[ad_1]

One scoop to start: Chinese fast-fashion retailer Shein has shed up to one-third of its value in private markets in recent months after reaching a valuation of more than $100bn earlier this year, said people briefed about the matter.

Coming up next week: Due Diligence Live. We can’t wait to see you in-person on October 12 in London. Get your in-person pass here or if you can’t make it, DD readers can register for a complimentary digital pass here.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

-

Crunching the numbers at Twitter

-

Goldman finds an angle on the UK pensions mess

-

A Chinese EV battery maker tries to leave the past behind

Twitter: the hidden upside for Elon Musk

To hedge funds betting Elon Musk will complete his $44bn purchase of Twitter, much of the trade’s attractiveness boils down to Musk spending less of his net worth for the social media company than what it costs an ordinary person to buy a house.

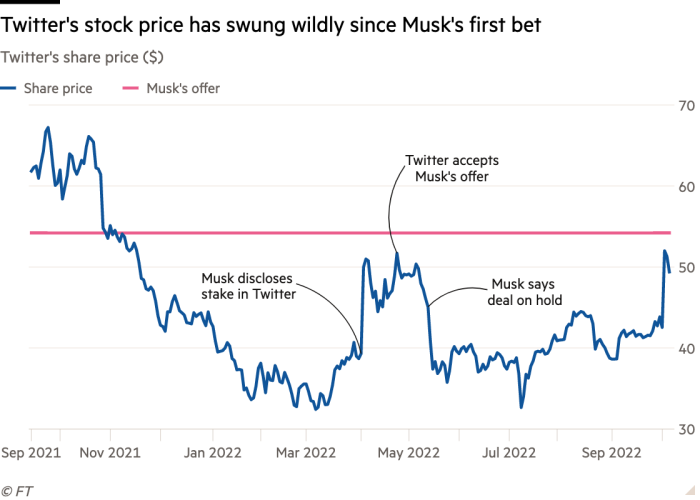

Thinking of Twitter as a home purchase is a good way to understand why Musk surprised the social media company this week by moving forward with his originally agreed $54.20 purchase price, after spending months trying to back out of the deal.

Musk is badly underwater on his purchase of Twitter. Due to surging interest rates in recent months, however, he’s in the money on the $13bn financing package he received when the takeover was agreed in April, report DD’s Eric Platt, Antoine Gara and James Fontanella-Khan.

“The financing package, if it comes through, is very valuable to Elon Musk,” said David Allen, chief investment officer at AlbaCore Capital Group.

If Musk were to try to recut his purchase price, it would give banks the opportunity to force him to raise a new financing package at today’s much higher interest rates.

Allen estimates that the net present value of the financing is worth billions of dollars to Musk, mitigating some of the perceived erosion of Twitter’s overall equity value since this spring, which some analysts estimate could be $20bn.

The bank syndicate, led by Morgan Stanley, stands to lose over $500mn on the financing, said sources familiar with the situation, with some cautioning the figure could be higher.

Like a real estate buyer who recently bought property with a rate locked in this spring, Musk may have overpaid, but the debt is relatively cheap.

Unfortunately, the magnitude of Musk’s mistake is far greater, threatening to further freeze takeover financing markets as large banks struggle to offload tens of billions of dollars of debt that they had committed to finance this year.

Banks sustained $600mn in realised losses late last month when they sold $8.55bn of debt at knockdown prices to finance the takeover of software maker Citrix.

Last week, a $3.9bn debt offering to fund Apollo Global Management’s takeover of telecoms group Brightspeed was shelved. Financing for the takeovers of Nielsen, TV broadcaster Tegna and car parts maker Tenneco also remains unsold.

Twitter is a massive potential landmine.

“The gap between where banks are prepared to take the loss and where people are prepared to buy Twitter [debt] is too wide to get a deal done so if a deal comes they’ll have to sit with it for a while,” said Roberta Goss, a senior managing director at asset manager Pretium. “That will be ugly.”

Goldman spots opportunity in a crisis

When life gives you a government bond meltdown, make money.

Plenty of financiers have been looking to achieve that goal since UK chancellor Kwasi Kwarteng’s “mini” Budget sparked turmoil in the gilts market last month.

Goldman Sachs Asset Management and Partners Group are primed to benefit from one, little-known, way to do this. They have raised billions of dollars with which they can scoop up cut-price private assets from pension funds in the UK — and elsewhere — as they seek to raise cash.

Many pension funds ventured into private markets in search of higher yields during the long era of low rates. Investments in private equity funds are typically locked up for about a decade, their value determined using a process of sophisticated guesswork. So the only way out is to sell those stakes to somebody else — which is where a section of Goldman’s asset management arm, and other specialist “secondary” investors, come in.

There are multiple reasons why a pension fund might be persuaded to sell its private equity stakes at a discount.

