[ad_1]

Advisor Group, the network of independent broker/dealers, will make a series of changes in 2023 to prices charged to its affiliated advisors, according to a memo obtained by WealthManagement.com.

“This year, we are simplifying and bundling our fees and aligning nearly all pricing across the entire Advisor Group network,” the memo stated. “We are also eliminating certain regulatory markups that have been charged to you in the past. As your partner, we are committed to ensuring our pricing is fair and competitive in the marketplace. We also continue to leverage our size and scale to invest in your business, and ours, to ensure we deliver optimal value to you and your clients.”

A spokesman for Advisor Group did not respond to a request for comment.

For one, the firm is bundling certain fees that were previously charged separately, including the advisor’s affiliation, core technology, errors and omissions (E&O), Fidelity Bond, firm element (a training requirement), cyber insurance and CyberGuard program fees.

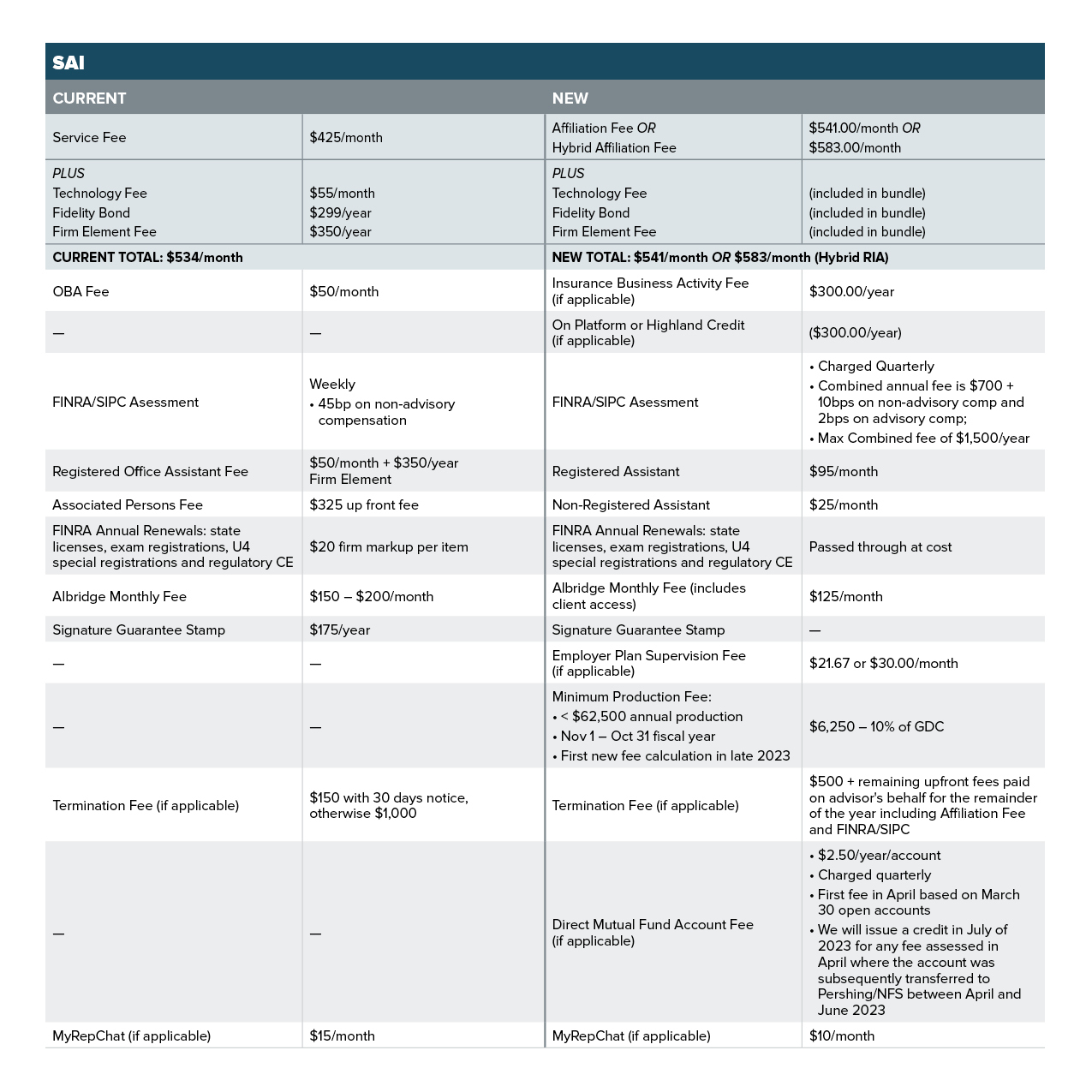

The changes in Advisor Group’s fee schedule from 2022 to 2023. Click to enlarge.

