This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

New EU forecasts showed a sharp drop in German output would drag the bloc into recession this winter. Inflation will also be higher than originally forecast at 7 per cent for 2023, a slight improvement on the 9.3 per cent expected this year.

-

China eased coronavirus quarantine restrictions for close contacts and international travellers in the first signs of a softening of its zero-Covid strategy. The manufacturing hub Guangzhou however is on the brink of a citywide lockdown.

-

The crypto market faces a 2008-style financial crisis, according to the head of Binance, the world’s largest crypto exchange, a point echoed by US editor-at-large Gillian Tett. Binance’s rival FTX, previously valued $32bn, has filed for bankruptcy.

For up-to-the-minute news updates, visit our live blog

Good evening.

“I am under no illusion that there is a tough road ahead.”

That was the reaction of chancellor Jeremy Hunt to news this morning that the UK economy had shrunk more than expected, highlighting the challenge he faces ahead of his landmark statement on the public finances of a nation teetering on the edge of recession.

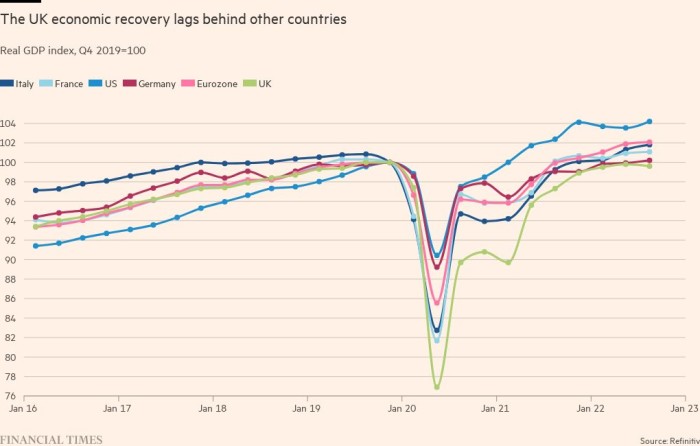

GDP fell 0.6 per cent between August and September, while output dropped 0.2 per cent between the second and third quarter, the first three-monthly decline since February 2020. This leaves the UK economy, unlike its peers, smaller than before the pandemic.

The Bank of England has already forecast that the third quarter would be the start of a long recession thanks to tighter financial conditions and the squeeze on household budgets from surging prices.

There are also ominous signs in the labour market, an area where the government has been keen to trumpet its success. New analysis suggests the UK will be the only developed economy with employment still below pre-pandemic levels at the start of 2023. A new “winter of discontent” is also looming as more public sector workers — nurses are the latest — demand pay rises in line with inflation.

Hunt meanwhile is casting around for ways of filling the £55bn budgetary hole as he prepares for his big moment on November 17 in what could be, as former top government official Nicholas Macpherson sees it, a return to Treasury orthodoxy.

About half is set to be filled by spending cuts, ushering in what former Bank of England official Charlie Bean dubbed “Austerity 2.0”. Other potential measures include a delay in social care reforms, a freeze in income tax thresholds and a stealth raid on inheritance tax. (And if you think you could balance the books yourself, have a go at our “fill the black hole” interactive.)

Ultimately, says economics editor Chris Giles, Hunt has to choose between politics and economics.

Immediate tax rises and spending cuts may put the country’s finances in better position later this decade, but that’s when the opposition Labour party is likely to be in power. Deferring action could minimise the immediate pain and mean Labour inherits weak public finances, but runs the risk of falling foul of financial markets. And, as recent history shows us, that is not a good position to be in.

FT Schools is hosting a free economics webinar on Monday with senior FT journalists and guests covering topics from green energy to government budgets and Brexit. See the full agenda here and sign up here to submit your questions to the panel.

Need to know: UK and Europe economy

UK targets for housing suffered a new blow as developers warned demand had dropped as much as 50 per cent as higher mortgage rates kick in. The trend is also clear from the latest survey on new buyer inquiries from the Royal Institution of Chartered Surveyors.

The UK has frozen more than £18bn in assets as part of sanctions against Russia, according to new data. Since Russia’s full-blown invasion of Ukraine in February, it has hit 120 Russian entities and more than 1,200 individuals linked to the Kremlin.

EU leaders promised to outline measures to set a limit on gas prices on November 24 but several member states declared their impatience with the commission’s efforts.

Need to know: Global economy

US consumer price inflation slowed from an annual 8.2 per cent to a better than expected 7.7 per cent in October, the lowest level since January. Core CPI, which excludes volatile food and energy, also slowed, hitting an annual rate of 6.3 per cent. US stocks and government bonds rallied on the news as investors bet the Federal Reserve would slow the pace of rate rises.

US business leaders celebrated what looks like a split Congress after the midterm elections, arguing that a divided government prevents either party from doing anything too extreme. Catch up on the latest results with our election tracker.

Unless Africa gets support to rebuild its food and water systems to cope with climate shocks, a humanitarian catastrophe will follow, warns Michelle Williams, an academic at Harvard. Encouraging innovation from African scientists, engineers, farmers, financiers, entrepreneurs and political leaders is key, she argues.

The G20 group of nations meets next week in Bali, an occasion FT commentator Gideon Rachman calls the “first global summit of the second cold war”. The meeting will be the first face-to-face as leaders between Joe Biden and Xi Jinping and will also feature a rare appearance on the world stage for host nation Indonesia’s president Joko Widodo.

Need to know: business

SMIC, China’s largest chipmaker, said US sanctions had hit output. Germany blocked another Chinese purchase of a semiconductor company, highlighting concerns over security and supply chains.

Apple iPhone maker Foxconn said it would keep expanding in China despite the hit to revenues from Covid restrictions. China is still trying to court global companies, as evidenced at the Shanghai trade fair.

Daimler Truck, the world’s largest truckmaker, warned the global supply chain was “broken” even as it reported a 27 per cent jump in third-quarter sales to €13.5bn. Electric carmaker Polestar echoed the supply chain message.

An official report showed many UK companies took Covid support funds from the government even though they could have accessed finance elsewhere.

Science round up

Pressure is mounting for political solutions to the climate crisis as new data highlight the impact from extreme heat on developing countries. India’s workers, students and business owners have given FT film makers a first-hand account of how extreme heat affects working conditions.

Global carbon emissions will hit a record high this year, despite a slowdown in China, thanks to an increase in coal use and a pick-up in economic activity after the worst of the coronavirus pandemic.

The promise of nuclear fusion for “unlimited clean energy” is moving from fantasy to reality.

Gene-edited crops aka “frankenfoods” could be a fix for climate change, thanks to their increased resistance to extreme heat and drought. Our Big Read examines proposals for lighter regulation from the EU.

Moderna ended its truce on enforcing patents against its vaccine rivals, setting up a fight over mRNA technology. The decline in Covid infections has gathered pace across the UK.

What makes our cells tick? Read our review of Siddhartha Mukherjee’s new book on the science of the body: The Song of the Cell.

Covid cases and vaccinations

Total global cases: 627.3mn

Total doses given: 12.9bn

Get the latest worldwide picture with our vaccine tracker

In Wednesday’s DT we inadvertently referred to a potential “blue wave” of Republican support in the midterm elections, which as our US readers will know, should of course have been “red wave”. We apologise for the error.

Some good news

A new ranking of the world’s best female scientists hopes to promote women’s achievements while bringing more attention to gender bias in the science community. Imed Bourchrik, the co-founder of Research.com, told DT: “We hope it will contribute to providing more opportunities and equal chances for women in science.”

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

Comments are closed, but trackbacks and pingbacks are open.