[ad_1]

This is the first part in a new FT series, Brexit: the next phase.

Almost two years after Britain left the EU, economists have reached a consensus: Brexit has significantly worsened the country’s economic performance.

They agree that the vote to leave the bloc has made households poorer, that negotiating uncertainties have taken their toll on business investment and that new barriers to trade have damaged economic links between the UK and EU.

While economists and officials do not agree on the precise magnitude of the Brexit effect, they consider it to be large. They also agree that new trade agreements with countries such as Australia and regulatory freedoms gained from leaving the bloc do not come close to offsetting the damage.

Andrew Bailey, Bank of England governor, told MPs this month that the central bank assumed that Brexit would cause “a long-run downshift in the level of productivity of a bit over 3 per cent” — most of which had already happened. “We have not changed our view on that so far,” he said.

The Office for Budget Responsibility, the fiscal watchdog, expects the UK economy to end up 4 per cent smaller than it would otherwise have been — a £100bn a year hit to prosperity — leaving the public finances less sustainable in part due to “a significant adverse impact on UK trade”.

Some former officials have gone further. “Put it this way, in 2016 the British economy was 90 per cent the size of Germany’s,” said Mark Carney, former BoE governor. “Now it is less than 70 per cent.”

The Canadian former governor has been widely criticised for his use of this statistic, with Jonathan Portes, professor of economics and public policy at King’s College London, saying the apparently dramatic contraction stemmed from currency movements, not Brexit. But Portes also acknowledged that there is no doubt that the negative effects of Brexit can be seen both in UK economic data and in-depth academic work.

Before the 2016 referendum, Brexiters such as Lord Daniel Hannan, an adviser to the Board of Trade, worried that having close trade ties with EU held back the UK economy. Britain was “shackled to a corpse”, he said.

But since the eve of the coronavirus pandemic, the UK’s economy has underperformed compared with every other G7 counterpart and it is the only one not to have recovered to its size in late 2019.

The OECD expects the UK’s performance over the next two years to be worse than any other advanced economy bar Russia.

Though these comparisons provide many headlines, academic economists worry that such summary statistics might be polluted by specific UK-related Covid-19 weakness or energy shock effects.

To identify specific Brexit economic impacts, they use various methods to build a so-called counterfactual — a simulated history of the UK if it had stayed in the EU — and then compare it with the reality of Britain’s economy after the Brexit referendum.

In two areas, there is now a clear consensus allowing them to say with certainty that the Brexit hit to UK prosperity was, as Swati Dhingra, an external member of the BoE’s Monetary Policy Committee, recently remarked, “undeniable”.

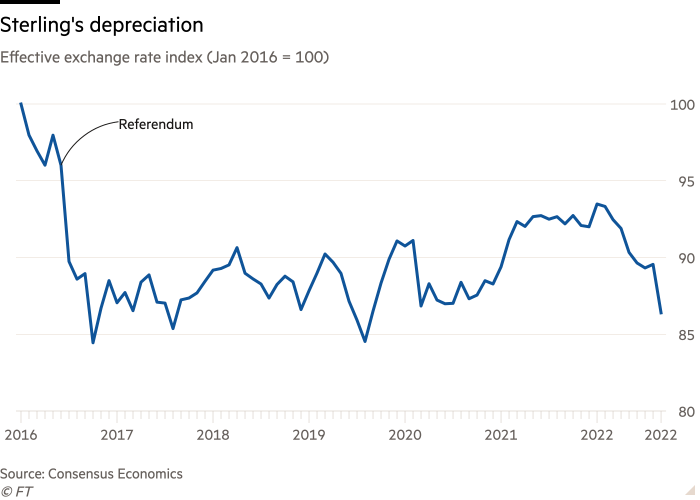

First, sterling depreciated more than 10 per cent after the Brexit vote in 2016 and has remained at this level ever since. This drop raised import prices, business costs and inflation, but failed to boost wages, exports or the competitiveness of the UK economy. The Resolution Foundation estimated that the depreciation raised import prices and overall inflation. It calculated that as a result real wages fell 2.9 per cent, costing households £870 every year on average.

The second clear effect has been on business investment, which has flatlined in real terms since after 2016 before falling during the pandemic.

Simon French, chief economist at Panmure Gordon, said that Brexit resulted in a rise in the cost of capital for UK companies as investors worried about diminished prospects of doing business in Britain. While he said other countries also saw weak business investment during the pandemic, the effect was much worse in the UK and looking at EU and US trends “suggests a material undershoot [of investment] of around £60bn a year”.

Most of the latest academic efforts have tried to quantify the trade impact of Boris Johnson’s Brexit deal, the Trade and Cooperation Agreement, which came into force at the start of 2021.

This work has been frustrated by statistical agencies in both the UK and EU changing the collection of import and export data and by disagreements on how best to identify a Brexit effect. But the results of studies now appearing suggest very large drops in trade between the UK and the EU, a decline in the variety of goods traded, a loss of trading relationships between companies and similar patterns in services.

“There is strong evidence the TCA has reduced the UK’s trade with the EU around 15 per cent so far,” said Thomas Sampson, associate professor at the London School of Economics. But he noted that the UK’s trade with the rest of the world had also decreased by similar amounts, leading him to be “not 100 per cent convinced we’ve seen a [Brexit] effect on exports so far”.

Other academics are less worried about the split between trade with the EU and the rest of the world, saying that there has been a definitive UK-specific drop in trade performance coinciding with Brexit.

Martina Lawless, a research professor in Ireland’s Economic and Social Research Institute, said Brexit had been “substantially negative” for the UK with her estimates showing declines in EU imports and exports of “close to 20 per cent”.

Almost every country except the UK saw a trade boom in 2021, she noted. “If something hadn’t happened in January 2021, UK trade should also have grown.”

The most sophisticated statistical modelling has been taking place at Aston Business School, where professor of economics Jun Du has found that imports to the UK from the EU have largely recovered. However, she estimates that exports to the bloc are now 26 per cent lower than they would have been without the new barriers to trade.

The effect of this can be seen most clearly in goods trade, such as food exports, where there are technical barriers and more stringent border checks. There has also been a large drop in the number of goods traded, with varieties dropping to 42,000 from 70,000 before the new rules came into effect.

According to Du, smaller companies have been hardest hit because the barriers are a more significant cost relative to the value of trade, which bodes ill for the future. “[Small companies are] not just unproductive firms, but also new firms — that’s why we are worried about future growth — when you lose that, your pipeline breaks,” she said.

“There is little dispute that trade has been damaged [by Brexit] big time,” she added.

Similar evidence is emerging in the services trade, economists said. Dhingra told MPs this month she could be even more certain there was a “stagnation” in exports because the trade data for the sector had not been distorted by changes in collection methodology in the way it had for goods trade.

So far, ministers have rejected the economic evidence. Jeremy Hunt, the chancellor, said last week that he did not accept the OBR’s estimate that Brexit had caused a 4 per cent hit to the UK economy.

“There are big opportunities for us to become much more wealthy than we would otherwise have been,” he added, citing regulatory freedoms and trade deals that could be struck with other countries.

The government has not quantified these potential gains, and where it has — such as for the Australia trade deal — they were estimated to be tiny, raising output by just 0.08 per cent.

Economists say this is scant compensation for the economic losses the country has suffered so far.

“We know now that Brexit has made UK households worse off by raising the cost of living and it has made life harder for UK firms [by increasing trade barriers], and this has made the UK poorer,” said Sampson.

[ad_2]

Source link