[ad_1]

Even after the years-long global health crisis catapulted professional communications into the digital sphere, 39% of firms still don’t use social media to promote their practice and 44% don’t engage in any email marketing, while just 35% use digital advertising tactics and 32% produce multimedia content.

And those that are leveraging digital tools are often doing it wrong, according to industry experts.

A survey conducted last September by the WMIQ research team with advisor marketing platform FMG received 403 responses from firms each expecting to end the year with less than $20 billion in client assets. Those who reported an increase in assets under management between 2020 to the end of 2022 were characterized as “high growth” firms—and exhibited some notably different behaviors from firms whose assets decreased or remained stable over the same period.

In a finding FMG Chief Evangelist Samantha Russell called “really problematic,” 1 in 4 respondents overall indicated they communicate with existing clients on a quarterly basis or less.

“No one fires their advisor for overcommunicating,” she said, “but they definitely will if you undercommunicate.” During a recent webinar to discuss the survey results, Russell said clients who don’t hear from their advisor consistently are more likely to be alarmed when they do get a message from them, particularly in times of market turmoil when advisor communications should be trying to reassure clients, not scare them.

While three-quarters of respondents communicate with clients at least once a month, and 39% said they’re in contact multiple times a month, FMG Chief Marketing and Experience Officer Susan Theder said that may still be insufficient to really engage with a client. She pointed to a recent study by advisor technology firm YCharts that found almost 70% of investors feel their advisors do not touch base with them frequently. A significant portion of clients in that survey felt their advisors’ communications were “very” infrequent.

“I think what that gets at is the quality and relevancy of the communication,” she said.

Nine in 10 advisors communicate via email and 61% still use the telephone, the survey found. Just under half connect through social media or send out newsletters, while only a third have become comfortable videoconferencing with their clients. Twenty-three percent produce or participate in webinars, and 14% create blogs. Curiously, 2% said they do none of the above.

The split between firms that managed to grow assets over the past few years, including a volatile 2022, shows some dramatic differences in how advisors approach marketing and communications. High-growth firms use social media and videoconferencing far more frequently than firms that aren’t growing, the data found. Six out of 10 firms (61%) that grew assets between 2020 and 2022 used social media to reach clients, compared with 43% of firms that didn’t grow. Four out of 10 (41%) growing firms used videoconferencing with clients, compared with 29% of nongrowing firms.

Those gaps suggest that implementing these relatively inexpensive tactics could produce outsized results.

“You don’t see these types of deltas in most research; it’s generally more modest differences,” said Kristin Letourneau, VP of research at Informa Engage. “So, these are just tremendous numbers.”

