[ad_1]

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

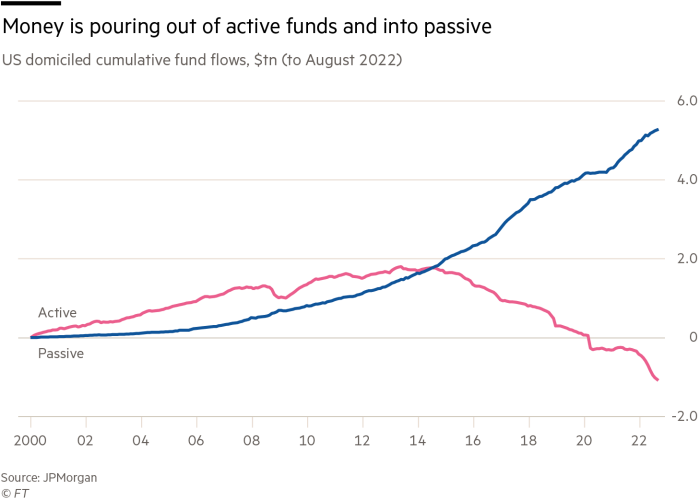

The shift from actively managed to passive index-tracking funds has accelerated this year, boosted by a jump in flows to bond and mixed-asset funds, research from JPMorgan shows.

The share of assets under management held in US-domiciled passive bond and hybrid funds — which invest in more than one asset class, for example, equity, fixed income and gold — rose from 23 per cent of all equivalent US fund assets at the end of 2019 to 28.5 per cent by August 2022, a rise of nearly 24 per cent.

“There is a secular move as a greater number of advisers use low-cost passive bond investments to replace their active bond managers,” said Peter Sleep, senior portfolio manager at 7 Investment Management.

Passive funds’ share of total US-domiciled equity fund assets under management passed the halfway mark at the beginning of the year, rising 13 per cent from a 46 per cent share at the end of 2019 to 52 per cent by August this year, JPMorgan found.

Sleep said that bond exchange traded funds were now catching up with their more broadly adopted equity ETF counterparts as the offering had broadened and become more cost competitive. The vast majority of ETFs are passively managed and follow an index.

The increase in flows to passive fixed income funds was all the more notable given the rapid and dramatic sell-off in bonds this year, Sleep said.

“But bonds now are at multiyear lows and investors can see value in areas like long-duration government bonds and corporate debt,” he added.

Jane Sloan, head of iShares and index investing Emea at BlackRock, pointed out that half of all inflows into global ETFs this year had been into bond ETFs, but she said the flows only told part of the story.

“Trading volumes in bond ETFs across the global industry are up 35 per cent since both 2020 and 2021, which indicates more people are using ETFs to trade bonds as they move within fixed income asset classes,” Sloan added.

For some investors there is a further incentive for exiting their actively managed fixed income fund — tax loss harvesting.

“Investors have losses to harvest in fixed income portfolios for the first time in many, many years. This is benefiting index ETFs as active mutual fund owners can sell their holdings at a loss to recognise a tax benefit, then rotate to ETFs to maintain their asset allocation,” said Drew Pettit, director of ETF analysis and strategy at Citi Research.

Data from EPFR indicate that the movement from active to passive funds is not just happening in the US but is a global phenomenon. Cumulative global fund flows for the year to mid-October show that passive equity and bond funds attracted $379bn and $178bn respectively, while active equity and bond funds bled $215bn and $442bn respectively.

“With so much value around it is quicker and easier for investors to capture the market returns through keenly priced tracker funds or ETFs than launch a search for an active manager. International ETF flow data for October 2022 showed that investors bought all sectors except inflation-protected bonds,” Sleep said.

Click here to visit the ETF Hub

[ad_2]

Source link