[ad_1]

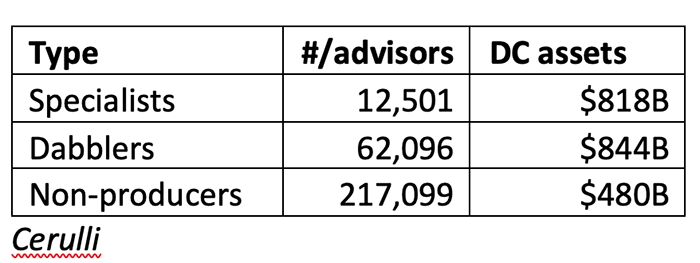

At a recent SPARK conference, a panel discussed what the defined contribution industry can do to entice the hundreds of thousands of wealth advisors that either dabble or stumble into a 401(k) or 403(b) plan but have no interest in specializing.

With the explosion of startup plans by smaller businesses because of state mandates, potential tax incentives, the growth of PEPs/MEPs/GOPs and the increasing importance of 401(k) plans that employees now expect, it only makes sense that wealth advisors who have relationships with the business owner or managers are best positioned to help.

But regulations, liability and potential fiduciary status cause broker/dealers to be extra cautious, making 401(k) plans complex. Startup and small plans with limited assets are not attractive to wealth advisors who may be asked to help people they really do not want to talk to. And beyond investments, few dabblers and blind squirrels know or want to know anything about ERISA.

The panel, moderated by Envestnet’s Sean Murray, included the heads of retirement at UBS and Raymond James as well as John Faustino from Fi360 and discussed ways to entice wealth advisors and remove hurdles. It struck me that fundamentally we are trying to make it easy for advisors to travel to a destination they really do not want to go to.

Most broker/dealers, have a huge incentive to try to engage wealth advisors in DC plans. UBS claims to have 50,000 wealth clients who control or influence a DC plan but manage none of them, which is typical. Envestnet, through its acquisition of 401kPlans and access to 110,000 advisors on its TAMP, is working with broker/dealers to streamline the onboarding of new plans offering 3(38) investment protection while others are offering 3(16) services either through a PEP or solo. Envestnet will be highlighting the wealth opportunities in plans that advisors might already manage through Yodlee and other technology to incentivize them to get more plans.

But let’s get real. Is this enough?

Will wealth advisors embrace 3(38) services? Investments are the only part of DC plans they are comfortable with. Adding 3(16) administrative fiduciary services increases costs to a low-margin business even within a PEP. Retirement plan advisors do not want referrals of small plans especially if they must share fees. Retirement desks at independent b/ds struggle to get adequate resources as 90% of the assets are held away with limited ability to track participant revenue.

I really hope I am wrong because the ideal situation would be to have these wealth advisors with relationships supporting clients’ 401(k) plans working with all participants leveraging AI, data and technology. Maybe younger advisors without established books will be interested, but then again they do not have the relationships yet.

More likely is that record-keepers, especially payrolls and others that can cross-sell wealth and benefits while keeping administrative and distribution costs low, will step in. Some of the fintech record-keepers, especially those that work with payroll companies like Guidelines and Human Interest, or those that support b/ds like Vestwell, are winning a lot of new plans, mostly startups. But there’s a reason they need hundreds of millions of venture capital and private equity investments to stay afloat.

Fundamentally it’s like offering me a weekend trip to downtown Newark, with all due respect to natives of there. I am sure Newark has many great featured attractions and I appreciate the efforts to make it easier to get there, but I am not sure what can be offered for me to leave Jupiter, Fla., especially in the winter.

Fred Barstein is founder and CEO of TRAU, TPSU and 401kTV.

[ad_2]

Source link