[ad_1]

In this industry, smaller advisors, those with sub-$250 million in assets, often get the shorter end of the stick. They don’t have the same service levels or media coverage that the larger firms enjoy, and they lack the scale to create negotiating power with vendors in the space. Pundits often talk about how the large firms, those that get bigger by consolidation, will dominate the small firms.

But many firms in this smaller cohort are surviving and, in fact, thriving, with no desire to get bigger. And the list of service providers catering to smaller advisors is growing. For instance, Advisory Services Network, a service and support platform to RIAs, has grown quietly over the last couple years by targeting this underserved segment specifically.

WealthManagement.com recently spoke to three of ASN’s advisors: Andy Garrison, senior wealth advisor with Inflection Point Wealth Advice, a firm with just under $100 million; Brandon Cabannis, an advisor with Williams Wealth Management, with $160 million; and Joel Yudenfreund, an advisor with Appleby | Yudenfreund Wealth Management, with over $100 million.

The three advisors discuss their challenges, goals and desire to maintain control of their businesses, rather than participate in the red hot market for M&A.

The following has been edited for length and clarity.

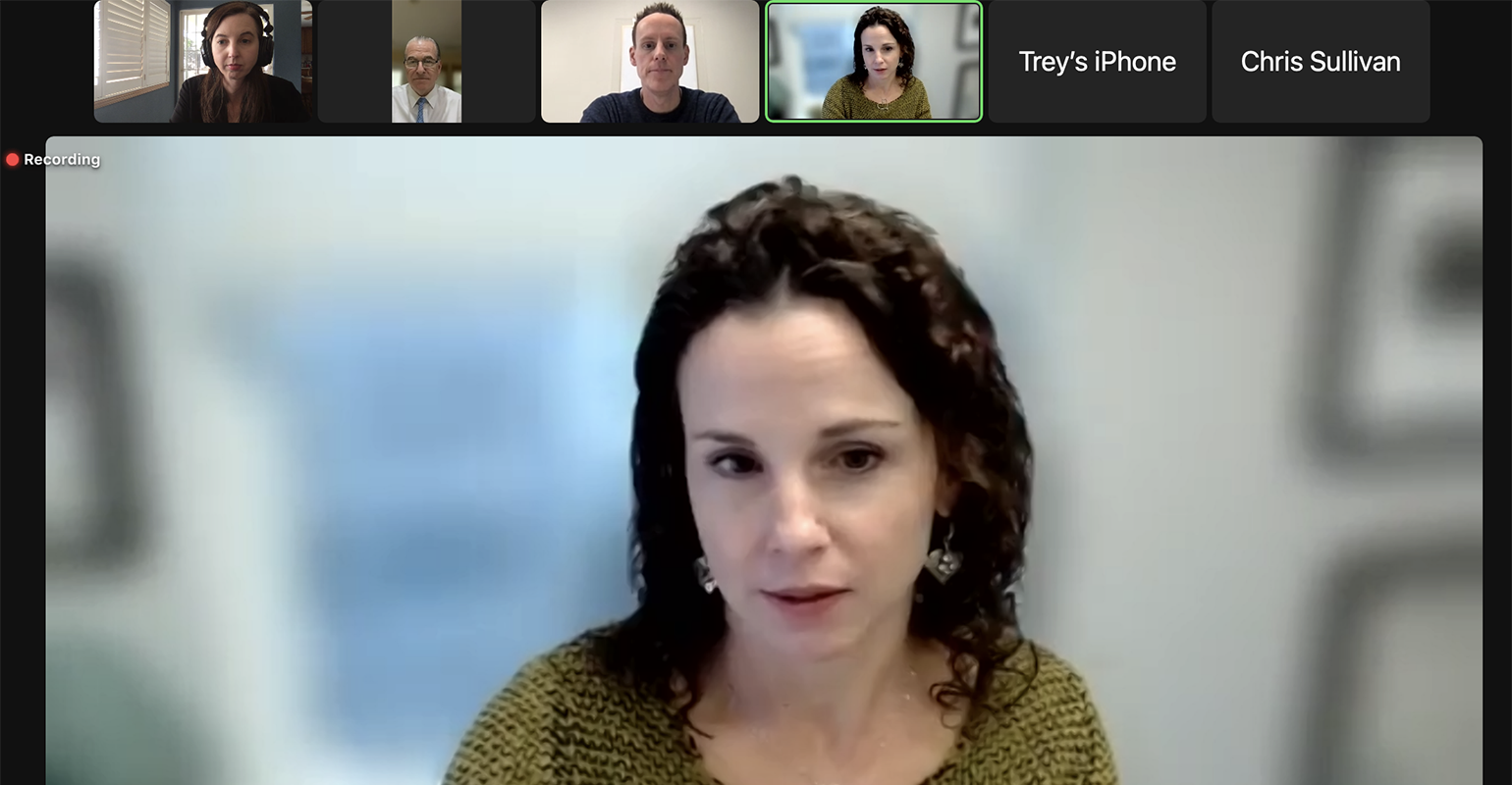

From left, at the top: Diana Britton, Joel Yudenfreund, Andy Garrison and Brandon Cabannis

WealthManagement.com: What are the biggest challenges facing you as smaller advisors?

