[ad_1]

UK retail investment funds are heading towards their first full year of contraction in more than a decade, including during the financial crisis, with withdrawals already topping £25.8bn in the 10 months to October.

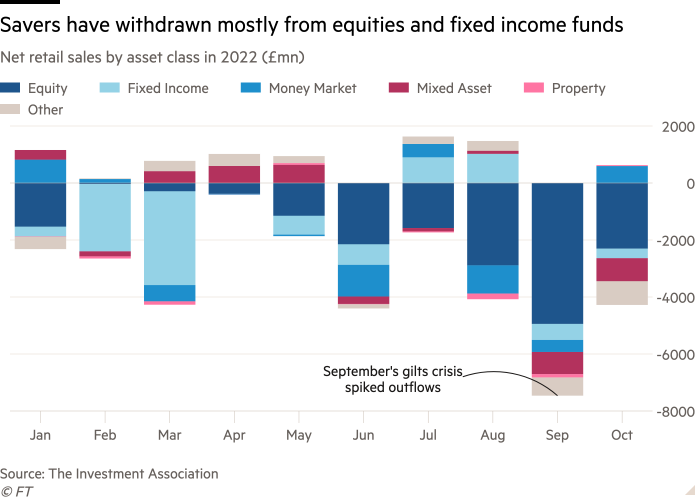

Funds have seen net monthly outflows for most of this year, with modest inflows reported only around the end of the financial year in April, when some investors top up their tax-free Isa holdings, according to data released this week by the Investment Association, an industry body.

Uncertainty has gripped the market in a climate of rising interest rates, high financial asset prices, inflation and recession. Even in 2008, net retail sales were a positive £4.8bn. Net sales were £43.6bn last year.

“We typically see retail flows turn net negative in periods of volatility or crisis,” said Sarah Ruggins, head of multi-asset research at wealth manager St James’s Place. She warned investors over trying to time withdrawals, saying “the largest rebounds come immediately after the largest drawdowns”.

Outflows have been broadly based, hitting equity, fixed income and money market funds. Despite withdrawals halving month-on-month in October to £3.7bn, sell-offs continued for all main asset classes, except passive funds.

The figures for October suggest the market settled slightly following the gilts crisis triggered by former prime minister Liz Truss’s September “mini” Budget, though the cost of living crisis and a looming recession next year continue to weigh heavily on consumer confidence.

Sell-offs in equity funds hit £17.3bn in the first 10 months of the year, with September the largest single month of withdrawals over the period at £4.95bn. Short-term flows between asset classes suggested a growing appetite for passive funds, with £1.4bn in net inflows in October.

With investors worried about the impact of Russia’s invasion of Ukraine, outflows of £4.5bn in European equity funds were higher than Asia and North America.

“Alternatives, bonds and equities have all had a torrid time in the year to date, and there’s been few places to hide, even for ‘cautiously’ positioned funds,” said Dzmitry Lipski, head of funds research at trading platform Interactive Investor.

Low-risk portfolios have not been a sure-fire source of returns for investors this year, with Vanguard’s LifeStrategy 60% Equity Fund down 7.49 per cent in the year-to-date, having experienced double-digit returns in two of the previous three years.

Ruggins said withdrawals were concerning, with some investors requiring ready access to capital. She noted individuals’ portfolios should be better diversified to lower-risk exposure and weather short-term disruption.

Central bankers’ appetite for further monetary tightening into next year has made investors wary of possible market turbulence affecting returns after the bond market turmoil in the autumn.

However, analysts suggested UK government and corporate bonds had been reset after a decade of steady yields ended suddenly, hit by rising interest rates. Newly-elevated returns available on bonds could be attractive, they said.

“As conditions shift, a higher interest rate environment means investing in bonds will become more attractive than it has been over the last decade,” said Chris Cumming, IA chief executive.

“Investors will need to navigate the changing investment landscape, and we may see further shifts in the pattern of fund flows,” he added.

[ad_2]

Source link