[ad_1]

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

Inside WorldQuant’s ‘Alpha Factory’

When Igor Tulchinsky was deciding whether to join hedge fund Millennium Management three decades ago, the Belarusian former video game programmer eschewed the systematic, data-driven approach that is characteristic of “quants” like him. He simply flipped a coin.

It was not “so that chance shall decide the affair, while you’re passively standing there moping”, to quote a poem by Danish scientist Piet Hein. “But the moment the penny is up in the air, you suddenly know what you’re hoping.”

The coin toss dictated that Tulchinsky should stay at his current employer, options trader Timber Hill. But when he announced the decision to Millennium, “I felt so bad,” he told me and my colleague Robin Wigglesworth in a rare interview. So he changed his mind and quit Timber Hill for Millennium.

His about-face turned out well for Millennium’s investors. Tulchinsky became one of its top portfolio managers, and in 2007 spun out a quantitative investment manager, WorldQuant, to manage money for the now roughly $60bn-in-assets hedge fund group. Over the past 15 years WorldQuant has grown into one of the largest and highest-contributing units at one of the world’s top hedge funds.

Its model is to produce algorithms that try to predict the price movements of various financial instruments, typically equities, and then take advantage of inefficiencies in the markets. Tulchinsky, whose intense gaze and head-to-toe black attire give him the air of a James Bond villain, refers to these algorithms as “alphas” and to WorldQuant as the “Alpha Factory.”

Don’t miss the full story of Tulchinsky’s unlikely career path, how WorldQuant is trying to stay ahead by diversifying into new areas like high-frequency trading and corporate bonds, and the company’s unusually decentralised global workforce.

Its offices in 13 countries are spread across many non-traditional financial centres, such as Ramat Gan, Israel; Budapest; Mumbai; Ho Chi Minh City and Seoul. The business is built on the premise that “talent is distributed equally around the world, opportunity is not”, says Tulchinsky. “And we provide opportunity to the talent.”

A new golden age for short selling?

Hedge fund short sellers have hardly enjoyed the best of times during a decade or more of a seemingly never-ending bull market. This year their luck finally appears to have changed.

The best known tool of the hedge fund industry, and one of its most controversial, short selling is back in fashion, writes my colleague Laurence Fletcher. That is thanks to the end of what former Soros Fund Management investor Renaud Saleur, who now runs Geneva-based hedge fund Anaconda Invest, calls the “fantasy” market, or the “everything rally” that lifted both good and bad stocks with little differentiation during the coronavirus pandemic.

This year’s huge sell-off in the speculative technology sector has provided a wealth of opportunities for managers, with Goldman Sachs’ Unprofitable Tech index falling 60 per cent as rising interest rates make such companies’ future cash flows far less attractive.

Another area of opportunity has been the cryptocurrency sector, where bitcoin miners have become the latest target. Lossmaking Marathon Digital, for instance, is one of the most shorted stocks in the US market. The firm paid its former chief executive nearly $220mn in stock awards last year but since has then fallen well short of its mining and profitability targets.

Hedge fund managers say that their shorts have been delivering the best returns in years. But it remains a tricky business navigating vicious bear market rallies and rising stock correlations. Meanwhile “speculative technology” is no longer the obvious short that it was at the start of the year.

Short sellers made millions during the dotcom bust two decades ago and again betting against the banks during the 2007-08 financial crisis. If the current bear market turns out to be anywhere near as bad as Elliott Management or Saba Capital’s Boaz Weinstein have recently predicted, then short selling could be entering a new golden age.