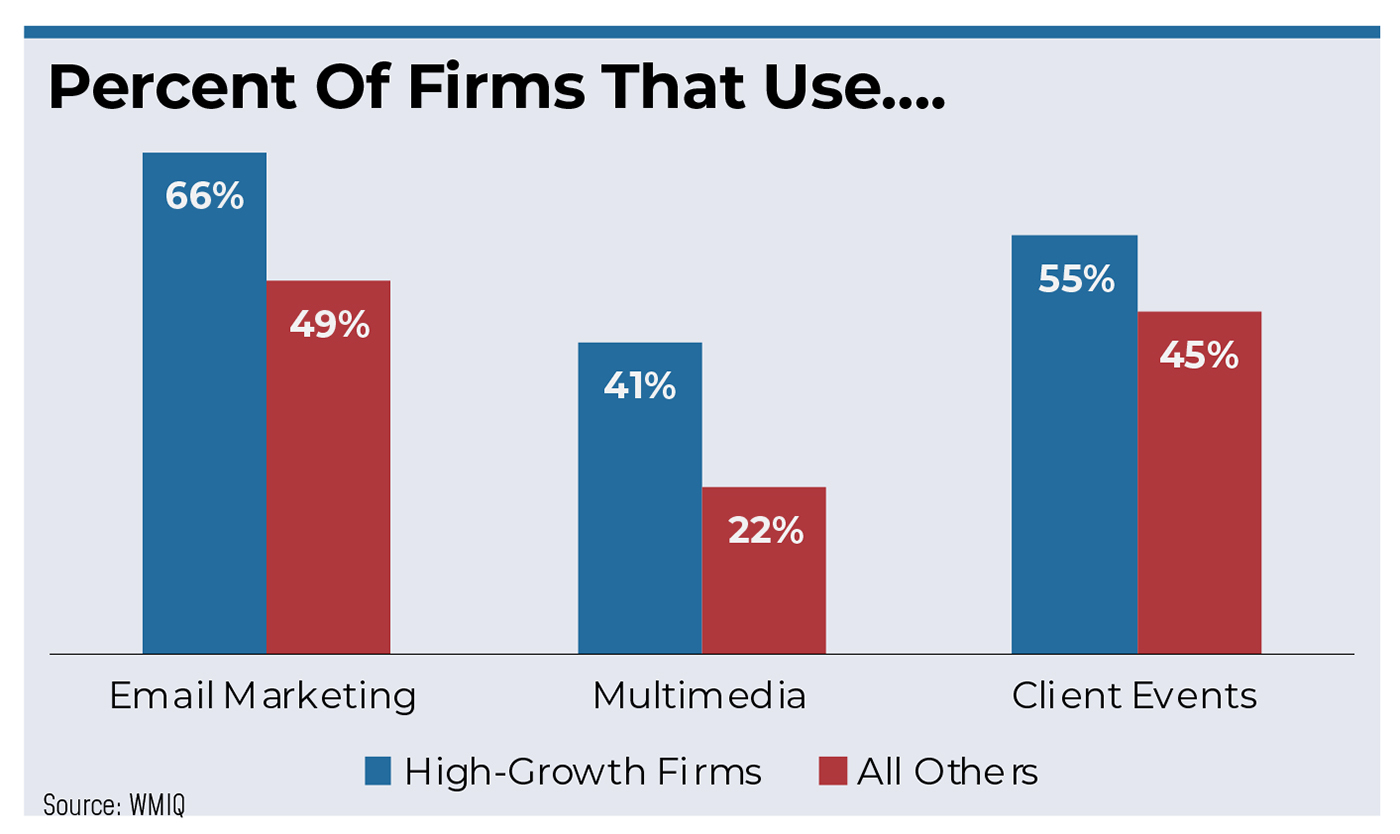

Similar differences exist in other marketing activities. There is a 17 percentage point gap in the use of email marketing between high-growth firms and their nongrowing peers, and a 19 percentage point difference for firms that produce multimedia content.

Half of firms also still host live events for clients. Live events were identified as the most expensive marketing activity advisors incurred, yet they were only marginally used more frequently by growing firms than their stagnant peers.

On the client side, Russell said FMG has seen “an explosion” in demand for multimedia. “What we’re finding in the research is that consumers want these short, digestible, quick hitting pieces of content more than any other type,” she said. “You don’t have to recreate the wheel, take things that are already performing well as a blog or an email and turn them into a video.”

Yet bombarding inboxes and social media feeds with material that is irrelevant, impersonal or invasive is ineffective and could in fact be harmful, she said—effective content is personalized, relevant and helpful.

Creating that kind of content is easier said than done, noted Theder, who said the most successful marketers develop a strategy around clearly articulated client personas, or segmented personas, to create the greatest impact. Still, she added, lots of timely topics are universally relevant to investors and are easily personalized.

“You start with a problem that somebody has or is thinking about, then you relate it to a shared human experience we all have,” explained Russell. “And then you can tie it to what you do and how you do it and make it unique about how you serve it.”

Much of this can be done for a nominal cost but requires human capital to accomplish effectively, and busy advisors and firm principals may find it difficult to produce a steady stream of quality content. Some turn to external experts, while others prefer to keep it with in-house staff, and many seem to be going it alone.

Less than half of responding firms (46%) said they use third-party firms or external marketing consultants (like FMG and other advisor-focused marketing companies) and those that do so hire them primarily for website design (58%), content creation (53%) and help with social media (49%). Ad design and search engine optimization are also farmed out more frequently than other tasks. According to the data, more than half of high-growth firms use external marketing vendors compared with 40% of their peers.

Theder and Russell said a platform like theirs can take care of about 80% of a firm’s marketing workload, but the rest should be handled by a dedicated in-house specialist.

“When you combine those two things together is where you’re going to see such, such great results,” said Russell. “Outsource the things that you don’t need to necessarily leave your own mark on, and only do the things that only you can do.”

“Without the staff, what I see happen is the consistency falls off,” said Theder. “So even if it’s a part-time employee that is strictly focused on it, you’re going to get a lot higher ROI on your activities than if it is something that somebody does sometimes.”

Almost 4 in 10 firms said they employ at least one dedicated marketing specialist. Fifty-seven percent of that number have just one, while 40% employ multiple positions, and the remainder assign the task to an existing position or bring in part-time employees or interns. Among the firms that haven’t grown, comparatively, just 28% have a dedicating marketing employee.

While 61% of all respondents said they aren’t looking to add new marketing staff, 46% do expect to increase their marketing budget in the current year. Nearly half (48%) said they spent less than $1,000 on marketing activities per month in 2022 and 71% spent less than $3,000. Fourteen percent spent $10,000 or more.

“The firms that are spending more are growing faster,” noted Mark Bruno, managing director for Informa Wealth Management (Informa is the parent company of Wealthmanagement.com, WMIQ and Informa Engage.) “But it’s not just about the raw dollar amount. It’s what they’re spending on and how they’re strategically leveraging those channels.”

Perhaps the most surprising result in the September survey was around the use of social media networks. Twelve percent of respondents claimed that they don’t utilize any social media for professional purposes—not even LinkedIn, which is used by 82% of the respondents. “I don’t know who those 12% are and why they’re not using any social,” said Informa Engage’s Letourneau. “But they do exist.”

Respondents who use LinkedIn primarily leverage the social platform to expand their professional networks (72%), but also to build their personal brand (58%), demonstrate expertise (50%), gain new clients (43%) and engage with existing ones (38%). Lagging far behind LinkedIn for professional use are Facebook with 36%, Twitter with 18% and Instagram with 12%. TikTok is used by 3%, while SnapChat has zero users among respondents.

“People often get the media part of social media—they post media—but they completely miss the social part,” said Russell. “And the social part is what actually moves the needle.” She identified three ways firms can instantly increase engagement with their content on social media channels:

- Simply engaging with others. “Because of reciprocity,” she said. “Comments are the currency of social media.”

- Writing longer introductions, rather than just posting or reposting content. Russell recommended summarizing topics contained in the shared material to encourage comments without the need to click away to read an article. (Longer LinkedIn posts also require readers to click an expanding link that increases their algorithmic popularity score.)

- “Be helpful, be helpful, be helpful.” This includes sharing content that answers questions or concerns likely to be held by a target client; highlights the accomplishments of local organizations, businesses or individuals; or increases awareness of local activities and events. “The more helpful you can be,” said Russell, “the more your message will naturally get out there and people will click back over to your profile.”

“In a nutshell, marketing for advisors is a long game,” said Theder. “It’s not a short game. It’s about creating both a personal and firm brand that is clearly defined based on who you’re trying to serve and what problems you’re trying to solve, and then developing valuable content around that.”

[ad_2]

Source link