[ad_1]

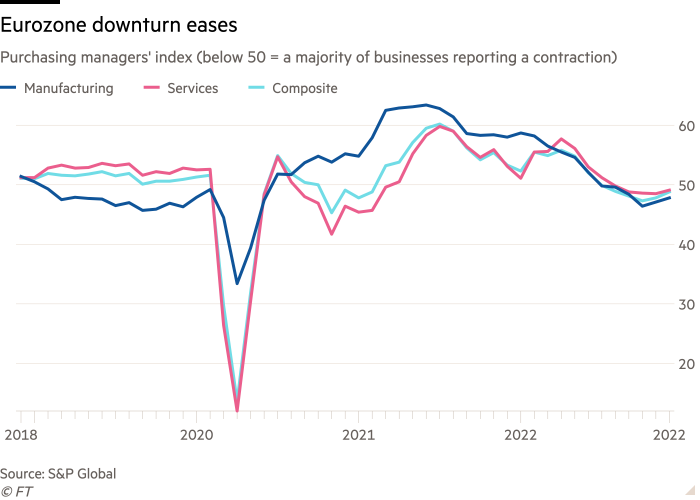

The eurozone’s economic downturn is set to be milder than expected, with a closely watched poll of the region’s companies signalling that pressures were not as bad as analysts had feared.

S&P Global’s flash eurozone composite purchasing managers’ index, a gauge of business conditions, rose to 48.8 in December — the highest level in four months and up from 47.8 in November.

The reading was also above the 48 figure forecast by economists polled by Reuters.

While a score below 50 signals the majority of the thousands of purchasing managers polled still think conditions worsened over the past month, the pace of contraction in activity may not be as great as it was during the previous month.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said that “while the further fall in business activity in December signals a strong possibility of recession, the survey also hints that any downturn will be milder than thought likely a few months ago”.

The survey’s forward-looking indicators, which track new orders that businesses receive, “are currently boding well for the rate of decline to ease further in the first quarter”.

The vast majority of analysts expect the eurozone economy to contract in the fourth quarter as a result of surging energy prices. However, many are now forecasting a milder recession after gas prices fell from the record highs seen during the summer and governments announced support packages to shield households and businesses from the impact of the higher prices.

“Whilst the eurozone is likely to suffer a fall in GDP, the PMIs at least are only pointing to a modest decline,” said Ryan Djajasaputra, economist at Investec.

On Thursday, Christine Lagarde, president of the European Central Bank, said she also expected “a shallow and shortlived recession”. Thanks to the active and robust labour market, and an easing of supply chain disruptions, she anticipates “that the recovery will pick up” after the recession, resulting in 0.5 per cent growth during 2023.

The resilience of the economy and continued high inflationary pressure prompted the ECB to raise its policy rate by half a percentage point to 2 per cent on Thursday, and signalling more half-point rises were to come.

The survey, based on data collected between December 5 and 14, showed that businesses’ costs rose at the slowest rate for more than one-and-a-half years, reflecting the combination of weakened demand and improved supply.

For the doves on the ECB’s governing council, the cooling in inflationary pressures in the PMIs “will likely fuel concern that the ECB could end up doing too much”, said Bert Colijn, economist at ING Bank.

Factories reported the first improvement in supplier delivery times since January 2020, before the pandemic.

The manufacturing downturn has moderated especially markedly in December, led by improvements in activity in Germany and linked to a combination of better supply conditions and reduced fears of energy constraints.

The French figures were the main disappointment, with its composite PMI dropping again to a 22-month low of 48, driven by weak trends in services.

Across the eurozone, the service sector malaise has also calmed, in part driven by signs of a less intense cost of living squeeze and, in the financial services sector, fewer concerns over the tightening of financial conditions.

[ad_2]

Source link