[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Chancellor Jeremy Hunt is planning a big package of spending cuts and tax increases in Thursday’s Autumn Statement after being warned that UK public borrowing would be about £70bn larger than expected.

The Office for Budget Responsibility estimates that a worse economic outlook will raise government borrowing close to £100bn in 2026-27, according to an ally of the chancellor. In its March forecasts the UK fiscal watchdog had calculated a budget deficit of just £31.6bn for that year.

Roughly half of the £70bn increase is caused by higher anticipated costs of servicing government debt, with the remainder coming from a weaker economic growth outlook hitting tax revenues and inflation raising the expense of welfare benefits and state pensions.

“We are going to see everyone paying more tax. We’re going to see spending cuts” — Jeremy Hunt

Prime Minister Rishi Sunak said the country would be punished by financial markets if it did not proceed with tax rises and spending cuts to fix public finances. Liz Truss’s disastrous “mini” Budget in September unleashed turmoil on the markets and culminated in her resignation as prime minister.

Here are five things to watch for in the Autumn Statement, from a miserable economic backdrop to Austerity 2.0.

Do you agree with plans for spending cuts and tax rises? How might you be affected? Let me know at firstft@ft.com. Thank you for reading FirstFT Europe/Africa. — Jennifer

Five more stories in the news

1. Crypto exchanges race to soothe nerves Digital assets exchanges are rushing to reassure clients that their funds are safe following the collapse of Sam Bankman-Fried’s FTX. Binance, the world’s biggest crypto trading venue, as well as smaller rivals Crypto.com, OKX and Deribit, have vowed to publish proof that they hold sufficient reserves to match their liabilities.

2. Northern Trust told to improve after pension turmoil UK regulators have ordered the US custody bank to improve its operating systems after it was overwhelmed from processing margin calls during the recent pension fund crisis, people familiar with the situation told the Financial Times.

3. EY timetable slips for partner votes on break-up plan Voting by the Big Four accounting firm’s UK and US partners on a radical break-up plan is set to be delayed to next year as its leaders try to hammer out legal documents governing how the split will work.

4. Ukraine minister warns state could seize more corporate assets Energy minister German Galushchenko has warned that Kyiv would take more companies under state control if they did not fully back the war effort after the government invoked the conflict against Russia to commandeer five industrial groups.

5. Six killed in Istanbul bomb attack The explosion ripped through one of the Turkish city’s busiest streets yesterday, killing six people and wounding 81 more. President Recep Tayyip Erdoğan suggested the blast might have been an act of terrorism.

The day ahead

Joe Biden and Xi Jinping meet The US president and his Chinese counterpart meet in person for the first time as leaders on the sidelines of the G20 summit in Bali, Indonesia. The high-stakes encounter is the most significant test yet of whether the two sides can reverse a dramatic decline in relations.

UK-France migration deal The two nations are set to unveil an expanded deal that will seek to curb the growing number of asylum seekers crossing the English Channel to Britain in small boats, as part of a renewed annual security pact, according to French diplomatic officials.

European manufacturing The latest test of eurozone factories’ resilience will come with the publication of industrial production data for September. Economists polled by Reuters expect output to be up 0.3 per cent from the previous month and 3 per cent from a year ago despite soaring costs. The UK also has its Rightmove house price index for October.

A day of anniversaries King Charles III turns 74. He will be honoured with a 41-gun salute and a rendition of “Happy Birthday” at Buckingham Palace’s changing of the guard. In other anniversaries, the BBC marks 100 years since its first daily radio service, and Scotland’s first minister Nicola Sturgeon completes eight years as leader of the Scottish National party. (BBC)

Elon Musk in court over Tesla pay The trial begins in Delaware’s chancery court over the billionaire’s $56bn remuneration at the electric carmaker. A shareholder has claimed that the amount paid to the chief executive is an excessive payout. (Reuters)

FT Schools is hosting a free economics webinar today with senior FT journalists and guests covering topics from green energy to government budgets and Brexit. See the full agenda here and sign up here to submit your questions to the panel.

What else we’re reading

Tories need to abandon their shibboleths The Conservatives have been in power in the UK since May 2010, and their record has been dreadful. This is partly because of adverse circumstances. But it is also because the party is in the thrall of an outmoded ideology, writes Martin Wolf.

Vladimir Putin to dominate G20 summit from afar Russia’s president won’t be attending the meeting, but that doesn’t mean he won’t feature heavily in its talks as a result of his war in Ukraine, which has sparked myriad global crises and divided the world’s largest economies. Here’s what is up for discussion.

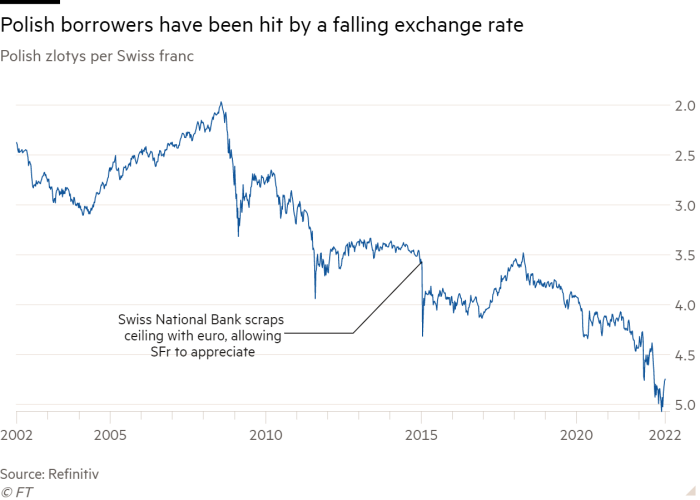

The mortgage time bomb ticking beneath Poland’s banks Hundreds of thousands of Polish homebuyers were advised to get mortgages in Swiss francs in the mid-aughts. Now, the legal fallout from that scheme threatens to push banks under — and rattle a fragile economy.

The creeping normalisation of the hard right Many mature democracies are experiencing the normalisation of the anti-liberal far right — and it’s not easy to combat. It is more fundamental than a struggle over political representation; it is also a struggle over the definition of normality, writes Timothy Garton Ash.

France to shake off World Cup holders’ curse of complacency There is what is known as the winner’s curse in football: four of the past five world champions have been knocked out of subsequent tournaments in the first round, including France in 2002. How can Les Bleus, with just one win in their past six matches, avoid that fate? Simon Kuper explores.

Film

Critics Danny Leigh and Leslie Felperin review last week’s six best cinema releases, including the return of Black Panther, the first since the death of Chadwick Boseman.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link