[ad_1]

For Jason Macaree, a butcher in the English town of Rochford, cash is coming back.

Rochford in Essex is one of two towns — the other is Cambuslang, outside Glasgow — chosen to run a pilot project to improve access to cash as banks close branches to cut costs. Under the scheme, lenders jointly provide staff on a rotating basis at hubs operated by postmasters.

For many of Macaree’s customers, the hub, which was launched early in 2021, has become a lifeline. Cash now makes up as much as 50 per cent of his daily takings, around twice as much as the same time of year in 2021.

“People find it much easier to budget with cash in their pocket, and everyone’s on a tighter budget,” he said, adding that for business it was also important for paying suppliers.

The coronavirus pandemic accelerated a longer-term trend of moving towards a more cashless society, with bricks-and-mortar retailers and the hospitality sector embracing digital payments.

But during the cost of living crisis, an increasing number of households are turning to cash as a budgeting tool as they struggle to cope with soaring price rises.

However, many have struggled to access coins and notes as banks close large parts of their high street networks as part of a cost-cutting drive that has left fewer than 6,000 branches across the UK, less than half the number of two decades ago.

“We’re in a financial climate where people who didn’t care about budgeting are now having to,” said Derek French, a former bank executive who headed the Campaign for Community Banking Services. “The [cash access] problem is gaining ground, and the remedies are not happening anywhere near fast enough.”

In 2018, the independent Access to Cash review, funded by ATM operator Link, began exploring how to preserve cash, with the bank hubs proving to be its most successful projects.

The UK government first said it would legislate to protect cash access in the 2020 spring Budget. However, the Financial Conduct Authority watchdog is only due to gain the powers to enforce that duty with the financial services and markets bill that is currently going through parliament.

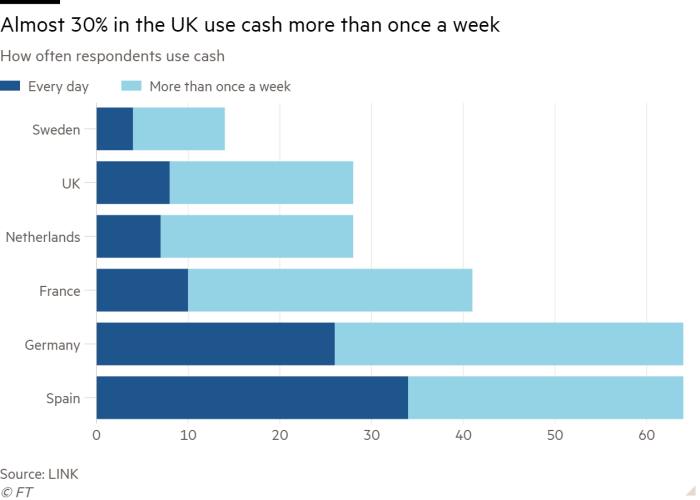

With more than a quarter of people in the UK using cash more than once a week and almost 10 per cent, or around 5mn, using it daily, campaigners warn that upcoming legislation on cash access must be strengthened to protect them.

Last month, the chief of the UK’s financial regulator criticised banks for being too slow in rolling out banking hubs. “We want to see banking hubs and alternative forms of provision accelerated,” said Nikhil Rathi, the FCA’s chief executive.

Jaime Bush, owner of The Square, a café in Rochford, said the pilot hub had become important for his business. “We have a lot of the older generation coming in especially on Tuesday [when Rochford has its market day],” he said. Without access to the hub, he would have to make a 40-minute round trip by train to the nearest city, Southend-on-Sea, to deposit his takings.

“It’s also handy for change — the whole register can be empty by midday.”

But new hubs have been slow to get started. Two opened their doors earlier this month in Brixham, Devon, and Cottingham, Yorkshire — the first to launch since the pilot scheme despite the announcement of 27 planned sites over the past year.

French estimates that there are at least 100-150 communities across the UK that need a hub and he anticipates that number will increase. He said the pilots had already shown there were wider benefits to offering banking services, such as reviving struggling high streets.

“The [Access to Cash review in December] was very conclusive — hubs not only serve individuals’ cash needs, but brought footfall back to towns, which was hugely helpful for everyone.”

Frustration over the slow rollout of hubs is partly due to complexities of the model, according to Natalie Ceeney, who chairs the Cash Action Group that led the pilots.

“Setting up new services takes time, especially when this involves banks joining forces to share new infrastructure,” she said.

Jeff Mitchell at CleanSlate, a not-for-profit group that works with lower- income households, warned that although the pandemic had made cash less relevant for many retailers and business in the hospitality sector, it remained crucial for many people.

“Pubs, bars or restaurants that are card-only . . . reinforce the false assumption that everyone can live their lives that way.”

According to the British Retail Consortium, cash accounts for 15 per cent of retail spending, with some of the UK’s largest supermarket chains, including Aldi and Tesco, running trials with cash-free and checkout-less stores.

But countries farther down the road towards a cash-free society, such as Sweden, have discovered the challenges of this approach. The diminishing number of shops accepting notes and coins means about 600,000 of the country’s 10mn population struggle daily, said Gabriela Guibourg, head of analysis and policy at the Riksbank, the Swedish central bank.

“We do get a lot of calls . . . saying ‘how am I going to cope with this?’, especially from the very elderly,” she said. “Those people have to have access to reasonable payment.”

The UK Treasury said it was “absolutely committed” to protecting access to cash, and Rishi Sunak, the prime minister, told MPs on Wednesday that the legislation in the financial services and markets bill represented a “significant intervention” and remained a priority for his government.

But French urged ministers to give the FCA more power so that banks would speed up the establishment of more hubs.

“The legislation is a long time coming and it’s not as strong as it should be — if you’re responsible for these things in the bank, you’ll be rubbing your hands and saying ‘let [the status quo] go on’.”

[ad_2]

Source link