[ad_1]

The man of the moment in private capital is not anywhere near New York City. Rather, Anant Bhalla is based in sleepy West Des Moines, Iowa, running a retirement annuities purveyor that is captivating Wall Street’s savviest financiers.

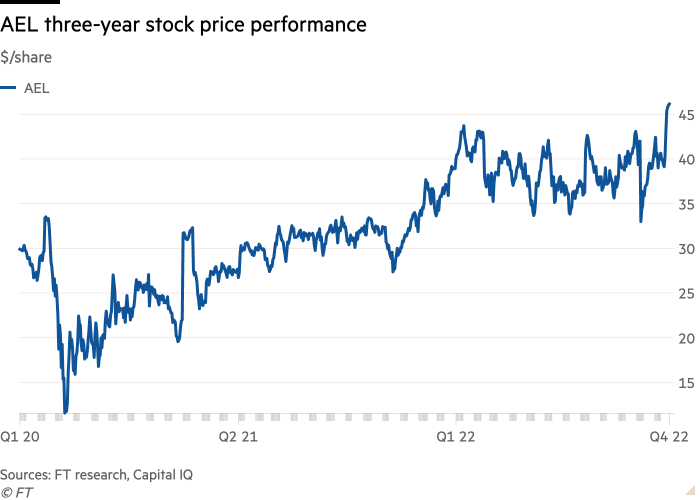

American Equity Investment Life last week rebuffed an unsolicited $4bn offer from a rival controlled by Paul Singer’s Elliott Management, capping a tumultuous year during which Bhalla also antagonised his company’s largest shareholder, Canada’s Brookfield Asset Management.

Underpinning the boardroom drama is Bhalla’s determination to keep AEL, one of the few independent annuities operators left, out of the wave of consolidation sweeping through the industry as private equity groups hoover up insurance assets.

The bad blood between Bhalla and Brookfield is a product of a deal that AEL entered into in November with start-up fund manager 26North, founded by the former longtime Apollo Global executive Josh Harris.

Bhalla had first turned to Brookfield in 2020 as it sought a white knight to fend off an earlier hostile bid from Apollo, where Harris worked at the time. Now with the Elliott bid out in the open, AEL and its $70bn of assets are in the crosshairs as a clutch of Wall Street investment titans circle the company.

Apollo, Brookfield, KKR, Carlyle Group, Ares and Sixth Street are among the many groups that could be bidders in a potentially frenzied auction next year.

“AEL is the last remaining independent/standalone fixed indexed annuities player of scale,” Daniel Bergman, an equity analyst at Jefferies, wrote in a recent note to clients. “Our sense is that there continues to be strong demand from alternative asset managers looking to grow in the fixed indexed annuities space.”

The looming descent of the Masters of the Universe upon Iowa might sound incongruous, but it would not be an anomaly. Private equity groups that once specialised chiefly in leveraged buyouts have made debt investing the key pillar of their efforts to grow their asset bases to reach trillions of dollars.

Building and acquiring insurance operations has proven to be a preferred method for private equity groups to find steady, permanent capital derived from the premiums paid by policyholders, which they then invest in newfangled credit securities before paying out to customers years later.

Bhalla has so far convinced AEL’s board and its shareholders that the company can go it alone despite the whirlwind of dealmaking, arguing that he had mastered the financial engineering needed to build a standalone private-equity-style insurer. But his desire to keep AEL independent is set to face its biggest test yet.

“It’s a game of chess — his strategy on paper looks interesting but it is hard to execute,” said one private equity executive not involved in the bidding.

Bhalla is among those financiers that believe annuity providers need to move beyond vanilla bond investing and plough capital into exotic debt securities, which proponents argue are just as safe while yielding higher returns because they are complex and illiquid.

This is the strategy that was pioneered by Apollo when Harris worked there. It bought a troubled block of annuities from AEL in 2009 that would eventually form the foundation of its Athene annuities business. Apollo’s wager was that both annuity sellers and policyholders could benefit if premiums were more aggressively invested.

Bhalla landed the chief executive job at AEL in early 2020 after stints at MetLife and AIG, where he had become a close ally of Peter Hancock, the longtime JPMorgan executive who had taken the helm of the teetering insurer after the financial crisis. At MetLife, Bhalla was heavily involved in separating its retail life insurance business into the publicly traded Brighthouse Financial, where he became finance chief.

“Anant is very smart — I’d describe him as a technician who has good, creative ideas,” said the private equity executive. “He’s done a fine job. Some people will say he is sometimes a little too smart for his own good and less practical.”

Within months of joining AEL, Bhalla’s ambition would be tested by unsolicited bids from not just Apollo but also MassMutual. It was at that point he decided to sell a stake of almost a fifth to Brookfield to fend off the suitors.

At the same time, Bhalla unveiled a new strategy he dubbed “AEL 2.0” that he said would boost shareholder returns. Rather than selling out to a private equity group, AEL would contract investment management out to multiple managers with specialist expertise.

Since then, the company has struck deals with groups including Pretium Partners, Adams Street and Monroe Capital. AEL says nearly a fifth of its assets are now invested in private capital, helping nudge up its annual investment yield to 4.3 per cent, from 4.0 per cent in 2020.

In an interview with the Financial Times after the Elliott bid, Bhalla said this so-called open architecture was “best for policyholders” because it means that assets are managed “based on merit and market opportunities”.

Separately, AEL is trying to push further into the reinsurance business to boost equity returns. It is this that appears to have irked Brookfield, which cut a reinsurance deal with AEL when it first acquired its stake. Under that arrangement, Brookfield paid a fee to AEL in exchange for the transfer of billions of dollars of liabilities that Brookfield wanted to invest.

The row erupted in an unusually dramatic fashion in November, when analysts on an earnings call started peppering Bhalla with questions about why a Brookfield executive on AEL’s board had abruptly resigned. Bhalla struggled to answer because he had just found out: the securities filing containing the news was made public while the call was in progress.

In a letter explaining the defection from the board, Brookfield’s departing board member said there had “been a fundamental change in the strategic direction of AEL”.

That strategy change was the new agreement with Harris’s 26North, under which the two companies signed up to a reinsurance partnership. AEL also bought a stake in 26North, the size of which has not been disclosed.

Since pulling its representative off AEL’s board, Brookfield has demanded that the Iowa company make public the process and terms of the 26North deal. The suggestion is that Bhalla has unwisely partnered in what Brookfield believes is an unproven venture by teaming up with Harris.

However, Bhalla recently told investors that the 26North transaction was a sideshow, and that the real reason the parties fell out was because Brookfield had in May acquired a rival insurer and thus become a “direct competitor” of AEL. “You can come to your own conclusions about Brookfield’s motivations,” he added.

Regardless of who is right, the public boardroom bust-up has put AEL in the spotlight — and into play. On December 8, Elliott’s life insurance affiliate Prosperity Group submitted the $45-a-share offer that has been repeatedly rebuffed by AEL as “opportunistic”.

A person involved in the situation said one large private capital manager told Prosperity it was pleased that it had put AEL in play, indicating its own interest in pursuing a bid.

In late November, AEL granted Bhalla 1.2mn new shares that vest at stock prices between $45 and $60, an aggregate award that could eventually be worth more than $70mn. Selling the company at $45 per share would mean missing out on the full windfall.

Bhalla managed to maintain AEL’s independence in 2020 but might find keeping it out of the clutches of a buyer more difficult this time. Brookfield has gone from a white knight to a thorn in his side. In a securities filing last week, Brookfield said it would soon exercise its right to reappoint a director to the board to help AEL evaluate what it described as the “highly credible” offer from Elliott.

[ad_2]

Source link