cent, while it has jumped from 1.4 per cent to 8 per cent in the corresponding Growth index.

These shifts have occurred despite energy being the cheapest sector in the S&P, trading on a historic price/earnings ratio of 9.6 and a consensus forward p/e of 8.4, a fraction of index-wide metrics of 17.4 and 18.9, according to Schwartz.

Energy’s surging weight in the Growth benchmark is instead a function of its red hot 66 per cent return last year, with 12-month share price momentum one of three factors S&P uses to define growth stocks.

This shift is even more evident in the S&P 500 Pure Growth index, a concentrated version of the concept, where energy now accounts for a 30.5 per cent weight and technology just 12.9 per cent, even though the latter was a third of the benchmark until December.

“Energy is the cheapest sector by any metric,” said Schwartz. “Because [energy companies] had such strong growth, they became viewed as growth rather than value stocks, which to me is the puzzling thing.”

Hamish Preston, director of US equity indices at S&P Dow Jones, said “several energy companies [such as ExxonMobil and Chevron] have moved from having a 100 per cent allocation to Value before the rebalance to 100 per cent Growth,” as a result of strong earnings and sales growth, as well as share price momentum.

This was “not unprecedented” with the energy sector having a 12 per cent weight in the Growth index after rebalances in 2011 and 2009, but the 6.6 percentage point increase is the largest since then.

Healthcare has also undergone a style metamorphosis, having transitioned from a 17.7/13.5 per cent split between Value and Growth to a 9.4/21.4 per cent split in the blink of an eye, thanks to its outperformance of the wider market during 2022.

While the Russell 1000 Value index trades on a consensus forward p/e of 15.4 and WisdomTree’s US High Dividend Fund (DHS) at 11.3 times, the S&P 500 Value index now has a multiple of 17.3, Schwartz said, less than a point below the 18.2 of the S&P 500 itself.

“That’s not a real value basket in my opinion,” he added. “Some of these stocks have become like true value stocks. Some are still expensive and just became value because they went down a lot. They can still go down a lot more if they are still expensive.”

Preston said that “many people do look at growth versus value through a p/e lens but there are others factors that you can use. It really depends what people are looking to do and the exposures they are looking to get when it comes to style.”

However Crill, whose US Large Cap Value portfolio has a 15.8 per cent exposure to energy, said “you can drift from a focus on value if you are combining lots of different metrics. We use price/book, with profitability screens and look at momentum to avoid value traps.”

Click here to visit the ETF Hub

[ad_2]

Source link