-

Pension funds often have strict rules over how much they’re allowed to invest in private capital, as a percentage of their total assets. The fall in the value of their publicly traded holdings has pushed them over those limits — the so-called denominator effect.

-

The wave of dealmaking over the past several years has sped up the pace at which buyout funds call on investors’ commitments. Many deals are struck using “subscription line” financing, or short-term debt, meaning pension funds are asked for money a year or more after the deal. So, calls to fund those boom-time deals are still coming through.

-

Many institutional investors fulfil cash calls using money handed back to them from successful deals. But that kind of cash-recycling is getting harder now that the distributions are drying up.

-

Now for the most timely reason: emergency collateral calls. As gilt prices plummeted last week, pension funds were faced with margin calls, leading to more pressure to sell assets and raise cash. Even some of those not affected have seen the episode as a wake-up call about the risks of holding illiquid assets.

A combination of the first three had already left investors selling stakes in private equity funds at a record pace by this summer. Now, that is expected to pick up.

“We’re seeing discounts of 20 to 30 per cent for a high-quality portfolio [of stakes in private equity funds],” Goldman Sachs Asset Management managing director Gabriel Möllerberg told DD’s Kaye Wiggins. “It’s absolutely an opportunity.”

“In these market conditions, you get very attractive buying opportunities,” said Ross Hamilton at Switzerland-based private equity firm Partners Group. Blackstone also has a large fund with which it buys pension funds’ stakes.

In another resourceful spin, GSAM is also lending money to investors against their private equity holdings to help them access cash without having to sell the stakes, said Möllerberg.

If you’re wondering whether this means that some private equity groups are buying stakes in other private equity groups’ funds, the answer is yes. And yes, many private equity funds have a similar set of underlying pension fund investors. The industry is nothing if not creative about moving money around.

The Chinese battery maker struggling to shake its military past

The queen of China’s EV battery industry, China Aviation Lithium Battery’s chair Liu Jingyu, courted investors in Hong Kong last month selling a story of global ambition.

CALB, she said, knows no borders and transcends business: “We are a company that benefits mankind.”

But when the fast-growing company debuted in Hong Kong on Thursday, investors showed little appetite, the FT’s Edward White reports.

Despite being the third-largest battery producer in China and the seventh-largest in the world, it was always going to be a tough sell.

Longevity of the EV battery business aside, it’s a tough time to raise capital in equity markets. Especially if you’re a Chinese company carved out from Aviation Industry Corporation of China, a state-backed manufacturer of missile and fighter jets for the People’s Liberation Army.

Its origins weren’t the only concern ahead of the IPO. Analysts also raised questions over the group’s profitability, margins, funding and allegations of intellectual property theft and underlying geopolitical tensions.

Liu had robust answers on most concerns at a media briefing last month, but she didn’t respond to questions from the FT on the latter.

Here’s why that’s problematic: CALB made its public debut on Monday, as Joe Biden’s administration increased its calls to the west to reduce their reliance on Chinese industry.

Companies with the biggest targets on their back? Those linked to the Chinese military.

Job moves

-

Barclays has promoted Luca Maiorana, who leads its fintech and asset management unit, to lead its financial institutions group across Europe, the Middle East and Africa, per Reuters.

-

Amundi has hired Nisarg Trivedi from Schroders to lead its third-party distribution business in the Middle East, per Bloomberg. He will remain based in Dubai.

Smart reads

The big bang Florida entrepreneur Jack Owoc — fuelled by the holy spirit and a whole lot of caffeine — has built a multi-billion-dollar energy drink empire against all odds. But faith may not be enough to keep his business from crashing, Bloomberg reports.

Silicon slump “The Silicon Valley of *insert region here*” has become a popular moniker for up-and-coming tech destinations. But the former start-up hotspot has been struggling to attract foreign investors amid high taxes and the surging cost of living, the FT reports.

Still scrolling Confused by the Twitter takeover saga? You’re not alone. FT reporters have mapped out the chaotic timeline from start to (potential) finish.

News round-up

Tiger Global slows pace of investment with scaled-down fund (FT)

Porsche overtakes VW as Europe’s most valuable carmaker (FT)

Former Rusal chief launches London’s first mining Spac (FT)

Prince Harry among those in joint legal action against Daily Mail publisher (FT)

Founders of Gotham and Portsea join forces in new short selling fund (FT)

Woodford fund investors warned illiquid holdings to curb future payouts (FT)

Ex-JPMorgan banker defrauded Libya fund of millions, jury told (Bloomberg)

Do Kwon denies prosecutors froze $67mn of his cryptocurrency assets (FT)

SoftBank weighing sale of stake in TelevisaUnivision (Bloomberg)

TikTok staff push ahead with work councils (FT)

Recommended newsletters for you

[ad_2]

Source link