[ad_1]

Amundi, Europe’s largest fund manager, has caused ructions in the sector. It has declassified the majority of its $45bn of “really green” funds to “sort of green”. This highlights one of the complexities of ESG investing: it is not yet clear what counts as a sustainable place to put one’s money. There are other — more fundamental — concerns, too.

The EU’s approach to sustainable investing makes some sense. The energy transition is partly a challenge of financial plumbing. Regulators do not want fund management groups labelling their funds as sustainable if they are not. Germany’s DWS has faced accusations of such greenwashing this year.

Europe’s Sustainable Finance Disclosure Regulation (SFDR) and taxonomy define what should count as green and force funds to label themselves according to their underlying investments. These policies should enable investors to put their money to good use in a measurable way.

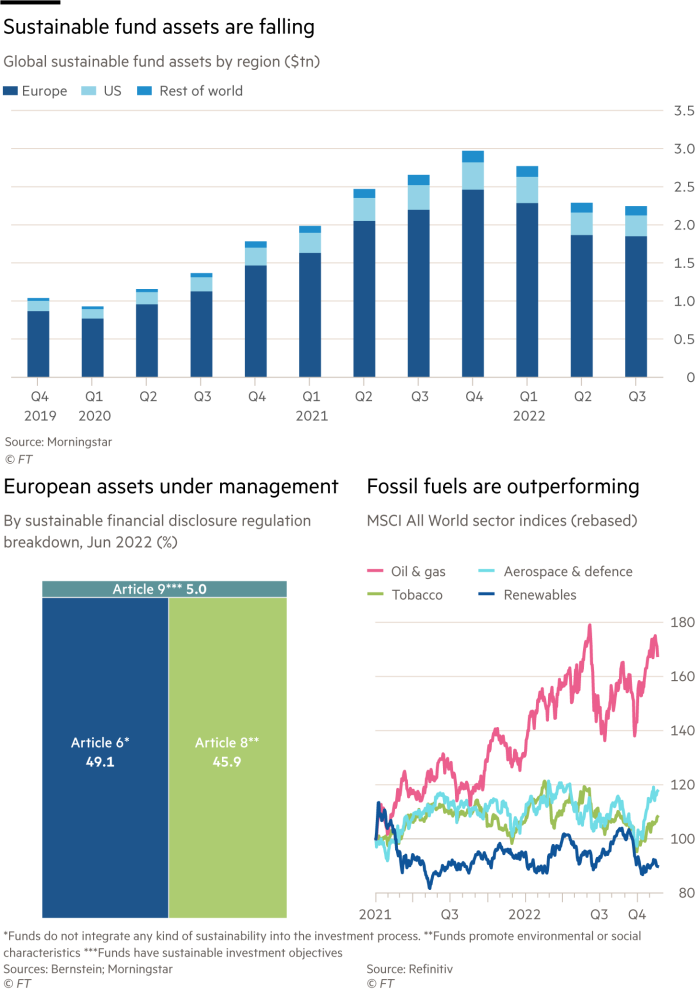

Some evidence of success exists. More than 50 per cent of European funds are labelled as article 8 (light green) or 9 (dark green). Yet evolving guidance means 380 products changed designation in the third quarter, according to Morningstar research. This is what Amundi and some of its peers have done, partly to avoid any legal challenges later.

But the real question for investors is: to what extent can ESG investments deliver higher risk-adjusted returns and help save the world in the process?

On the first point, ESG sectors should have a growth tailwind and lower risks. They will still suffer from economic cycles. Indeed, since the beginning of 2021, sectors frequently excluded from ESG funds — oil and gas, defence and tobacco — have outperformed the wider market and renewable electricity.

But there is also merit to ESG investing. Pouring money into renewable energy stocks should make it easier for these companies to speed up investment plans.

But it is not clear that a box-ticking approach will always be sensible. Some grey-hued companies may be in the process of turning themselves green. This, too, requires capital. Judging from the recent behaviour of some fund managers, that lighter green segment of the SFDR has plenty of potential.

Our popular newsletter for premium subscribers is published twice weekly. On Wednesday we analyse a hot topic from a world financial centre. On Friday we dissect the week’s big themes. Please sign up here.

[ad_2]

Source link