[ad_1]

One thing to start: Ryan Cohen, the activist investor popular among meme stock traders, is pressuring Alibaba to speed up its share-repurchase plan after acquiring a minority stake in the Chinese ecommerce group.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

A crackdown on LBO securitisation

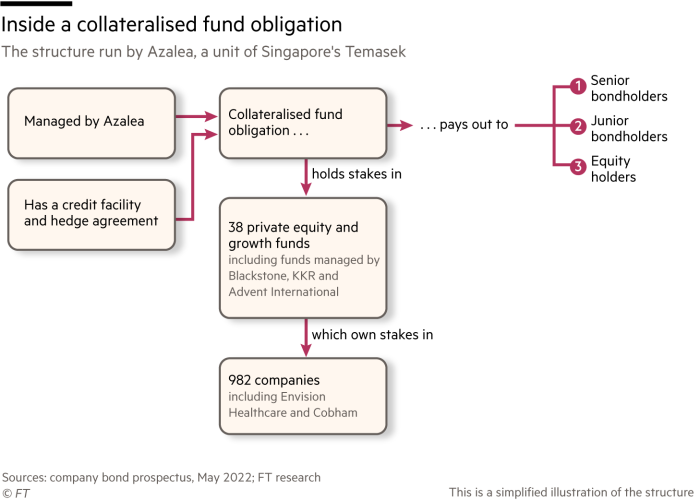

One of private equity’s more controversial inventions is a type of derivative known as a “collateralised fund obligation”.

DD’s Kaye Wiggins dug deep into these structures in November. In essence, a CFO is a box containing stakes in a range of private equity funds, and sometimes credit, real estate and infrastructure funds too. The box issues equity and debt, which pay out using the cash flows from the underlying funds.

It’s a product that became more popular during the cheap-money-fuelled boom times, which seemed to encourage the development of ever more complex, esoteric and opaque types of financial engineering.

It’s also a way to build an extra layer of leverage into a private equity industry that is already built on debt.

And if it seems reminiscent of now-infamous pre-2008 “collateralised debt obligations”, well, it is. The structures involved are very similar, even if the underlying assets are different.

Shortly after the FT’s piece was published, a US regulator took the CFO market by surprise.

In a move that one adviser said could have a “profoundly adverse impact” on the development of CFOs, the National Association of Insurance Commissioners said it was planning to change the rules so that insurers could no longer rely on rating agencies’ assessments of the instruments.

Instead, it would assess the risks itself.

A big part of what’s bothering the NAIC is the potential for what it calls “risk-based capital arbitrage” — the idea that insurers are, for risk purposes, treating equity-like products as though they were debt.

Here’s what they mean. At the moment an insurer could invest in a CFO’s debt, with a risk-based capital charge of less than 1 per cent. If the same insurer invested in the underlying private equity funds directly, it would face a much higher charge of as much as 30 per cent.

The NAIC is also troubled by the lack of transparency about the contents of CFOs. Often even the existence of a CFO is not made public and there is little or no disclosure of the underlying assets in the box.

If the CFO industry finds a way to live with the close regulatory scrutiny, it will still have to contend with falling private equity returns and a lack of buy-in even from some corners of the buyouts industry. Several dealmakers have told DD privately that they simply don’t like the sound of securitising leveraged buyouts.

Peltz’s battle to take control of Disney

Nelson Peltz prefers winning the hearts and minds of corporate boards with his charm — but as one of his close friends once told DD, “as any true East New York kid, he won’t shy from a fight if it is the only way forward”.

A very public proxy fight is precisely what the octogenarian hedge fund manager has in store for Walt Disney’s executives after they refused to give him a board seat at the troubled Hollywood company behind Mickey Mouse and Beauty and the Beast.

Peltz’s fund Trian Fund Management has traditionally avoided bruising media-reliant wars with companies as it’s often easier to achieve what he wants by operating behind the scenes. However, when that fails Peltz tends to use a fairly common playbook to get what he wants.

A taste of his tactics was on full display late last week when he went on air on CNBC. Peltz compared Disney to communist China, ridiculed the company’s returning chief executive, Bob Iger, for taking a long yachting vacation off the coast of New Zealand and lambasted he media group’s $71bn acquisition of 21st Century Fox as value destructive.

