[ad_1]

Talk about a reversal of fortune.

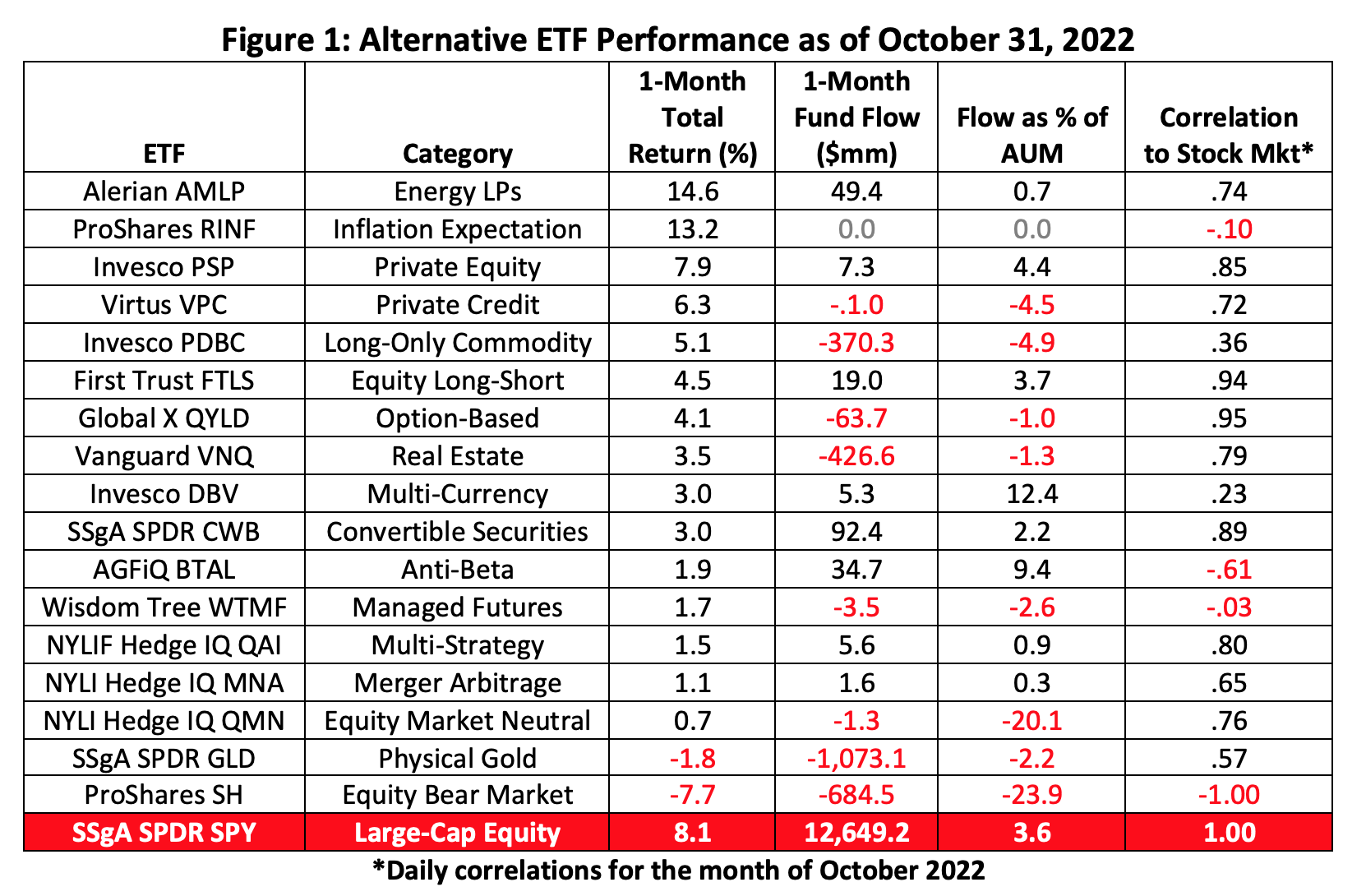

October’s roster of alternative ETFs looks pretty much like a mirror image of the previous month’s. In September, 93% of our alts funds were in the red. But by the time all the trick-or-treat loot was sorted in October, 88% of them were positive for the month.

Alt ETFs averaged a 3.7% gain in October, reversing September’s 3.9% mean loss. Only two portfolios bettered the 8.1% return of the SPDR S&P 500 Trust (SPY): the Alerian MLP ETF (AMLP) and the ProShares Inflation Expectations ETF (RINF).

