[ad_1]

The writer is chief economist for the Asia-Pacific at Natixis and senior research fellow at the Bruegel Institute

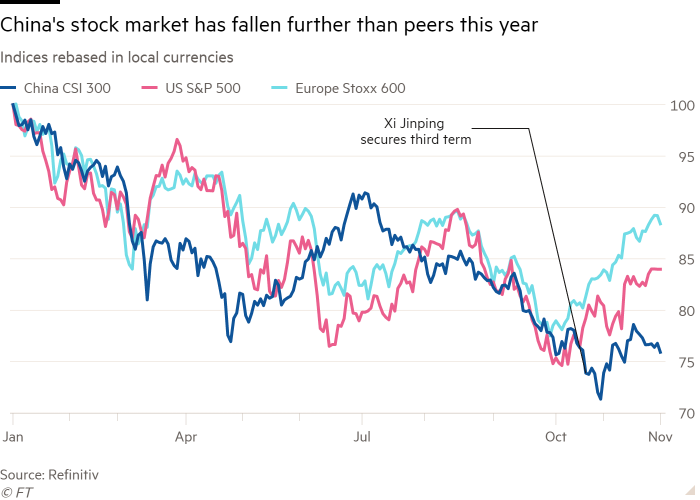

This year has not been easy for China or for investors in the country. It has been characterised by an underwhelming stock market, a weakening renminbi and capital outflows, especially from the fixed-income market.

Both trends, though, do not necessarily stand out in a global context. The hawkish turn by the US Federal Reserve on monetary policy has harmed stock markets around the world and virtually every currency has depreciated, except those tightly pegged to the dollar.

Still, things could have been different for China as they were in 2020 and early 2021, when the country was expected to be “first in, first out” with the Covid-19 pandemic.

With a large economic growth differential in China’s favour over the rest of the world, there was massive foreign direct investment into the country as well as a surge in portfolio flows. In fact, the foreign share in China’s bond and stock markets peaked at 3.5 per cent in mid-2021.

However, things started to change in late 2021, first with the default of China’s largest real estate developer, Evergrande, on its international debts and troubles at several of its industry peers. This was followed by the arrival of the Omicron variant of Covid in early January 2022 and the Chinese government’s decision to stick with zero-Covid policies even when faced with a much more contagious virus. This has led to a clear reduction in mobility and, thereby, economic activity in the course of 2022.

Since then, Chinese stock markets have underwhelmed and tumbled in late October after the Communist party congress confirmed Xi Jinping’s unprecedented third term as president. However, only a few days later, two important announcements were made to tackle China’s problems.

The first was the gradual lifting of zero-Covid policies, and the second was the People’s Bank of China’s 16 measures to support the real estate sector. Outright market euphoria followed, as if the path towards leaving with the virus was not only clear but also feasible and the government could shore up a moribund real estate sector just through financial support from banks with deep-pockets and by easing regulations.

Reality has struck back. Zero-Covid policies continue unabated, and more and more cities — accounting for about 20 per cent of China’s GDP by now, according to Nomura — are in lockdown. In the same vein, we are still to see a rebound in housing prices that would make the recovery of the real estate sector sustainable.

Now, protests are expanding across different cities and markets have reacted negatively. The question is what to expect next.

Starting with the positive scenario, these protests — which have been rather focused on Covid policies so far — could become the wake-up call needed for China to move ahead with lifting restrictions to deal with the virus.

However, it is one thing to want to open and a different thing to do so with a moderate cost to human lives. China’s vaccination rate for the elderly population remains stubbornly low. Less than 40 per cent of 80-year-olds and above are reported to have received a third dose of a Covid vaccine. Investors should watch for announcements on rapid — perhaps compulsory — vaccination for a constructive outlook for Chinese markets.

Instead, in the absence of a major vaccination campaign and the stubborn mantra of zero-Covid policies remaining in place, the protests are bound to expand, risking a harsh reaction from the government.

This will only worsen China’s economic scenario further as consumption and sentiment will remain repressed, with obvious negative consequences for investment. In addition, fiscal and monetary stimuli are much more constrained than in 2008, as local governments are experiencing a collapse in land sales and a massive increase in Covid-related expenditure, estimated at about 1.5 points of gross domestic product by Soochow Securities.

If the protests lead to a harsher regime, the lack of appetite of foreign investors would probably lead to more draconian capital controls and a weak renminbi. The US might also push more measures to limit technological transfers to China.

In addition, there is still the not insignificant tail risk of potential conflict in the Taiwan Strait. If political tensions rise in China, Xi might want to focus domestic attention on the one issue that unites much of the country — reunification with Taiwan.

All in all, we are bracing for a true rollercoaster as far as Chinese markets are concerned.

[ad_2]

Source link