That’s just a taste of what’s to come, a person who worked with Peltz told DD. “He always starts by crushing management and humiliating them publicly as he did today on CNBC. Then he usually gets what he wants — in this case, a seat at the table,” said a second person who has worked with Peltz. “Finally, he becomes friends with them.”

When Peltz challenged HJ Heinz’s board in 2006 after it rejected his turnround plan, Trian ended up winning two seats. But he later became a consigliere of Heinz’s CEO William Johnson despite initially humiliating the US food group’s boss. Heinz ended up selling itself in 2013 to Warren Buffett’s Berkshire Hathaway and 3G Capital for $28bn, generating a big profit for Peltz as well as Heinz’s management and shareholders.

Not all of his campaigns have been great, though. Trian’s biggest failure has been at General Electric, which one investor described as a “disaster”. Peltz bought GE at about $25 per share and three years later the stake was worth about a quarter of that.

Will Peltz’s fight at Disney end like at Heinz or GE? Villains usually lose in Disney productions. But it is too early to tell who exactly is the bad guy in this battle.

Microsoft bets big on AI

A potential $10bn Microsoft investment could become the defining deal for a new era of artificial intelligence.

The software giant is considering ploughing billions into research outfit OpenAI, the San Francisco-based group behind ChatGPT.

The service has gained widespread attention for its natural-sounding answers to written queries. But Microsoft executives believe the technology behind the service will soon have a deeper impact throughout the tech world, changing the way people interact with computers, the FT’s Tabby Kinder and Richard Waters report.

Microsoft’s potential investment, first reported by Semafor last week and confirmed by two people familiar with the situation, would see it take a significant minority stake that would value OpenAI, after the investment, at $29bn.

The relationship between Microsoft and OpenAI dates back to 2019, when the big tech firm made its first $1bn investment in the group, gaining the first rights to commercialise its technology.

Microsoft is not alone in seeking partnerships with companies in the space. The group’s biggest cloud computing rivals have also been seeking to align themselves with some of the most promising generative AI companies.

Yet if a handful of tech giants become the central platforms for — and investors in — the start-ups building the next generation of AI technology, it could stir concern among regulators.

One person familiar with Microsoft’s investment plans conceded that its alliance with OpenAI was likely to come under close scrutiny. But their current thinking is that the minority investment should not provoke any regulatory intervention.

Job moves

Permira, the private equity firm, hired former EY US boss Kelly Grier as a senior adviser to its global services team. Grier left last year after deciding not to run for re-election following a clash with global boss Carmine Di Sibio.

Deloitte US hired Jason Girzadas as chief executive and Lara Abrash has been appointed as the chair of the board. They respectively succeed Joe Ucuzoglu and Janet Foutty.

Specialist investment bank KBW has promoted Alistair McKay as head of European investment banking. It also hired Alex Smith and Gonzalo Smolders as managing directors in London.

The Credit Suisse Commodity Return Strategy Fund has hired Scott Ikuss as a portfolio manager. He was previously a portfolio manager at DWS Group.

Smart reads

Fool me three times A New York oil dynasty that was a client of the legendary fraudster Bernard Madoff and lost billions in the demise of Enron has been embroiled in the collapse of FTX. Investment firms for the Belfer family were included in a list of shareholders of the cryptocurrency exchange and its US business that were released in court documents, the FT reports.

Hong Kong at crossroads Beijing’s growing influence on the former British colony has raised existential questions about the sustainability of the territory’s role as Asia’s unparalleled bridgehead to global finance, the FT’s Patrick Jenkins writes.

And one smart story: JPMorgan Chase & Co’s takeover of grand old UK investment bank Cazenove & Co became a personal nightmare for former CEO Robet Pickering, he recounts in a forthcoming book reviewed by Bloomberg’s Paul J. Davies.

News round-up

Pharma and biotech seek cure for industry deal slump (FT)

TIM’s top shareholder Vivendi leaves board seat (Reuters)

Big Four accountants in Spain probed over long hours (FT)

Bain Capital prepares to relist Virgin Australia (FT)

Tiger Global’s hot potato trade (FT Alphaville)

Businesses must ‘reinvent’ themselves or fail (FT)

[ad_2]

Source link