Andy Garrison: The things that don’t scale, I’m biased because of what I do, but I think they are often the most important stuff, and that’s the client experience, client relationship, the things we’re doing that add direct value to them. And as much as we try to scale that in this industry, there are parts we can, but I think one of the bigger challenges often is all that stuff that can scale that does not add direct value to the client relationship.

We’ve all found a good solution for a big chunk of that, whether it’s back-office related, operations. So those, what I would call either indirect or just maybe not totally relevant from the client’s eyes, things have always been a challenge.

The two biggest challenges that I feel the smaller firm may not have the best capacity is compliance and then also operations. Everything from billing and reviewing and all that, to making sure the back office relationship with the custodians and everything is sound and going as it should.

As a small operation without an ASN or something, that time’s got to come from somewhere. It’s either clients or family, and most of the time it’s both. And so I think that’s why you’re seeing a move to try to shift some of that to someone who does that at scale.

Brandon Cabannis: If you’re independent and at this size, you have a lot of hats to wear of your own. You want to grow the business. And marketing, things like that, that may not be your forte, and trying to decide where to put the dollars.

Now that we have more control over dollars, being in the independent side and having the support from an admin and ops area, from ASN, there’s still those other dollars to spend and other ways to grow and to develop the business. Do we take on new people to support staff? Do we grow and acquire other advisors? Or do we continue down this road that’s really working great and just build the business and stay small?

I think there’s always a little bit of a question of how big do you want to be and when you give up on the client service side and the personal side, the ability to have more touches with your clients versus growth.

We would like to double in size without adding more people, so that’s our shorter term goal. I think we can get there.

Joel Yudenfreund: How do you keep in contact with the clients? How do you not grow too fast? I know it’s a cliché, but with our clients, it really is like family. We want to keep it that way.

We really do get in with clients about not only investment management but the estate planning and the tax. And you really have to know the family if you’re going to take on that role. It’s having that constant contact to know what people have going on in their life and not get too big where you can’t do that and all of a sudden you’re putting them off on other people.

WM: How do you keep those really deep integrated relationships with your clients, while continuing to scale?

JY: So far, we’ve been able to do it. We have more larger clients, so we’re able to keep that focus and we intend to keep doing that. We’ll add AUM and not necessarily a tremendous amount of people for each, let’s say $1 million of AUM we add.

Again, knowing the family is, in this business, I think a lot of people overlook that. But if you just know the client and you don’t know the children and you don’t know that next generation, it’s not going to be a success.

WM: What are some of the special or differentiated needs of the smaller advisor?

AG: I think that there’s a lot more sorting through the noise that we have more on the smaller side of practices. There’s just so much stuff out there. There’s new stuff every day coming out, and I think we’re all pretty passionate about making sure we’re bringing the latest and greatest, not necessarily from an investment side, but from a service and advice and consideration side to our clients. And so sorting through that can add a leverage point, as size grows too.

WM: What’s your take on all the M&A activity going on, especially among the large enterprises? Have you considered selling or merging with another practice to achieve more scale or expand your services?

BC: That was one of our options that we weighed when we did our due diligence about going independent, so we looked at a local firm essentially acquiring us. And then we weighed that with ASN, and the three of us, the advisors of the group, just said ‘no.’ At the end of the day, we want to make the calls about how we run our business and how we speak to the public and how we work with our clients.

We want that opportunity first before we get acquired into someone else’s culture. And culture’s the big word here because we can control that if we remain independent and it’s just us. If we do decide to acquire, that will be one of the first interviews we have, is about the type of people and would we want to work with them and do they have the same values and culture that we have here? So, for now, we don’t have plans to do that.

JY: I think we want to stay independent. Whether you sell or you merge, you’re kind of going backwards. And part of the great thing about being independent is being able to do these things. And once you join another firm again, they’re going to have their procedures and they could change weekly to be quite candid.

AG: Globally, I think the M&A space, it’s kind of this interesting dichotomy of what do the firms need to continue on, whether it’s the succession plan-type process or it’s a way to get scale or transition or something like that. I think at one level that makes sense and it’s always an interesting balance of how a merger or something like that might affect advisors, how it affects clients and how those pieces all come together.

If you have two advisors, you add one, you just increase your headcount by 50%. And so when we think about scaling and growing, I think we’re all in a spot to be able to do it intentionally, for a lack of a better term.

WM: What do you think about all the new choices out there in the marketplace in terms of M&A, such as minority investments and different capital options?

