[ad_1]

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Financial markets may have slumped across most of the world in 2022, but a handful of countries are on track to see growth in exchange traded fund assets despite the headwind of plummeting valuations.

The resilience attests to the growing adoption of ETFs around the globe — particularly in some emerging market economies where uptake has lagged behind more developed countries — as well as some pockets of resistance in financial markets themselves.

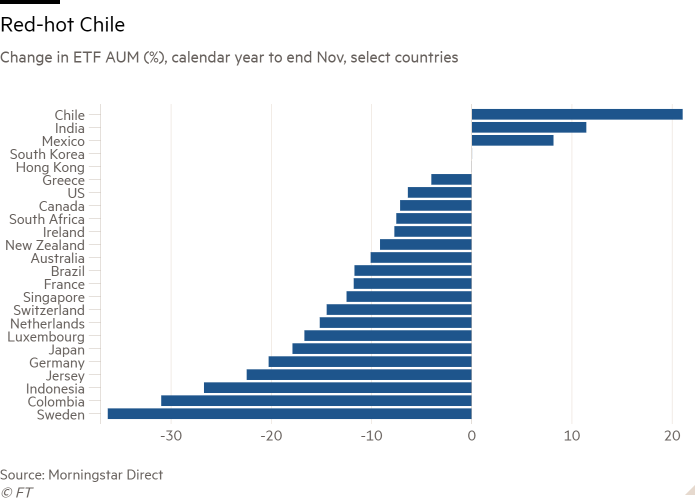

As of the end of November, Chile, India, Mexico and (just) South Korea were on track to record year-on-year ETF asset growth, according to data from Morningstar Direct, even as global ETF assets fell 7.6 per cent from $10.3tn to $9.5tn, according to ETFGI, a consultancy.

The declines have been sharper still in some cases. The assets of Swedish-listed ETFs tumbled 36.3 per cent to $6.3bn in the first 11 months of 2022, according to Morningstar as the MSCI Sweden equity index slid an outsized 27.3 per cent in dollar terms.

The Colombian ETF market saw a 31 per cent contraction to $1.4bn as net inflows worsened a 12.4 per cent stock market fall in dollar terms, while Indonesia’s tiny market managed to shrink even further, by 26.7 per cent to $358mn, thanks to net outflows — despite a 9.1 per cent stock market rise.

Among the larger markets, assets of US-listed ETFs have fallen by 6.4 per cent to $6.8tn, according to Morningstar, those of Irish-listed vehicles by 7.7 per cent to $964bn and those of Japan by 17.9 per cent to $446bn. Luxembourg-listed ETFs have contracted by 16.7 per cent to $281bn and Canada has seen a 7.1 per cent decline to $254bn.

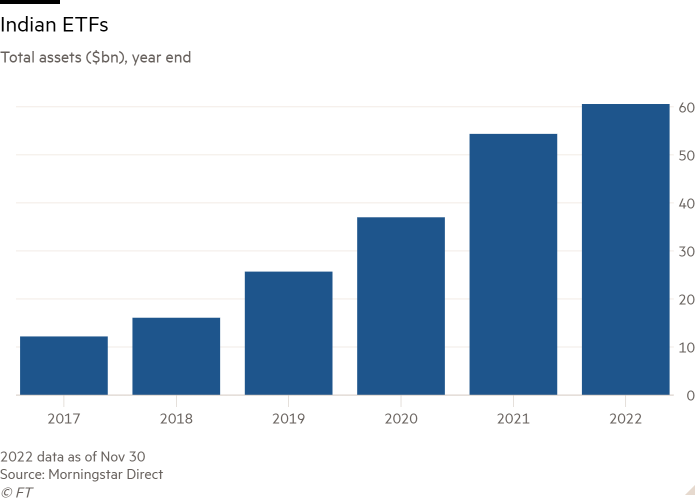

There have been pockets of growth for the industry, though, perhaps chiefly among them India, where ETF assets have risen 11.4 per cent this year to $60.6bn, despite the stock market making small losses in dollar terms.

“India has seen huge growth in index products, both ETFs and mutual funds,” said Deborah Fuhr, managing partner and founder of ETFGI. “It has really seen an awakening in terms of growth of index products tracking the Nifty 50 [equity] index.”

Kenneth Lamont, senior fund analyst for passive strategies at Morningstar, said India was one of the more “interesting” ETF industry growth stories, with at least 15 ETFs, both equity and fixed income, receiving $100,000 or more in net inflows so far this year.

“We are late in the race but we’re catching up,” said an official for NSE Indices, a subsidiary of the National Stock Exchange of India. “The index fund as a concept is very popular in India and it’s growing.”

The country’s ETF assets have quintupled since December 2017, when they were a mere $12.2bn, according to Morningstar, the second-fastest rate of growth in the world, behind only Chile.

The official dated the start of the industry’s growth spurt to 2015, when total assets in equity and bond ETFs were a “minuscule” $1bn, despite the first Indian ETF having launched in 2001.

That year, the Employees’ Provident Fund Organisation, which administers India’s mandatory pension fund, started pumping 5 per cent of incremental investments into equity ETFs tracking the Nifty 50 and Sensex 30 indices. This was later tripled to 15 per cent.

“That was the driving force of the ETF industry taking off,” the official said. “Once they started investing, the industry has grown in leaps and bounds and retail investors have also started investing in passive funds.”

India now boasts 294 passive funds, up from just 84 in March 2017, according to data from the Association of Mutual Funds in India, collated by NSE Indices, with the segment now accounting for about 15 per cent of total fund industry assets.

Some 16.3mn investor “folios” now include ETFs, and 3.1mn involve passive mutual funds, up from 1.3mn and 0.3mn respectively as recently as March 2019, according to AMFI data collated by the exchange.

“Most of the active funds, especially in the large cap category, are finding it difficult to outperform the underlying indices, so people are switching from active to passive funds,” said the official.

The other major success stories have been in parts of Latin America. Chile has seen the strongest asset growth this year of any country tracked by Morningstar, with AUM up 21 per cent to $4.1bn.

Net inflows were a solid $919mn, the second-highest on record although a fraction of 2021’s $3.2bn, while a 22.4 per cent rise in the dollar-denominated MSCI Chile index will have helped those investing in the domestic stock market.

Mexico is another bright spot, with a combination of net inflows and more modest stock market gains helping propel an 8.2 per cent rise in assets to $6.1bn.

Lamont emphasised that these markets remained small, and in the case of Chile most of inflows were sucked up by just one fund, Singular Global Corporates, which invests in dollar-denominated debt issued globally.

However, the data, which are based on the primary listing of each ETF, probably fails to capture the full vigour of LatAm markets, Lamont said, given that many now permit the cross-listing of ETFs whose primary listing is overseas.

Hector McNeil, co-founder and chief executive of HANetf, which has cross-listed more than 20 ETFs in Mexico, alongside others in the likes of Chile and Peru, said there was “a huge amount of demand” for overseas assets, such as US Treasuries, hedged back into Mexican pesos, in order to limit risk.

Moreover, McNeil said European-listed ETFs based on the continent’s Ucits fund structure, were more tax efficient than both US-listed ETFs, which typically levy a withholding tax, and even direct holdings of Mexican bonds.

Click here to visit the ETF Hub

[ad_2]

Source link