[ad_1]

Sponsored by

Although advisors may encourage clients to make the transition to model portfolios for these reasons, it’s not necessarily a straightforward task. One primary hurdle to transitioning clients to model portfolios is taxes, particularly in cases where clients need to transition assets from taxable accounts in which they have significant capital gains. Clients often do not want to absorb the sizeable tax bill that comes with making such a transition.*

Model portfolios gaining popularity

About $315 billion in assets followed model portfolios as of June 30, 2021. It is a “conservative estimate” after the number of reported model portfolios more than doubled from the previous year, according to a 2021 Morningstar study.**

It’s hard to track model portfolios, but with more than 2,100 model portfolios reported in the market to Morningstar, it shows that advisors already have access to model portfolios and are trying to make use of them.

Model portfolios are growing in popularity because they are professionally designed and managed. By outsourcing some management functions to a model portfolio, advisors can devote more attention to client conversations.

To transition or not?

At face value, transitions may appear to be an all-or-nothing decision at one point in time for clients. An advisor introduces the model portfolio, and the client either agrees or disagrees with the proposal.

If the client disagrees, we’ve found it’s often because the client either can’t or doesn’t want to handle the increased taxes it’d cost to make the change. Other times, it could be because the client wants to continue holding a security that isn’t in the proposed model.

Whatever the reason, for the advisor and for the client, there doesn’t seem at first to be many options.

Doing the math

In a technologically advanced world, there is a way today for the advisors to create more options.

For example, maybe a client is willing to pay some taxes now to transition to an advisor’s model portfolio, and open to paying more in the future to continue transitioning into the model portfolio.

What would that cost?

Taxes are among the most operationally challenging variables to address in clients’ portfolios. We’ll show you a simple way to go about the calculations with technology, through a hypothetical example.

Creating more choices for clients

One day, a prospect, Alfred Baker meets with an advisor.

Alfred’s current portfolio has concentrated stock positions that led him to deviate significantly from his stated risk appetite. The advisor hopes to win Alfred’s account by optimizing $3 million of allocations closer to a target model portfolio that aligns with his risk profile and goals.

But there’s an obstacle.

Alfred doesn’t want to liquidate the portfolio and move to the proposed model. If he did that, it would increase his short-term taxes. He’s sensitive to any short-term taxes. Plus, Alfred is a stock picker who has embedded taxable gains in his investments.

What would you do if you were the advisor? If you want to show Alfred it doesn’t have to be an all-or-nothing decision, you can use technology to calculate the tradeoffs. Alfred can decide how close to the model portfolio he wants to get and see how much it’d cost in taxes to get there.

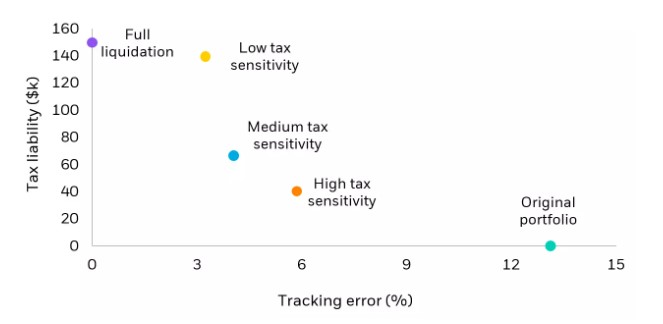

In the chart below, we visually represented the results.

Balancing the tradeoffs between taxes and tracking error

For illustrative purposes only. Based on data from BlackRock Aladdin, 2022.

Mapping a client course

As shown above, Alfred doesn’t have to fully liquidate or stay with his original portfolio. He has alternate paths for getting closer to the target portfolio – without having to stomach all the short-term taxes.

Understanding the tax tradeoffs can help lower the barriers for clients who are hesitant about making the transition to model portfolios. Even at a high tax sensitivity, as represented by the orange dot, the technology showed that the existing tracking error can be reduced by almost half while only incurring a fraction of the potential tax amount.

If you were the advisor, imagine the difference in conversation between an all-or-nothing approach compared to one with optionality. Which presentation would be more likely to convince Alfred to work with you?

Let’s say you present Alfred with the above choices. He decides to take the medium tax sensitivity path. You’ve now gained a new client and can help Alfred start the process of getting closer to the model portfolio.

Ongoing monitoring

Technology can also enable advisors to scale this for multiple clients. Advisors can monitor investments for clients on an ongoing basis, or over a specific time span.

