[ad_1]

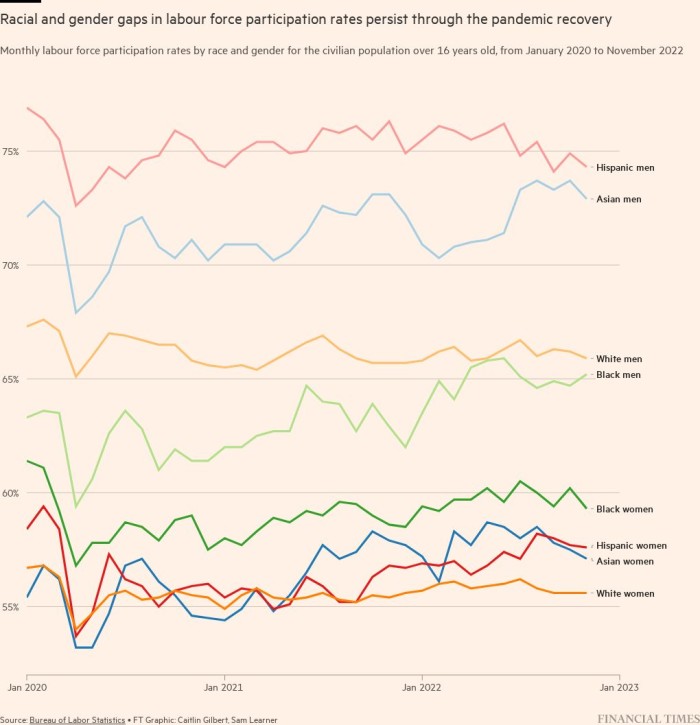

Black workers led the US return to work after the Covid crisis, but economists warn that their gains will reverse as the Federal Reserve attempts to cool the economy down with aggressive interest rate increases.

Earlier this year, rising wages and a shortage of workers pulled black workers into the labour market at record levels. Black Americans worked and looked for jobs at higher rates than white Americans in May for the first time since 1972, according to labour department data. Employers reduced job requirements, expanded upskilling programmes and diversified their recruitment schemes to fill their ranks amid staff shortages, providing new opportunities to historically disadvantaged workers in the process.

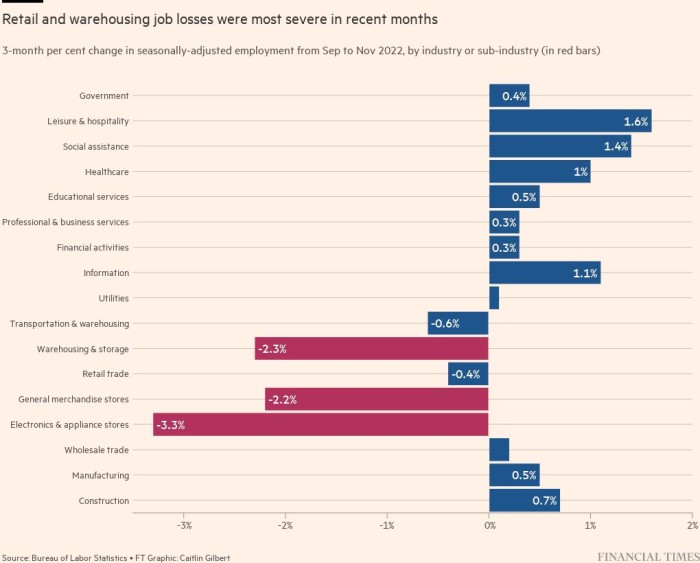

While the unemployment and labour force participation rates for workers of colour have remained relatively stable in recent months, rising interest rates and a worsening jobs market could reverse those gains. In recent months, employment has already dropped off in several industries that disproportionately employ workers of colour, including retail, transportation and warehousing.

Between September and November, general merchandise stores, including department stores, lost 71,500 jobs, and the warehousing and storage industry lost 41,000 jobs. Many of these industries rely on lower-wage workers, with mean annual wages often ranging from $30,000-$50,000 in retail and warehousing.

William Spriggs, a professor of economics at Howard University and the chief economist of the union AFL-CIO, said the “moment firms cease hiring . . . the unemployment rate goes up because the people who were unemployed can’t escape unemployment. And that hurts black workers first.”

Spriggs added that “the big recovery in black labour force participation, which in the last six months has really helped black workers . . . that goes away.”

Fears about the US economy tipping into a recession have percolated as the Fed has ploughed ahead with the most aggressive series of interest rate increases since the early 1980s. In a bid to tackle decades-high inflation, the central bank in less than a year has raised its benchmark policy rate from near zero as of March to nearly 4.5 per cent currently. Further rate rises next year are expected, with top officials forecasting the federal funds rate to peak at 5.1 per cent.

Policymakers believe there is a path for inflation to return to the Fed’s 2 per cent target without major job losses and a recession — a claim many economists across Wall Street and academia dispute. A recent poll conducted by the Financial Times in partnership with the University of Chicago’s Booth School of Business found that an overwhelming majority of leading economists expects a recession next year, which they warn could push the unemployment rate beyond 5.5 per cent from its current 3.7 per cent.

Most Fed officials currently forecast the unemployment rate will rise roughly 1 percentage point to 4.6 per cent next year and stay at that level through the end of 2024.

Economists and policymakers acknowledge that people of colour are disproportionately harmed when the unemployment rate rises, especially when there is a recession, even a mild one.

“Black Americans never have low unemployment,” says Algernon Austin, director for race and economic justice at the Center for Economic and Policy Research, a Washington-based think-tank. “The unemployment rate ranges from high to very high to extremely high.”

“It’s important to recognise that a mild recession means going from high unemployment to very high unemployment for black people.”

Prior to the pandemic — when the US labour market was in good health — the unemployment rate for black Americans was roughly twice that of white and Asian adults. In 2019, it stood at 6.1 per cent, compared to just 3.3 per cent and 2.7 per cent for white and Asian adults, respectively. For Hispanic adults, it was 4.3 per cent.

At the worst of the Covid economic crisis, the black unemployment rate skyrocketed to nearly 17 per cent. For white workers, it was slightly lower, at 14 per cent.

Fed officials have emphasised that inflation also hits those communities the hardest, and that in order to revert to a healthy economy, they must get prices back under control. Failing to do so in the near-term will also mean more pain later on, they argue, as the central bank will be forced to slam the brakes on the economy even harder.

“Without price stability, the economy does not work for anyone,” Jay Powell, Fed chair, said in mid-December at his final press conference of the year. “We will not achieve a sustained period of strong labour market conditions that benefit all.”

Austin expressed concerns about other factors, such as the war in Ukraine and China’s Covid policy, that are outside the Fed’s control but are having an outsized effect on the trajectory for inflation. He warned that the central bank was not only “unnecessarily” imposing costs on the most economically vulnerable people, it was also undercutting their capacity to handle the price pressures they were already struggling to overcome.

“[Put] people into unemployment, then they won’t be able to handle the inflation,” he said.

[ad_2]

Source link