This article is an on-site version of our Moral Money newsletter. Sign up here to get the newsletter sent straight to your inbox.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

In 2019, BHP’s then-chief executive hit back at efforts to divest from mining companies because of their big carbon footprints.

That year, the world’s largest mining company faced a shareholder revolt for its membership of industry groups that were lobbying against tighter restrictions on fossil fuels.

But 2019 also ushered in significant change at BHP. Three years ago, the company named Mike Henry as its new chief executive. In his time at the helm, Henry has publicly stressed his intention to pivot BHP away from fossil fuels and towards cleaner commodities that will power the future — a subject of increasingly vital concern for the world economy. Companies such as Tesla, for example, are worried about sourcing nickel for their electric cars, which also require at least two and a half times more copper than their petrol-powered cousins.

With this in mind, Gillian and I sat down with Henry in New York yesterday, to gain an insight on these burning issues from a man at the apex of the global resources industry. BHP has delivered strong returns this year for investors desperate for anything that can weather interest rate rises and the rout in the technology sector. But tough challenges remain for a company that continues to be a proxy bet on China’s sputtering economy. (Patrick Temple-West)

Has executive pay at big corporations reached unjustifiable levels? Or is it a fair reward for hard work and added value? That debate will be the focus of our next Moral Money Forum report — which will, as always, feature the views of our readers. Have your say by answering our short survey here.

Mike Henry: decarbonisation can’t happen without more capital for miners

As uncertainty swirls around global commodity markets, with the energy transition assailed by geopolitical strife and supply chain worries, this was a useful moment to pick the brains of the head of the world’s biggest mining group.

At BHP, copper, nickel and potash are being emphasised because they will ride the world’s emerging megatrends, the group’s chief executive Mike Henry told us. Global population growth is driving demand for food, while the accelerating energy transition is creating an increasing need for metals such as copper and nickel.

“If the world said tomorrow there is no capital available for mining, decarbonisation is impossible. It simply can’t happen,” he said. “There is a growing recognition of the criticality of mining to the world’s decarbonisation effort.”

The opportunities in the growing low-carbon economy, coupled with intensifying public and investor pressure, have pushed BHP to take an axe to its long-established fossil fuel operations.

Rather than extend the life of Australia’s largest thermal coal mine until 2045, BHP said this year it would close Australia’s biggest thermal coal mine in 2030, having failed to find a buyer for it. Also this year, the company spun off its oil and gas business to Australian company Woodside.

Asked whether shareholders were questioning BHP’s decision to accelerate its shift away from fossil fuels, given this year’s bull market in that sector, Henry said: “Not at all.”

“Over a two, three, four decade time horizon, the choices we are making about potash, nickel and copper . . . are sensible choices for us to make,” he said.

“In the near- to medium-term, we think there is still a lot of value to be generated out of those [other] commodities,” Henry said. “But as a long-term company thinking in multiple decades, where do we want to put our focus? We want to focus on those commodities that stand to benefit from those big trends.”

Named BHP’s chief executive three years ago this month, Henry has enjoyed a favourable market environment this year. BHP’s shares are up 30 per cent from a year ago, topping returns at rivals Rio Tinto and Anglo American.

But Henry faces challenges heading into 2023. With its investments in copper, BHP fortunes are closely tied to China’s economic growth, which is imperilled at the moment by Xi Jinping’s zero-Covid policy.

Aside from China, analysts at Bank of America recently identified a green economy dynamic that looks important for BHP and its investors.

Demand for copper has delinked from industrial production in recent years, BoA said in a November 24 report. This suggests global spending linked to net zero carbon emissions targets is driving demand for copper, which is heavily used in electrical infrastructure, the analysts suggested. “Spending on green technologies toward achieving net zero should structurally raise copper demand growth in the coming years,” they wrote.

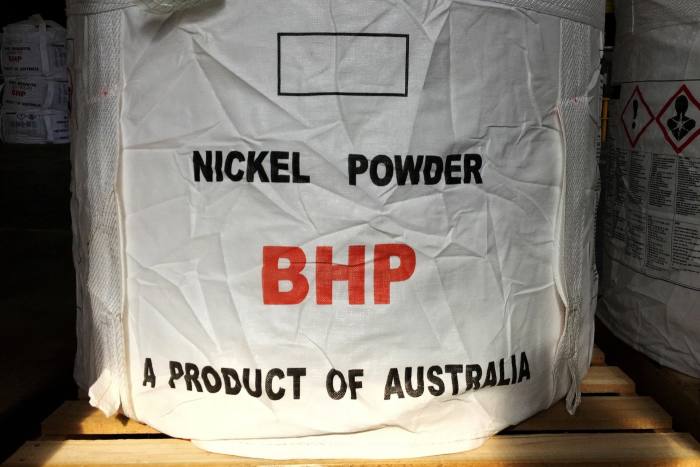

As demand rises for these metals, there will be particular opportunities for miners who can produce them with less impact on the environment. BHP’s nickel produced in Australia “is among the lowest carbon-intensity, class one nickel products globally”, Henry claimed. “In a world where you have the auto manufacturers and others looking increasingly at how they ensure that their supply chains are sustainable, I think that is a huge advantage for Australia that can be leveraged.”

The third leg in the commodity stool at BHP is potash, a key ingredient in fertilisers. Canada, where BHP has invested in potash, is the world’s biggest producer. The other top players — Russia and Belarus — are obviously unattractive markets at the moment. Finally, in iron ore, the raw material for steel, Henry rattled off a list of partnerships with steelmakers aimed at cutting the carbon emissions associated with their production. Among these is a tie-up with ArcelorMittal to develop a carbon capture and storage process for steel.

Henry said he was a proponent of strong ESG reporting — a concept that is being challenged in the US by Republicans who argue it “is a cancer”. But like many companies, BHP raised concerns earlier this year with a new proposal from the Securities and Exchange Commission, which would force companies to disclose data on climate-related risks and greenhouse gas emissions. When the SEC finalises this climate rule in 2023, it will be interesting to see whether BHP falls into line, or supports what could become a legal fight to kill off the new requirements.

Despite BHP’s reservations about the SEC draft, Henry insisted it was in favour of greater transparency and accountability in this space.

“Good ESG performance I think, over time will prove to be a competitive advantage for companies,” Henry said. “But for that to be the case, shareholders and other stakeholders need to understand how the company is actually performing — what are its policies and how is it performing against those policies. And that requires reporting and transparency.” (Patrick Temple-West and Gillian Tett)

Smart read

In just a few years, Hungary has transformed itself into a potential electric vehicles powerhouse, centred in Debrecen, a town in the eastern part of the country. By 2030, battery production in Debrecen — population 200,000 — alone will rival every European country other than Germany. Don’t miss our FT colleagues’ eye-opening Big Read on this topic.

Comments are closed, but trackbacks and pingbacks are open.