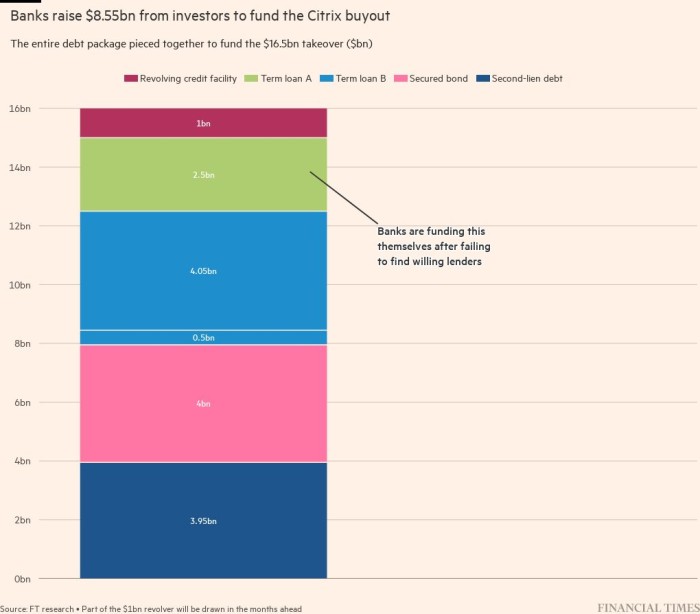

Banks lost $600mn this week when they closed the largest corporate junk bond sale of 2022. Yet the financial damage inflicted from underwriting the $16.5bn leveraged buyout of Citrix may only be beginning.

After offloading $8.55bn of bonds and loans at knockdown prices, lenders including Bank of America, Goldman Sachs and Credit Suisse still have billions more Citrix debt on their books worth far less than when they agreed to underwrite it in January. And banks still hold vastly more debt from financial packages backing buyouts of television ratings group Nielsen, TV broadcaster Tegna, car parts maker Tenneco and — if completed — Elon Musk’s $44bn takeover of Twitter.

The Citrix debt sale was viewed as a test of capital markets that have been shaken since Russia invaded Ukraine, global growth cooled briskly and central banks from Frankfurt to Washington began to aggressively raise interest rates. Demand was weak, with money managers preferring to hold cash or higher quality investments than lend to risky companies and private equity firms. One banker involved in the deal said it was a “bloodbath”.

Interest was so scant that one of the investors to buy $1bn worth of the bonds was Elliott Management — which along with Vista Equity Partners is also one of the two private investment groups buying out Citrix, according to people briefed on the matter and documents viewed by the Financial Times.

“We had to get the pig through the python,” a second banker involved in the buyout financing said. “Everyone was getting comfortable in August again but unfortunately Jackson Hole happened and then everything went haywire,” the banker added, alluding to Federal Reserve chair Jay Powell’s remarks in Jackson Hole, Wyoming last month, where he made clear his resolve to tame inflation with higher interest rates.

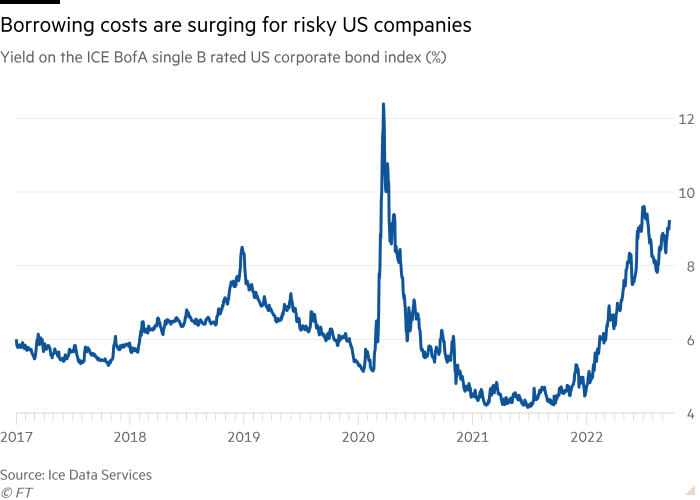

Borrowing costs have surged. When banks were racing to lend to companies and private equity firms at the start of the year, a US business with a lowly single B debt rating could expect an interest rate of roughly 4.74 per cent. The rate is 9.2 per cent today. As Citrix demonstrated, even that level may not be enough to entice would-be creditors.