Advisors can use this to continue determining how clients may further reduce tracking error as other opportunities arise, such as for tax-loss harvesting.

The challenging topic of taxes can become more digestible with technology, timely support for advisors as model portfolios continue to grow in popularity.

Aladdin Wealth™ as a compass

Using technology to help with tax management can enable advisors to personalize preferences that are specific to each client. On the Aladdin Wealth™ platform, advisors can optimize portfolios and calculate potential tax implications based on “tax-sensitivity” levels ranging from moderate to very high.

Advisors can also estimate tracking error to propose trades that can balance a client’s tax costs with portfolio risk, all while streamlining ongoing portfolio management processes. The platform provides more options for transitioning to model portfolios, so advisors don’t have to set out on new paths for clients without any help.

© 2022 BlackRock, Inc. All rights reserved.

* Yacik, George. “Model Portfolios Haven’t Reached Full Potential Yet.” Financial Advisor Magazine, Charter Financial Publishing Network, May 1, 2020.

** 2021 Model Portfolio Landscape, Morningstar, September 2021.

This material is provided for informational purposes only and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change at any time without notice. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Performance and risk calculations, including those incorporated into Aladdin Wealth technology, are based on assumptions, historical correlations, and other factors (such as inputs provided by the Aladdin Wealth users) and are not assured to predict future results. All graphs and screenshots are for illustrative purposes only. BlackRock’s Aladdin Wealth platform is a financial technology platform designed for institutional, wholesale, qualified, and professional investor/client use only and is not intended for end investor use. Aladdin Wealth users undertake sole responsibility and liability for investment or other decisions related to the technology’s calculations and for compliance with applicable laws and regulations. The technology should not be viewed or construed by any Aladdin Wealth users, or their customers or clients, as providing investment advice or investment recommendations to any parties. This material should not be construed as a representation or guarantee that use of Aladdin Wealth technology will satisfy your legal or regulatory obligations. BlackRock, as provider of the technology, does not assume any responsibility or liability for your compliance with applicable regulations or laws. For additional information on any of the descriptions contained herein, please contact your Aladdin Wealth Relationship Management representative. BlackRock may modify or discontinue any functionality or service component described herein at any time without prior advance notice to you.

In the U.S. and Canada, this material is intended for public distribution. In the UK, this material is for professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. In the EEA, this material is for professional clients, professional investors, qualified clients and qualified investors. For qualified investors in Switzerland: This information is marketing material. This material shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services (“FinSA”). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa. In Singapore, this advertisement or publication is intended for public distribution and has not been reviewed by the Monetary Authority of Singapore. In Hong Kong, this material is intended for public distribution. The technology and the material have not been reviewed by the Securities and Futures Commission of Hong Kong. In Japan, this is for Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975 AFSL 230 523 (BIMAL). The material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. In Brunei, Indonesia, Philippines and Malaysia, this material is issued for Institutional Investors only. In Latin America, for institutional investors and financial intermediaries only (not for public distribution). No securities regulator within Latin America has confirmed the accuracy of any information contained herein. Please note that IN MEXICO, the provision of investment management and investment advisory services (“Investment Services”) is a regulated activity, subject to strict rules, and performed under the supervision of the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, the “CNBV”). BlackRock does not provide, and it shall not be deemed that it provides through Aladdin Wealth technology, any personalized investment advice to the recipient of this document, by reason of its use or otherwise. These materials are shared for information purposes only, do not constitute investment advice, and are being shared in the understanding that the addressee is an Institutional or Qualified investor as defined under Mexican Securities (Ley del Mercado de Valores). Each potential investor shall make its own investment decision based on their own analysis of the available information. Please note that by receiving these materials, it shall be construed as a representation by the receiver that it is an Institutional or Qualified investor as defined under Mexican law. BlackRock México Operadora, S.A. de C.V., Sociedad Operadora de Fondos de Inversión (“BlackRock México Operadora”) is a Mexican subsidiary of BlackRock, Inc., authorized by the CNBV as a Mutual Fund Manager (Operadora de Fondos), and as such, authorized to manage Mexican mutual funds, ETFs and provide Investment Services. For more information on the Investment Services offered by BlackRock Mexico, please review our Investment Services Guide available in www.blackrock.com/mx.

©2022 BlackRock, Inc. All rights reserved. BLACKROCK and ALADDIN WEALTH are trademarks of BlackRock, Inc., or its subsidiaries. All other marks are the property of their respective owner.

[ad_2]

Source link