[ad_1]

Most British investment managers spent last week pinned to their screens, watching the impact on their funds of the UK market turmoil. But one executive at a British funds house spent the week poolside in Dubai, fretting about his hotel bill.

“I was watching my holiday get more expensive by the day,” he said. But his own worries about the upheaval in sterling were overwhelmed by the scale of the financial crisis gripping London. “This really is one where we probably won’t see something like this again in our careers.”

Although the pound and government bonds have bounced back from lows after a huge £65bn intervention from the Bank of England, the market ructions that followed prime minister Liz Truss’s “mini” Budget will impose lasting pain, according to wealth managers.

They expect a further squeeze on living standards, with the damage done by higher energy bills, even more inflation and increased borrowing costs, especially on mortgages.

“It will hit households in terms of inflation, higher interest rates and a more challenging mortgage market . . . and a pushing out of the point at which inflation peaks,” says Richard Flax, chief investment officer at digital wealth manager Moneyfarm.

While some bold investors like to spot opportunities in a sell-off, the cloud of uncertainty already hanging over markets from the Ukraine war, energy prices, inflation and economic distress has only grown darker.

“There’s a lot of nervousness,” says Alexandra Loydon, director for partner engagement and consultancy at St James’s Place, the UK’s largest wealth manager.

She has spent the week conferring with SJP’s army of 4,600 financial advisers, who are fielding questions from 800,000 clients. She says: “It’s difficult to provide certainty and reassurance in such uncertain markets, but encouraging the right behaviour is really important . . . don’t start moving assets and stay invested.”

How do wealth managers assess what happened in markets this week?

While sterling’s fall hogged the headlines after chancellor Kwasi Kwarteng’s speech, the drama that erupted midweek in UK government debt was arguably far more significant for finance professionals and ordinary savers.

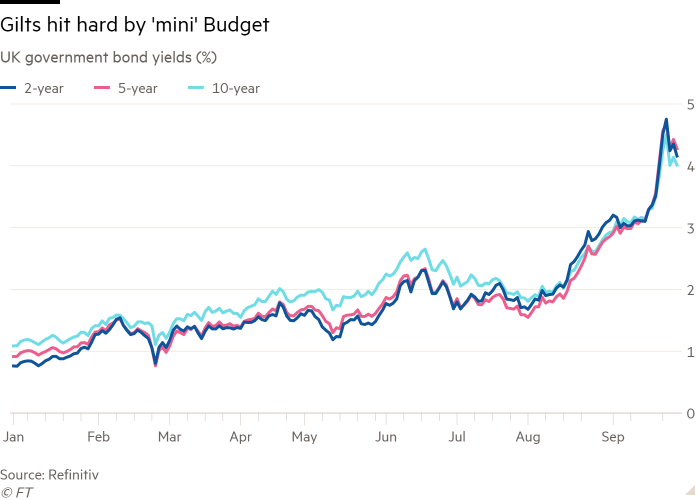

UK sovereign bonds, known as gilts, saw some of their sharpest-ever moves. “What we’ve seen is some sort of crisis of confidence both in the gilt market and in sterling,” says Peter Spiller, manager of the Capital Gearing investment trust.

Duncan MacInnes, investment director at Ruffer, says gilts have seen “absolutely wild gyrations for a first-world sovereign bond market”.

The BoE intervened after the price falls posed a serious threat to pension funds using special strategies known as liability-driven investments (LDIs) to manage risks.

The yield — the interest rate that rises when prices fall — on the UK’s 30-year gilt, which on Wednesday touched a 20-year high of more than 5 per cent, fell to 3.85 per cent on Friday morning.

The intervention leaves the BoE torn between a promise to raise interest rates to battle inflation, and an emergency money-printing operation. Professional investors are still betting on further rate rises from the central bank. “At this stage they have just increased the confusion,” MacInnes says.

Will mortgage fears fuel the cost of living crisis?

Government debt markets matter to householders because they set the baseline for mortgages and other personal borrowing.

Loydon said clients were starting to grapple with the impending “massive impact” of rising rates and asking questions.

The average standard variable rate for mortgages, which had already risen to the highest level in a decade — above 5 per cent — earlier in the month, could now rise to 6 per cent.