Advisor Group is also following in the footsteps of some other broker/dealers and charging a fee for mutual funds held directly at the fund companies versus in brokerage accounts or separately management accounts. Advisors will pay an annual fee of $2.50 per account type for those held-away accounts. It will be implemented on April 1, 2023, and based on March 31, 2023, assets.

“This is a pass-through fee that we’ve historically subsidized, covering mailing costs, data feeds for aggregation and supervision, and various systems we license to offer you the flexibility to opt for direct business,” the firm said.

In 2020, Avantax Wealth Management imposed a $60 annual fee on advisors for directly held mutual funds. An activist investor in Avantax’s parent company, Blucora, called for the firm to cease and desist that annual charge.

Advisor Group will eliminate its outside business activity fee, which was $600 a year, and replaced it with a new insurance business activity fee, a $300/year levy that covers the cost of additional E&O associated with insurance business.

A new annual minimum production requirement fee will be assessed on those with an annual production of less than $62,500. The firm, which cited overall advisor growth and ongoing regulatory scrutiny as reasons for the change, will analyze advisors’ trailing 12-months production through October 2023, and assess the fee late next year or early 2024. Advisors in the first three years of their careers or in their first year at Advisor Group will be exempt.

Further, advisors’ FINRA/SIPC assessment will now be based on individual production, with a $700 minimum and $1,500 maximum annual fee. Previously that fee was 45 basis points on non-advisory compensation, charged weekly.

Advisor Group has also updated its fees for registered assistants and non-registered assistants/associated persons. Reps will now be charged $95 a month for registered assistants, compared to the previous $50 a month plus $350 a year for firm element training. The firm will charge a new $25 monthly fee for non-registered assistants/associated persons. These fees cover back-office support, system access, email retention and other services, the firm said.

The firm instituted a new fee on advisors who do ERISA and non-ERISA employer retirement plan business of $21.67 per month on those with one retirement plan or $30 a month for those with two or more plans. That includes access to Retirement Plan Advisory Group (RPAG) reporting, “which supports Advisor Group’s compliance and supervision processes.”

The changes also included a number of fee reductions and credits, with FINRA annual renewal fees being cut to remove previously charged markups on state licensing fees, exam registrations, regulatory CE and special U4 registration fees. Those future fees will be passed through at cost as compared to a $20 firm markup per item.

The firm has also reduced fees charged to advisors using Albridge Premium and MyRepChat from $150 or $200 per month to $125 per month and from $15 a month to $10 a month, respectively.

In addition, advisors who have 50% or more of their assets “on platform” can received a $300 annual credit. Advisors are eligible for that credit if they have 50% or more of their assets in DirectChoice, brokerage and Wealth Management Platform business through NFS or Pershing, or write at least one life insurance policy or annuity with Highland Capital Brokerage, an Advisor Group subsidiary.

The firm has also eliminated its signature guarantee stamp, which was previously $175 per year.

The memo also mentioned changes coming in February 2023 to custodial fees charged to end clients. The firm says those changes will primarily be fee eliminations or cuts, but there are also some fee increases.

“They say the lowered costs are due to their scale ,which is partially true, but it is more about earning more on money market sweep accounts,” said Jonathan Henschen, founder of the recruiting firm Henschen & Associates. “If the Fed were to reverse course and drop interest rates, you’d see b/ds reverse course and raise expenses once again.”

Commonwealth Financial Network recently announced that the firm will reduce the pricing tiers on its platform by about 60%, effective Jan. 1. Commonwealth launched the platform fee four years ago, wrapping a single fee for trades in all securities for taxable accounts and IRAs. The old platform fee ranged from as low as 1 basis point for larger accounts to 12 basis points for smaller accounts. The new platform fee structure has fewer tiers, and fees range from 5 basis points to 1 basis point, depending on account sizes.

[ad_2]

Source link