[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

The rapid rise in US consumer prices showed no signs of abating in September, prompting a see-saw trading session on Wall Street, as investors weighed whether the Federal Reserve would have to become even more aggressive to slow rampant inflation.

The consumer price index’s core measure of inflation, which strips out volatile energy and food costs, rose 6.6 per cent on an annual basis last month, faster than the 6.3 per cent rate in August — and its fastest pace in four decades — suggesting underlying inflationary pressures are still accelerating.

The increase in the overall CPI last month, including energy and food, rose 8.2 per cent over a year earlier, little changed from the 8.3 per cent annual rise recorded in August.

Investors and economists had been looking for signs that the Fed might start to slow the pace of its interest rate rises. But the CPI data released yesterday suggest such a move is not yet on the immediate horizon.

Economists say it is also likely to push the US central bank to continue its supersized rate rises beyond its upcoming policy meeting in early November and at least until there is more clear-cut evidence that price pressures are easing.

Thanks for reading FirstFT Americas. Here is the rest of today’s news — Abby

Five more stories in the news

1. Kwasi Kwarteng leaves Washington early to address UK economic crisis The UK chancellor left IMF meetings last night for London as Prime Minister Liz Truss came under increasing pressure to rip up the government’s “mini” budget. Expectations are mounting in London and in financial markets that Kwarteng will imminently announce a U-turn on the £43bn package of unfunded tax cuts.

-

Delays at US custody bank exacerbated UK pension sell-off Custody lender Northern Trust was overwhelmed by margin calls during the gilt market turmoil, hampering pension funds’ ability to raise cash, according to people involved in the trades.

2. January 6 committee votes to subpoena Donald Trump The congressional committee investigating last year’s attack on the US Capitol has voted unanimously to issue a subpoena to former president Donald Trump. The vote is only the seventh time in history Congress has issued a subpoena to a sitting or former president, according to legal historians.

3. US dismisses Saudi defence of Opec oil output cuts as ‘spin’ The White House on Thursday dismissed Saudi Arabia’s claims that recent Opec+ production cuts were unrelated to the kingdom’s stance on Russia’s invasion of Ukraine and had been the result of a unanimous decision by the cartel’s members. “The Saudi foreign ministry can try to spin or deflect, but the facts are simple,” said John Kirby, a top spokesperson for the US National Security Council.

4. World’s top chip equipment suppliers halt business with China Leading chip equipment suppliers have suspended sales to semiconductor manufacturers in China, as new US export controls disrupt the Chinese tech industry. Lam Research, Applied Materials and KLA Corporation have all taken immediate measures to comply with rules banning the export to China of US semiconductor equipment that cannot be provided by any foreign competitor.

5. Twitter says Elon Musk being investigated by US authorities Musk is under investigation by US authorities for “his conduct in connection with the acquisition” of the social media company, Twitter has said. Twitter’s lawyers said they had demanded copies of “substantive correspondence” between Musk and federal authorities over the alleged investigation “months ago”, but his team failed to produce them.

The days ahead

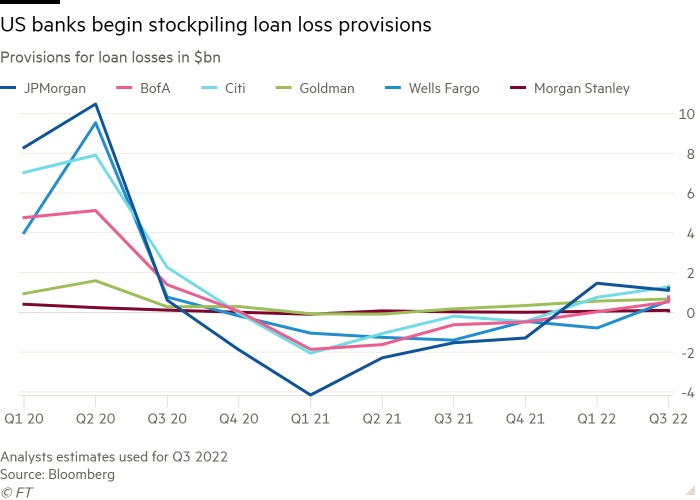

Bank earnings JPMorgan, Morgan Stanley, Citigroup and Wells Fargo will report earnings before the opening bell. The biggest US banks are expected to have collectively set aside about $4.5bn in the third quarter to cover potential bad loans in a sign that they are worried about the US economy.

Retail sales US retail sales — including fuel, autos and food spending — are expected to have continued a rebound in September despite sharply rising inflation, though at a slower rate than the previous month. Economists polled by Refinitiv have forecast a 0.2 per cent increase last month compared with August. When stripping out autos, however, retail sales are expected to have declined by 0.1 per cent.

Consumer sentiment Consumer sentiment, a leading economic indicator, is expected to have improved slightly in the first half of October as the Federal Reserve has continued aggressively raising interest rates to combat elevated, lingering inflation. Analysts expect a preliminary reading of the University of Michigan consumer sentiment index to rise to 59 for October, up from 58.6 in September.

Fedspeak Kansas City Fed president Esther George will discuss the forward view on inflation and the Fed’s rate hikes at a virtual S&P Global leveraged finance chat series. Fed governor Lisa Cook will participate in a separate fireside chat before the National Bankers’ Association, discussing the US economy, minority depository institutions and wealth creation. Christopher Waller, another Fed governor, will speak about central bank digital currency at a Harvard Law School symposium on digital currencies and national security trade-offs.

What else we’re reading

Housing shortage risks breaking the American dream Rising interest rates are making housing in the US even less affordable. For young buyers a broken market that is stopping them getting on to the housing ladder is a leading indicator for a broken American dream of living a better life than the previous generation, writes the FT editorial board.

The metaverse revolution may yet devour Meta Mark Zuckerberg is so in love with the promise of the metaverse that he rebranded his company and bet his business on the idea. But it is still not clear that ordinary people know what it means, and there are good reasons for doubting that Meta will ever “own” the metaverse, writes John Thornhill.

Qatar counts down to World Cup In just over a month, Qatar will host the most prestigious event in international football. But the Gulf nation is not known for its tourist attractions, and accommodation and leisure amenities are seen as a particular weakness. Can the wealthy gas nation deliver?

Tragic fallout from the politicisation of science in the US Anti-vaccine attitudes are hardly the sole preserve of the American right, but the breadth and depth of politicisation and polarisation in the US far outstrip what we see anywhere else in the developed world, writes John Burn-Murdoch.

China’s 20th Communist party congress The party’s 20th congress, which opens in Beijing on Sunday, will unveil a new leadership set to again be headed by Xi Jinping. In doing so, the congress will bring down the curtain on a two-decade period defined by predictable and orderly transitions from one party leader to another. What can we expect from the party congress?

Life & Arts

Harvard law professor and conservative scholar Adrian Vermeule’s far-reaching ideas illuminate a growing rift on the right about how to wield power.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link