The turmoil has made it difficult for providers to price new fixed-term deals, with thousands of products withdrawn. Around 600,000 fixed rate mortgage deals will expire by the end of the year, with 1.8mn coming up for renewal next year, according to UK Finance.

The government’s energy price cap has somewhat blunted the immediate cost of living crisis, limiting the expected maximum inflation rate in the next months to about 10 per cent. But utility bills are still rising and, with Truss’s economic plans likely to expand public borrowing, the upward pressure on inflation may last longer.

While many affluent households that make up wealth managers’ client base will benefit from the end of the top 45 per cent rate of income tax on earnings above £150,000 a year, and from a reversal of the tax increase on dividends, these gains will, for many mortgage holders, be outweighed by higher interest rates.

Rachel Winter, partner at wealth manager Killik & Co, says mortgages have “replaced energy bills as the number one fear in the UK . . . You’ve almost taken away the benefit of giving people a lower tax rate.”

Meanwhile, wealth managers say clients often underestimate the impact of movements in the pound. While sterling had recovered most of its lost ground by Friday — trading at about $1.12 to the US dollar, up from a low of $1.03 — it is still widely seen as fragile. Much hangs on how the government reacts in the run-up to its scheduled November fiscal plan announcement.

“A devaluation of sterling is inflationary and means the cost of living squeeze is going to get worse,” says Edward Park, chief investment officer at Brooks Macdonald.

What should I do with my portfolio?

The good news for many savers is that global investments can provide protection from UK turmoil. In particular, if sterling weakens, assets overseas are worth more in sterling terms.

“If you’re a Sterling-based investor with a well-diversified portfolio, weak sterling is helpful,” says Janet Mui, head of market analysis at wealth manager Brewin Dolphin.

Wealth advisers have been inundated with questions from clients: they want to know whether to buy sterling or gilts at current prices, or to decrease sterling holdings in case the currency falls again.

Experts strongly advise individuals not to make any sudden moves. “It’s the old advice: if you’re going to panic, panic first. If you haven’t panicked yet, it’s probably a bit too late,” says MacInnes.

But uncertainty in the UK underscores the importance of diversifying away from the home market. A majority of UK retail investors allocated more than a quarter of their portfolio to British stocks, according to a Quilter survey last year, despite the country making up only 4 per cent of the MSCI World index.

The UK’s FTSE 100 index itself brings global exposure, as its companies make 80 per cent of their revenues overseas. That gives foreign currency exposure but it still limits the choice of companies, especially because the UK market is heavy on energy and mining and light on tech.

Wealth managers say their clients also worry that higher borrowing costs threaten house prices. “For the last few decades, property has been something you can live in and doubles as your diversified investment portfolio,” says William Hobbs, chief investment officer at Barclays Wealth & Investments. The market crisis has thrown into question the assumption that house prices will steadily rise, he argues.

“That’s why you need to have diversified exposure to the world economy, not just a particular street in the UK.”

Capital Economics predicts bluntly: “Both a recession and a big fall in house prices look inevitable.”

Meanwhile, investors need to be wary of investing in companies carrying a lot of debt, since borrowing costs are rising fast. “Debt is how you get into trouble, whether you’re an individual, a company or a country,” says Christopher Rossbach, managing partner at J Stern & Co. He recommends examining corporate balance sheets.

Gold, the traditional safe haven, has performed well as a hedge in sterling terms, rising about 16 per cent in the past 12 months. But it is down in dollar terms, suggesting there might be better ways of hedging. “I would be very wary of those telling you that whatever the question is, gold is the answer,” says Hobbs.

Gold also pays no income, so it becomes less attractive as interest rates rise. Although bonds have fallen dramatically this year and the UK gilt market has been upended this week, in the longer run higher yields are starting to make investors look again at debt instruments.

“We have a lot of clients who in my opinion hold too much cash,” says Winter. “It’s now possible to have a pretty diversified portfolio of pretty senior corporate bonds with a return of around 6 per cent.”

Savers who want to hold cash, despite the threat of inflation, are advised to find the best rates, since banks vary and many high street lenders have poor offers.

The return of decent interest rates on deposits and bonds amounts to a big shift for savers. MacInnes says: “That is a profound change to the investment landscape that has come out of nowhere in the last six months.”

[ad_2]

Source link