JY: It’s great to have options, but it’s really a matter of at the end of the day what you’re looking for. I mean, some people may like the M&A or the sale because they want to, let’s say exit the business, they’re retiring or they just want to go into another career and cash out. There’s a lot of things that come along with the dollars or the minority interest that you may get in that transaction.

At the end of the day, you’re losing that control that I think people, when they originally went independent, were trying to gain.

BC: We’ve looked at a couple of options, and we weren’t happy with the lending terms and the language, to be honest. We left a large broker/dealer because we wanted to go independent and not be beholden to a lot of contracts and things. We preach this to our clients and our community all the time—financial independence means having control over your dollars. And loans and liabilities, they often stifle that. It’s not that it’s a negative in our minds, it’s just not what we want right now.

AG: For a lot of years before some of those options and financing options came in, practices were able to grow and build the traditional route, and I think a lot of us are still attracted to that concept. And on succession planning too, that’s a traditional route, bring in good advisors, help build them up.

WM: What’s going into your choice of custodians?

JY: Most of the people we deal with are coming from that private banking background. We lean a lot toward Pershing because people in that world know BNY Mellon, and Pershing is part of them.

We always explore the other custodians and what they may or may not do better. There are positives and negatives on the private banking side and the retail side, and it’s always weighing those views. Given the choice, clients will have an opinion. But in my case it happens to be more that private banking slant.

BC: I’ve been super pleased with the multi-custodial approach and being able to offer our clients several custodial options because sometimes they do have a preference or in a few cases, the client actually wants to custody at several locations at several custodians. It’s been a competitive advantage over other banks and private banking competition really. To be able to offer fiduciary services and then offer that multi-custodial approach is pretty great. Fidelity is where we custody most of our client accounts, and I’m personally interested in them because they’re still private and they are run by a female. And I like the content that they put out to educate women about investing, money management.

AG: If options are good for advisors and firms, options are even better for clients and having the multi-custodial approach to be able to have different places in different locations that regardless of whatever may be going on that we can find the right place for the clients, that’s the important thing.

WM: Are any of you thinking about alternative ways of pricing your services? Or are you seeing any pressure on fees? Just opening it up to talk about that.

BC: I’ve had my CFP certification for a while, eight or 10 years. And this is the first time I’ve been able to charge a fee for planning. Our former broker/dealer didn’t allow it. That’s been tremendous because then I feel like I can service just about anyone. This year we’ve sort of tested what I call “wealth builders program” for clients that don’t meet our AUM minimum, but they need planning services.

That’s been tremendous because that’s a great way to not take on smaller accounts but still provide a service, especially if it’s a client relationship, a child or a family member or a friend. And you don’t want to say no, but you don’t want to take on a lot of small accounts.

It’s another revenue stream, and it’s a bit of a feeder system for business development because those people will eventually meet our AUM minimum.

AG: I think it’s always a good thing to think creatively and look at fees. We offer flat fees, planning fees and AUM in there, and I think for some clients that combination makes sense.

WM: Are you seeing any pressure on fees?

JY: No, not from our standpoint. I think we’re in that right place and people understand what we do. Again, that differentiator is our ability to talk to them about the tax and state planning issues that may come up, so they really value that in which we’re not charging separately for that. It’s just something that if we’re dealing with a high net worth client, it’s something they expect.

WM: How are you communicating with clients about the current market conditions? Are you making any adjustments?

AG: We try to be proactive in it. We tell clients, “Hey, market cycles happen, can’t get away from them.”

So what do we want to be thinking about when they’re down? Do we want to talk to their accountant about looking at Roth conversions? Of course. Do we want to be looking at or is there any kind of end-of-year tax loss harvesting we want to do? Or depending on their tax bracket, tax gain harvesting? So there’s all those different kinds of things where, I think years past, it used to be, “We just hold tight and we ride through it.” Now, it’s, “OK. We’re here. It is what it is. What do we need to do about it?”

WM: As we are coming up on 2023, what goals are you setting or new challenges that you think might be coming up?

BC: End of the year is a time we always try to set our business development goals for the following year. And with that comes some decisions about marketing and how to get our voices out there. Because, of course, there’s the traditional way to build business organically through referrals, and we do get a bit of that. We have an advisor in our group that is good in the media and he’s on the news and he’s speaking to things and we’re writing articles and we’re trying to push it all out there. So how do we get more eyeballs and more engagement with that to hopefully create some lead generation to grab.

AG: A couple of things I’m most excited about is just looking at all the different options out there and finding what all we can bring to clients. Our clients are getting older, and we want to make sure that we’re able to help those new clients that are up and coming and speak to them in the way we can.

And so we’re looking at combining not just the norm to financial planning and investment advice, but also looking at how do we bring a little bit of a personal development angle into it as well. And then we’re also just continuing to build out on our own firm growth goals. So we’ve got a system to scale that if we ever do. Identify some of those advisors as a good system to plug into and enable to operate pretty much from day one like that.

[ad_2]

Source link