[ad_1]

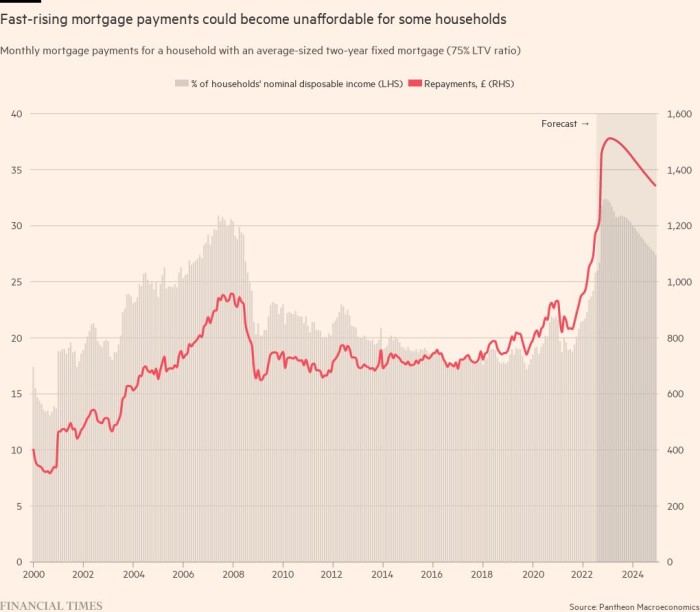

A decade-long party for homeowners is coming to an end. The cost of servicing mortgages in the UK, Europe and the US has spiralled at the same time as disposable incomes have been squeezed, and predictions of a downturn or even a house price crash are now common.

Last week, Knight Frank forecast that house prices in London would fall 10 per cent over the next two years — a highly unusual move for an estate agency, which adds to independent analysis and bank predictions of falls at least that across the UK.

How could housing markets, which have felt nothing but price growth for a decade, tip into crash territory?

The financial crisis in 2008 offered a chastening lesson in the dangers of borrowing excessively against housing.

Back then about one in seven mortgages were highly leveraged with loan to value ratios equal to, or greater than, 90 per cent. In the years since, banks have tightened their lending criteria with only 4 per cent having the same borrowing levels.

Today’s borrowers must raise relatively large deposits and demonstrate they can withstand interest rate rises. Reckless lending has largely been kept in check, reducing the danger of homeowners slipping into negative equity.

The other key feature of the past decade has been rock-bottom interest rates — allowing buyers to take on large mortgages at low monthly costs.

In turn, anyone able to build up a deposit could afford a pricier property — betting on repaying it as long as rates remained low and the mortgage term was long enough. Low rates have in effect made larger homes affordable, driving up house prices in return and crowding out those unable to raise cash for a deposit or tap the “bank of mum and dad”.

But rates have spiked higher this year — with the Federal Reserve raising the base rate from 0.25 per cent to 3.25 per cent and the Bank of England and ECB following suit — and markets are expecting they will continue to rise sharply into next year as central banks try to contain runaway inflation.

Suddenly, that affordability picture has changed dramatically.

“Only 2-3 months ago we were saying interest rates [in the UK] of up to 3 per cent would be a challenge, given affordability. Markets are now anticipating mortgage rates going up to around 6 per cent,” said Noble Francis, economics director of the Construction Products Association.

Rising interest rates have had an immediate impact. Mortgage lenders in the UK rushed to pull products after chancellor Kwasi Kwarteng’s tax-cutting “mini” Budget last month drove up expectations of a rate rise.

Anyone buying a house today in the UK will face far higher mortgage borrowing costs as a result. Mortgage payments, as proportion of income for first time buyers, are roughly 17 per cent on average, according to data from consultancy BuiltPlace.

However, it’s not just those at the start of property ownership. There is also an effect that will be felt more gradually. Each month, tens or hundreds of thousands of homeowners in the UK roll off fixed-term deals and have to remortgage. When they do they will face costs that are far higher than what they currently pay — and some may be pushed to sell.

“In a period of time where the majority of people are likely to endure real wage falls, it’s a perfect storm for homeowners who have purchased in the last 10 years and are not used to high mortgage rates,” said Francis.

There are signs that higher borrowing costs are already impacting demand for new homes, with property portal Rightmove reporting that activity from prospective buyers was down last week on recent averages — albeit modestly.

Ebbing demand will reduce transactions in the UK from an already-low base by historical standards. Lower demand typically puts a lid on house price growth and a paucity of transactions means data can be skewed by a limited number of deals.

“Clearly what you’re going to see is a much lower transactions housing market dominated by needs-based movers and the cash rich,” said Lucian Cook, head of UK residential research at estate agent Savills.

In the US, there is already evidence of heat coming out of the sales market, with transaction volumes falling across several large cities.

FT analysis of data provided by real estate company Zillow to the end of July 2022, shows that month-on-month growth in home sales in the US has fallen from 4.4 per cent at the height of post-pandemic rebound during the middle of 2021, to a low of -2.2 per cent on a 12-month rolling basis.

Outside of necessity — death, debt and divorce are frequently cited as the three biggest drivers of sales by estate agents — there is little incentive to sell in a down-market. But higher costs for remortgaging could put pressure on some homeowners to trade at a discount, dragging down average prices that are set by recorded transactions.

Dwindling sales numbers, stretched affordability and pressure on remortgaging homeowners could precipitate painful price corrections in the UK, US and elsewhere.

In the aftermath of Kwarteng’s budget, multiple forecasts now have average UK house prices falling more than 10 per cent on a nominal basis over the next two years. Thanks to the run-up in prices during the pandemic, even a fall that steep would only push prices back to levels recorded in May 2021.

But the consequences could nonetheless be dire, particularly for recent buyers. Because inflation is running at such high levels in the US and Europe, a 10 fall in nominal prices would represent a real terms drop of closer to 25 per cent — a larger fall than the painful correction that followed the financial crisis.

Data visualisation by Steven Bernard and Patrick Mathurin

[ad_2]

Source link