Bankers ended up selling $4bn of secured Citrix bonds at a discounted price of about 83.6 cents on the dollar to yield 10 per cent. A further $4.55bn of loans were sold at 91 cents on the dollar, also to yield 10 per cent. For the banks that agreed to lend to Citrix’s buyers before the Fed began tightening, the resulting losses have been painful.

“After a period of superabundant liquidity, when rates go up this much a bubble that has formed somewhere bursts,” said Bob Michele, head of JPMorgan Asset Management’s global fixed income, currency and commodities unit. “It has happened every single time, and that shows you the Fed has done its job.”

The Citrix deal captivated the market in part because of its size, but also because of the relatively small amounts of equity investment that Elliott and Vista were putting in to buy the enterprise software company. To support the gargantuan debt sale, Elliott contributed more than $2bn in cash while Vista merged its already leveraged Tibco software business at a more than $4bn valuation.

So flush were the banks in January, that they had little problem getting risk managers to sign off on the jumbo-sized deal they agreed to underwrite. The high level of gearing at Citrix has become increasingly costly, with some dealmakers privately worrying that rising interest costs could absorb most of its cash flow.

Citrix is not alone. Among the deals causing heartburn for Wall Street is Musk’s takeover of Twitter, a deal he is trying to back out of. But unless a judge sides with the billionaire — or the social media group’s board agrees to terminate the transaction — a group of seven banks that agreed to lend $13bn in April for the buyout are still on the hook despite recent troubles at the company and the market downturn. It is a deal that investors believe would heap mammoth losses on underwriters.

Bankers involved in the Citrix financing told the FT they were relieved that they were able to finalise the $8.55bn debt deal and that it did not fall apart. While they are still holding roughly $6.45bn of Citrix debt on their balance sheets — including some of the riskiest bonds that they could not sell — the fact that markets were not fully shut has given them hope they will be able to sell on more debt sitting on their books.

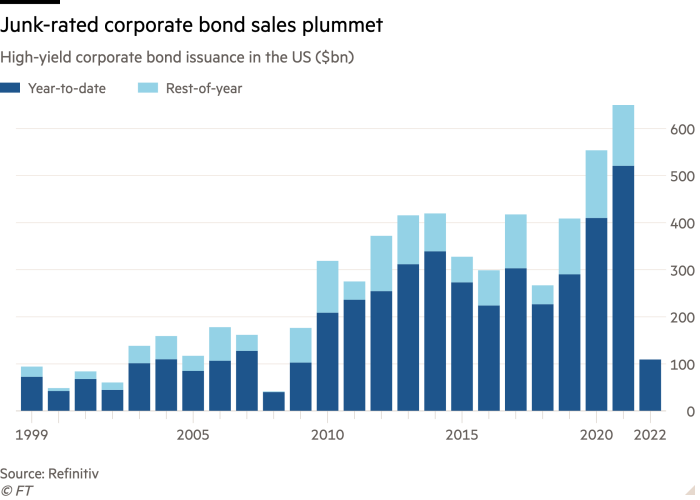

But the lacklustre demand, including the banks’ failed attempt to offload the junior Citrix debt over the summer, will nonetheless hamstring Wall Street’s ability to write new low-rated loans. The fact that some of the largest lenders in the US are stuck holding some of the riskiest debt may also concern regulators.

“It feels like even when the banks are through the deal, there’s still an overhang,” said a top executive at a large lender.

Bank of America, Credit Suisse and Goldman Sachs declined to comment.

As banks have closed to new business in order to clear problematic financings, frustrated private equity buyers have turned to direct lenders such as Blackstone, Apollo and Ares, which have financed ambitious privatisations as with Zendesk and Avalara this summer.

“Banks have basically gone on hold,” the head of a large firm that buys syndicated bank debts said. “Direct lenders are going upmarket into larger deals and taking business away.”

Comments are closed, but trackbacks and pingbacks are open.