If you’ve been following our reports on alt ETFs, you’ll note that the current table is stacked with more portfolios than before. In light of current market conditions and investment trends, three new categories—private equity, private credit and anti-beta—have been added.

We’ve profiled the AGFiQ US Market Neutral Anti-Beta Fund (BTAL) before. Invesco’s Global Listed Private Equity ETF (PSP) was highlighted back in 2007 as an easily accessible exposure for endowment-style investment portfolios. We haven’t looked under the hood of the 3-year-old Virtus Private Credit ETF (VPC) yet but now’s an especially good time to do so.

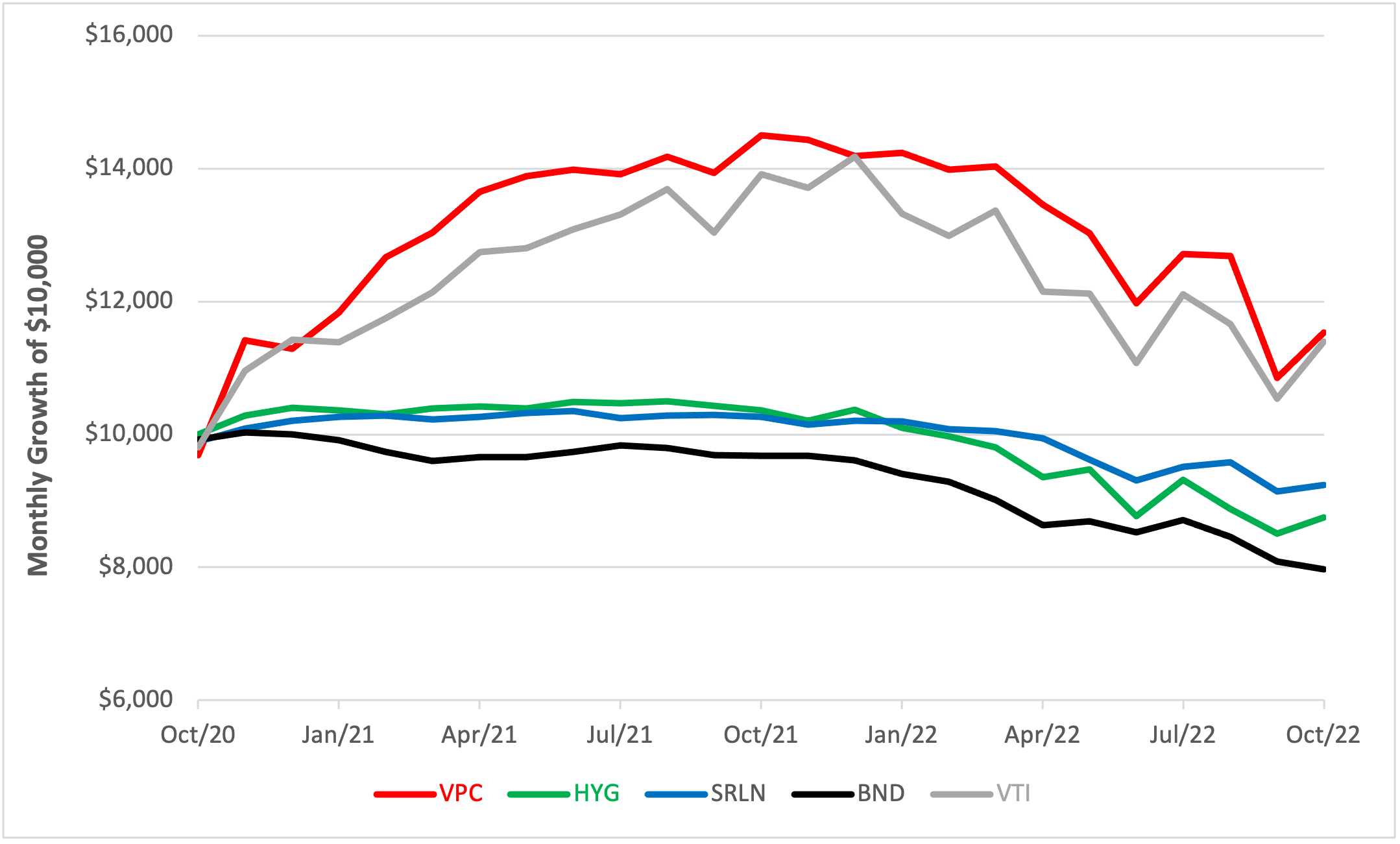

Why now? One need only to look at the recent value erosion in conventional credits to see why. Aggressive tightening by the Fed has broadly deflated the value of bonds and notes, increasing their correlations to equities and reducing their utility as portfolio diversifiers. The value of privately negotiated credits scribe a very different arc, however.