Chart of the week

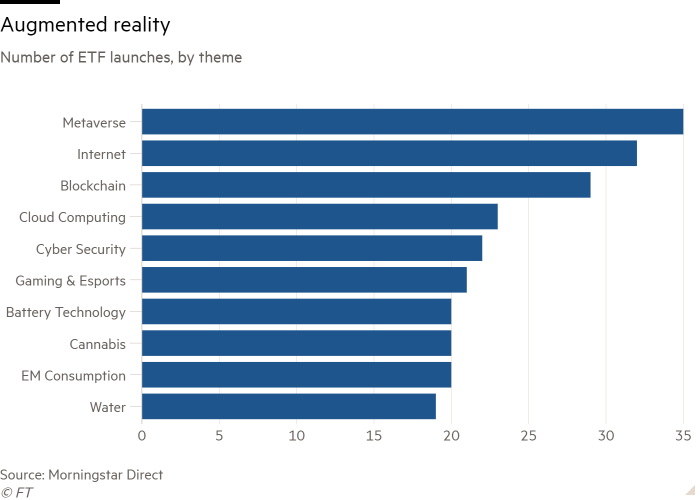

The metaverse has become the hottest concept ever in the history of exchange traded funds — despite steady media coverage suggesting there has been little interest in the “sub-theme”.

A total of 35 metaverse-badged ETFs have launched globally since the first rolled off the conveyor belt in June 2021, according to data from Morningstar, writes Steve Johnson.

This exceeds the number for any other “sub theme”, according to Morningstar classifications, ever, trumping the 32 for internet ETFs, 29 for blockchain ones, 23 for cloud computing and 22 for cyber security.

The avalanche of launches has come despite an embarrassing lack of traction for many early offerings in the metaverse — a futuristic immersive version of the internet enabled by virtual and augmented reality.

Even Meta Platforms, which was so enamoured by the concept that it changed its name from Facebook to “reflect its focus on building the metaverse”, has started to lay off workers associated with the project.

But when it comes to ETFs, “we have seen very, very fast uptake”, said Kenneth Lamont, senior fund analyst for passive strategies at Morningstar. “It’s the quickest ever.”

10 unmissable stories this week

BlackRock has pulled in much more money from US retail investors than its rivals so far in 2022, according to Morningstar data, even as the world’s largest asset manager has come under attack from both the left and right over its approach to sustainable investing.

Texas legislators have excused Vanguard from being grilled on its practices at a hearing on environmental, social and governance investment factors, a week after the asset management giant quit the main global financial alliance on tackling climate change.

The Fed needs to stop raising rates, writes Bill Gross, philanthropist and co-founder of Pimco. With too much hidden leverage around, the central bank should wait to see if the punch bowl has been sufficiently drained.

The Securities and Exchange Commission, the main US markets watchdog, has proposed the most sweeping overhaul of stock trading in almost two decades in an effort to improve prices and transparency for small investors.

Ray Dalio and Hollywood film-maker James Cameron have bought an equity stake in a submarine maker that allows the ultra-wealthy yachting class to explore the remotest parts of the planet. The billionaire founder of Bridgewater Associates, the world’s largest hedge fund, is now part-owner of Triton Submarines, a Florida-based company that specialises in submersibles for the super-rich.

A sea change is under way in markets, writes Howard Marks, co-founder and co-chair of Oaktree Capital Management, in this opinion piece. The investment world may be experiencing the third big shift of the past 50 years, which means that strategies that worked best this period may not be the ones that outperform in the years ahead.

Carlyle is struggling to raise the $22bn it had targeted for what it hopes will be its largest fund, as it grapples with a succession crisis and a market downturn. The US buyout group has asked investors for an extension until the end of August, after saying it expected to miss its target to raise $22bn by March 2023.

Muddy Waters has revealed a short position against Vivion, a €4bn European property company, accusing its top shareholders of using “bond sale proceeds to unduly enrich themselves” and inflating the true value of their assets.

Billionaire investor Kenneth Griffin has sued the Internal Revenue Service and US Treasury department over the leak of his tax records to non-profit media group ProPublica last year. The Citadel hedge fund tycoon alleges IRS employees were able to “misappropriate” confidential tax information and leak it because of a lack of safeguards at the government agency.

“Fraud in shorts and T-shirts”: the case against the FTX founder. Sam Bankman-Fried’s arrest in the Bahamas exposes money transfers before collapse of crypto empire.

And finally

Casablanca has returned to the cinemas for its 80th anniversary, a chance to see for the first time on the big screen the great romance between Humphrey Bogart and Ingrid Bergman. The golden age classic remains impossible to resist.

Wishing you all a very happy Christmas. We’ll be back on December 27 with a special year-end edition of FT Asset Management, Harriet

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

[ad_2]

Source link