VPC is an income-focused fund of funds that invests in private credits through US-listed closed-end funds and business development companies. Its portfolio consists of loans made to middle-market firms with below-investment grade ratings.

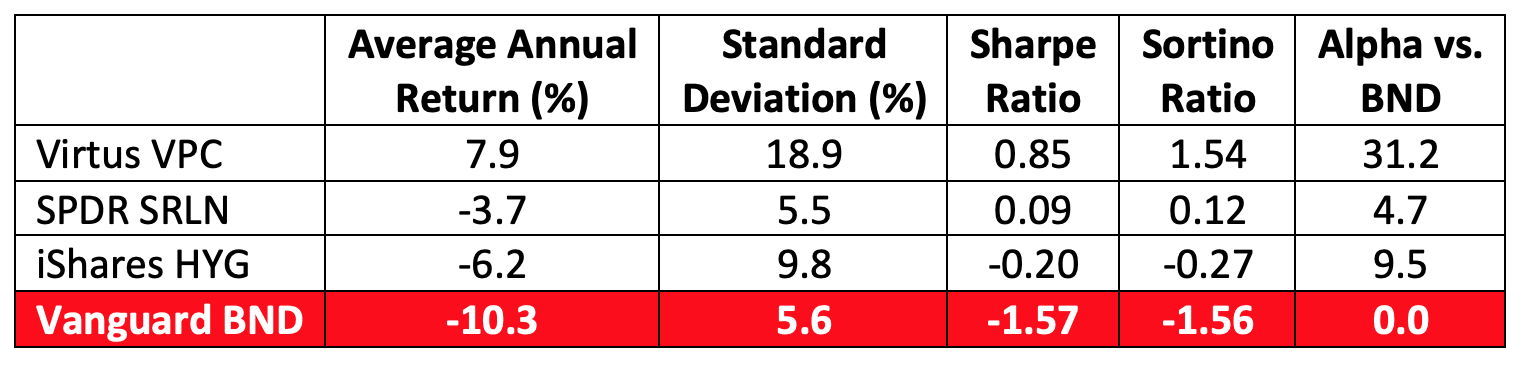

Over the past two years, VPC has outperformed other notable corporate debt ETFs because and despite of its relatively high volatility. The Virtus portfolio has spun off a 10.1% yield over the past 12 months with a duration of just 0.22 years.

VPC, like private credit in general, is gaining acceptance by advisors and investors seeking higher yields and better total returns.

Until VPC’s debut, investors hoping to snag higher yields than those offered by investment-grade securities often turned to the junk bond market. The iShares iBoxx USD High Yield Corporate Bond ETF (HYG) is the largest exchange traded fund tracking domestic high-yield securities. Though HYG’s portfolio consists of credits extended to lower-rated companies, they’re overwhelmingly fixed income notes which are very sensitive to interest rate risk. That’s reflected by the fund’s 4.09-year duration. HYG’s trailing 12-month yield is now 5.1%.

Investors concerned about rising rates are likely to consider a floating-rate debt allocation for their portfolios. Unlike HYG but similar to many of the loans in the VPC portfolio, the debt represented by the SPDR Blackstone Senior Loan ETF (SRLN) is floating rate. SRLN is an actively managed mix of senior secured loans made to non-investment-grade corporations. Over the past 12 months, SRLN’s 5.2% payout has been earned with a duration of 0.36 years.

Over the past two years, all three of the debt portfolios profiled outperformed the broad bond market proxied by the Vanguard Total Bond Market ETF (BND). The Virtus private credit portfolio has been the only one, however, to produce a positive return, even bettering the gains made by the Vanguard Total Stock Market ETF (VTI).

One can’t say for sure if VPC will continue its winning ways but its track record might very well prompt advisors and investors to look more closely at their fixed-income allocations. Perhaps some rejiggering may be in order.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.

[ad_2]

Source link